Answered step by step

Verified Expert Solution

Question

1 Approved Answer

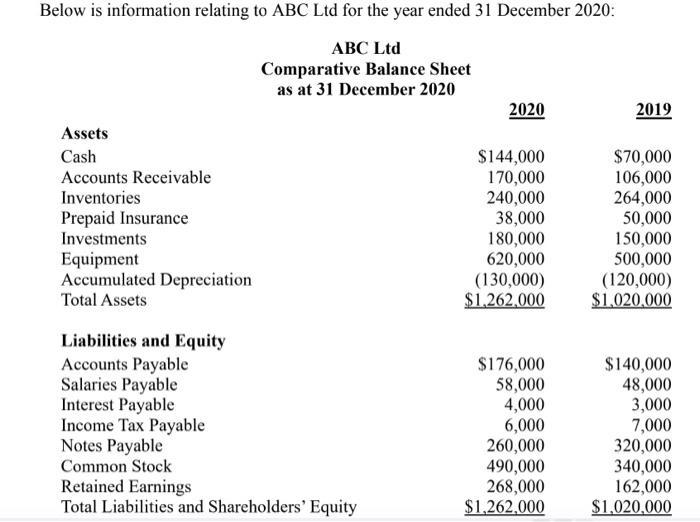

Below is information relating to ABC Ltd for the year ended 31 December 2020: ABC Ltd Comparative Balance Sheet as at 31 December 2020

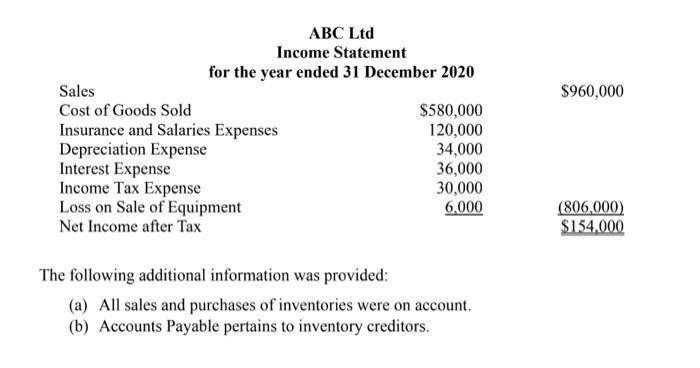

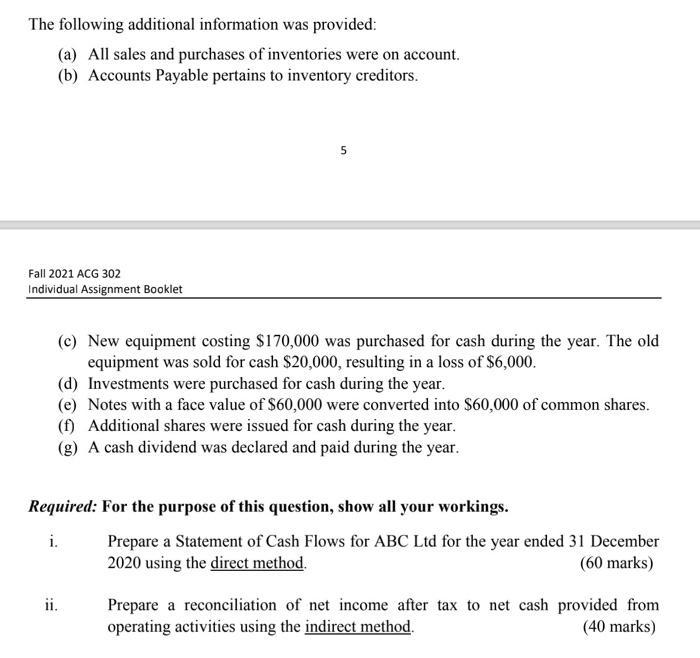

Below is information relating to ABC Ltd for the year ended 31 December 2020: ABC Ltd Comparative Balance Sheet as at 31 December 2020 2020 2019 Assets Cash $144,000 $70,000 Accounts Receivable 170,000 106,000 Inventories 240,000 264,000 Prepaid Insurance 38,000 50,000 Investments 180,000 150,000 Equipment 620,000 500,000 Accumulated Depreciation (130,000) (120,000) Total Assets $1,262,000 $1,020,000 Liabilities and Equity Accounts Payable $176,000 $140,000 Salaries Payable 58,000 48,000 4,000 3,000 Interest Payable Income Tax Payable 6,000 7,000 Notes Payable 260,000 320,000 Common Stock 490,000 340,000 Retained Earnings 268,000 162,000 Total Liabilities and Shareholders' Equity $1,262,000 $1,020,000 ABC Ltd Income Statement for the year ended 31 December 2020 Sales Cost of Goods Sold $580,000 Insurance and Salaries Expenses 120,000 34,000 Depreciation Expense Interest Expense 36,000 Income Tax Expense 30,000 Loss on Sale of Equipment 6,000 Net Income after Tax The following additional information was provided: (a) All sales and purchases of inventories were on account. (b) Accounts Payable pertains to inventory creditors. $960,000 (806,000) $154.000 The following additional information was provided: (a) All sales and purchases of inventories were on account. (b) Accounts Payable pertains to inventory creditors. 5 Fall 2021 ACG 302 Individual Assignment Booklet (c) New equipment costing $170,000 was purchased for cash during the year. The old equipment was sold for cash $20,000, resulting in a loss of $6,000. (d) Investments were purchased for cash during the year. (e) Notes with a face value of $60,000 were converted into $60,000 of common shares. (f) Additional shares were issued for cash during the year. (g) A cash dividend was declared and paid during the year. Required: For the purpose of this question, show all your workings. i. Prepare a Statement of Cash Flows for ABC Ltd for the year ended 31 December 2020 using the direct method. (60 marks) ii. Prepare a reconciliation of net income after tax to net cash provided from operating activities using the indirect method. (40 marks)

Step by Step Solution

★★★★★

3.53 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

i ii cash flows for ABC Ltd Particulars Rash flow from operating acti...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started