Answered step by step

Verified Expert Solution

Question

1 Approved Answer

i. As a fund manager at SOOFI FUND, you hold a portfolio of Malaysian stocks with a beta of 1.20. You are worried about

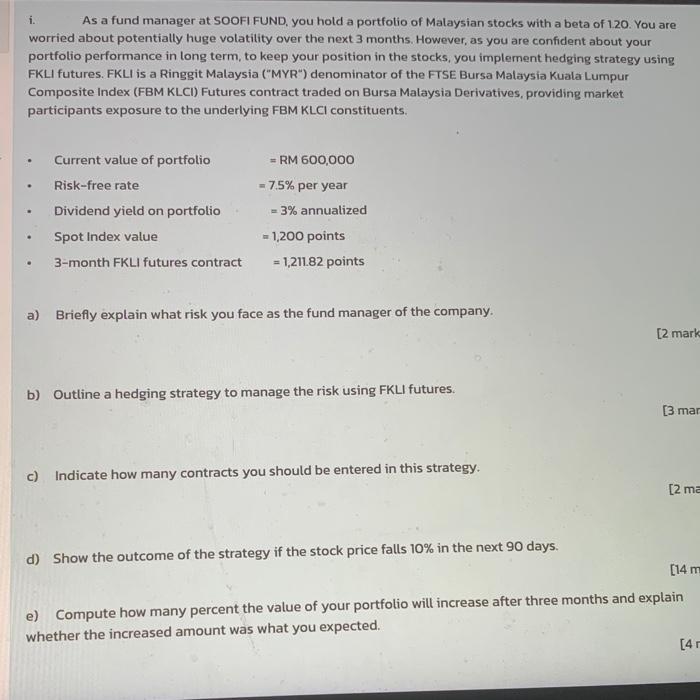

i. As a fund manager at SOOFI FUND, you hold a portfolio of Malaysian stocks with a beta of 1.20. You are worried about potentially huge volatility over the next 3 months. However, as you are confident about your portfolio performance in long term, to keep your position in the stocks, you implement hedging strategy using FKLI futures. FKLI is a Ringgit Malaysia ("MYR") denominator of the FTSE Bursa Malaysia Kuala Lumpur Composite Index (FBM KLCI) Futures contract traded on Bursa Malaysia Derivatives, providing market participants exposure to the underlying FBM KLCI constituents. . Current value of portfolio = RM 600,000 . Risk-free rate = 7.5% per year . Dividend yield on portfolio . Spot Index value 3-month FKLI futures contract = 1,211.82 points a) Briefly explain what risk you face as the fund manager of the company. [2 mark b) Outline a hedging strategy to manage the risk using FKLI futures. [3 mar c) Indicate how many contracts you should be entered in this strategy. [2 ma d) Show the outcome of the strategy if the stock price falls 10% in the next 90 days. [14 m e) Compute how many percent the value of your portfolio will increase after three months and explain whether the increased amount was what you expected. [4 r = 3% annualized W 1,200 points

Step by Step Solution

★★★★★

3.25 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

A B D 17 18 Answer a The risk of the fund manager is that he has a risky portfolio with a beta of 12...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started