Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Below is Larry Ltds income statement and two balance sheets: A. Calculate the increase in Net Working capital. (1 mark) B. Calculate the net capital

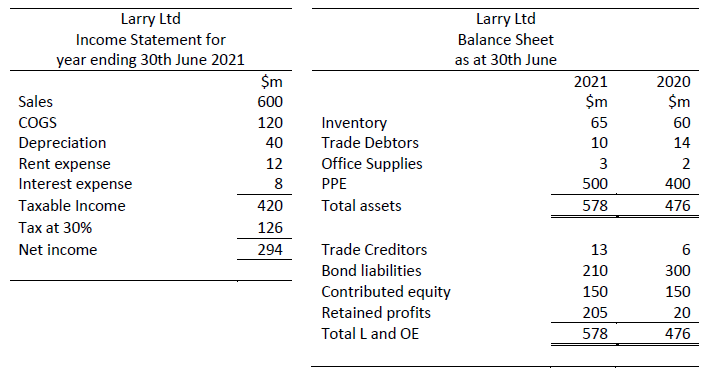

Below is Larry Ltds income statement and two balance sheets:

A. Calculate the increase in Net Working capital. (1 mark) B. Calculate the net capital expenditure. (1 mark) C. Calculate the firm free cash flow (FFCF or Cash flow from assets CFFA). (1 mark) D. Referring to the above example, suggest what business activity may have caused the change in capital expenditure. (1 mark)

Larry Ltd Income Statement for year ending 30th June 2021 Larry Ltd Balance Sheet as at 30th June Sales COGS Depreciation Rent expense Interest expense Taxable income Tax at 30% Net income $m 600 120 40 12 8 420 126 294 Inventory Trade Debtors Office Supplies PPE Total assets 2021 $m 65 10 3 500 578 2020 $m 60 14 2 400 476 Trade Creditors Bond liabilities Contributed equity Retained profits Total Land OE 13 210 150 205 578 6 300 150 20 476Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started