Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Below is my attempt at this problem. Please include ALLnecessary entries Supplemental Problem for Lesson 5 Assume that on 1/1/01 Big acquired 80% of Little

Below is my attempt at this problem. Please include ALLnecessary entries

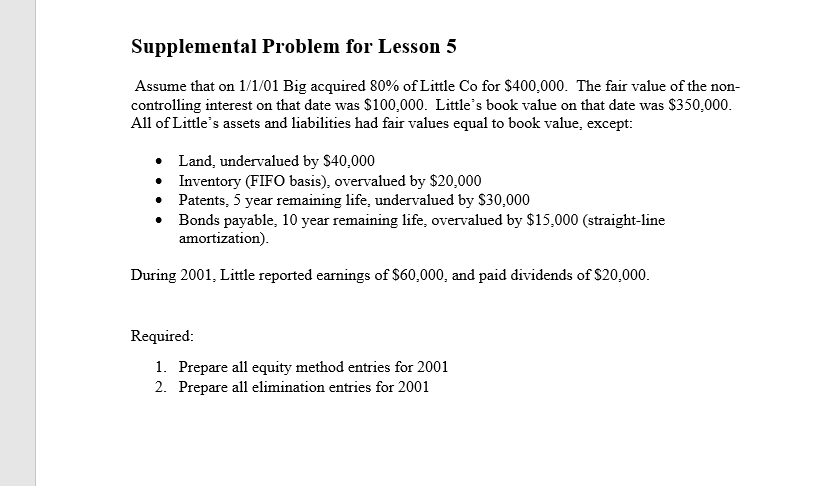

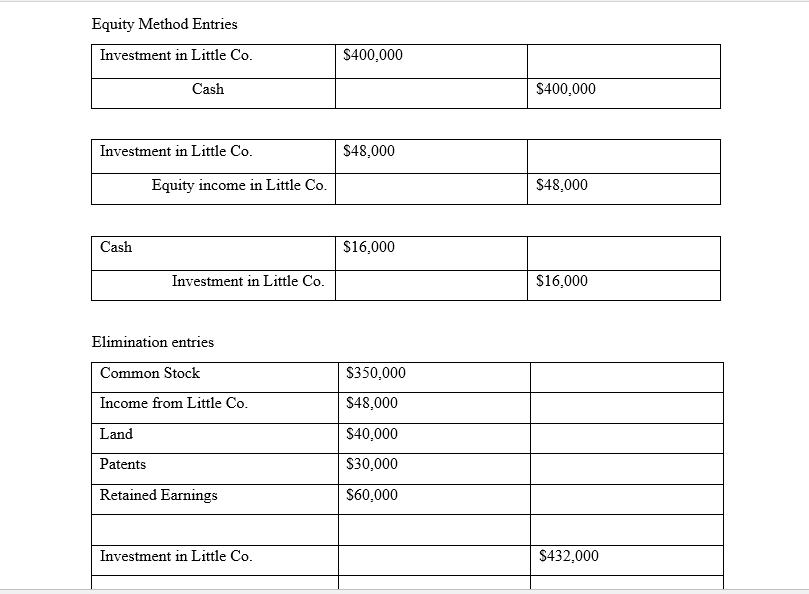

Supplemental Problem for Lesson 5 Assume that on 1/1/01 Big acquired 80% of Little Co for $400,000. The fair value of the non- controlling interest on that date was $100,000. Little's book value on that date was $350,000 All of Little's assets and liabilities had fair values equal to book value, except: Land, undervalued by $40,000 Inventory (FIFO basis), overvalued by $20,000 Patents, 5 year remaining life, undervalued by S30,000 . .Bonds payable, 10 year remaining life, overvalued by $15,000 (straight-line amortization) During 2001, Little reported earnings of S60,000, and paid dividends of $20,000 Required 1. 2. Prepare all equity method entries for 2001 Prepare all elimination entries for 2001

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started