Below is my company's financial measures, please write the letter on the the information provided. This is a Business assignment.

Part of your companys annual report is a letter to shareholders that provides a CEOs perspective on the current state of your business. Now that you have formalized your strategy and become a more seasoned Airline management team, it is time to convince current and potential shareholders that an investment in your company has positive potential returns (ie. motivate existing and potential shareholders to purchase shares of your stock. Your goal is to provide a persuasive, yet honest, appraisal of your company and its future prospects. Your letter to shareholders should consist of an update on your strategy, including target markets, management structure, key accomplishments and challenges, and future performance objectives. In addition, please discuss your most direct competitor and how and why you are positioned to outperform them in the future. The letter itself should be one page maximum, but up to 3 supporting exhibits are permitted on additional pages. You may want to search online for sample letters to shareholders to better understand the possible content.

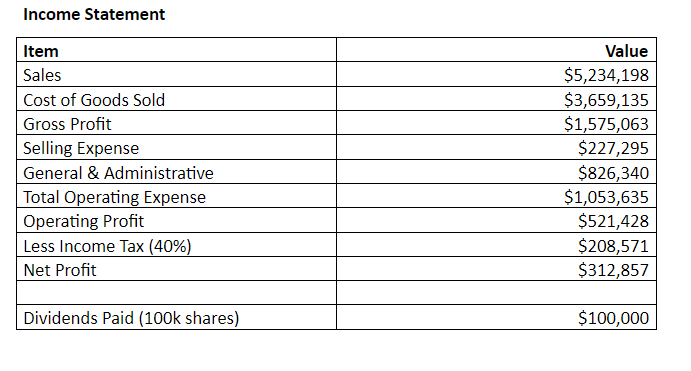

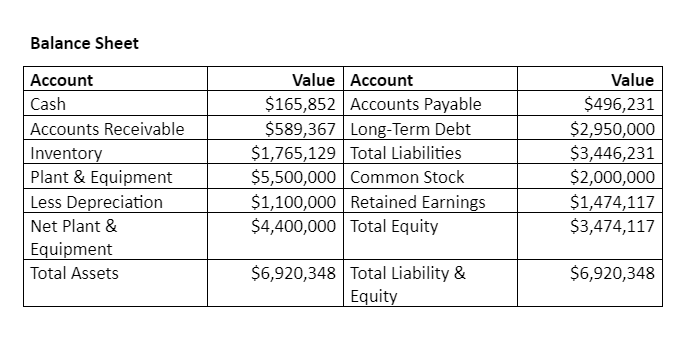

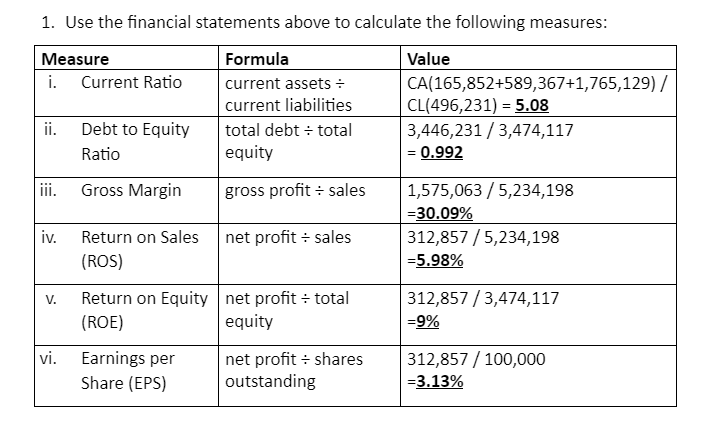

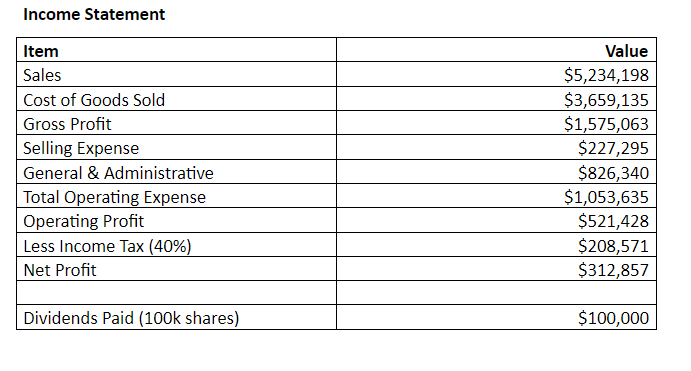

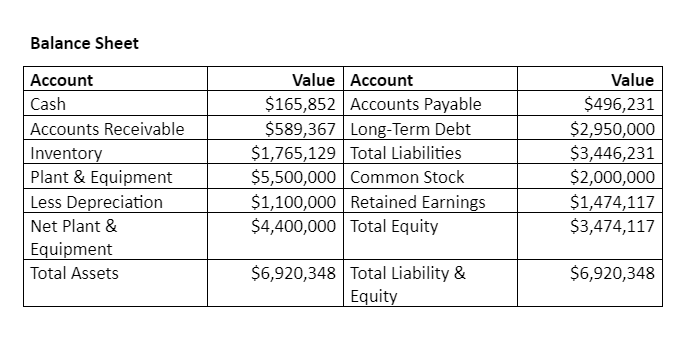

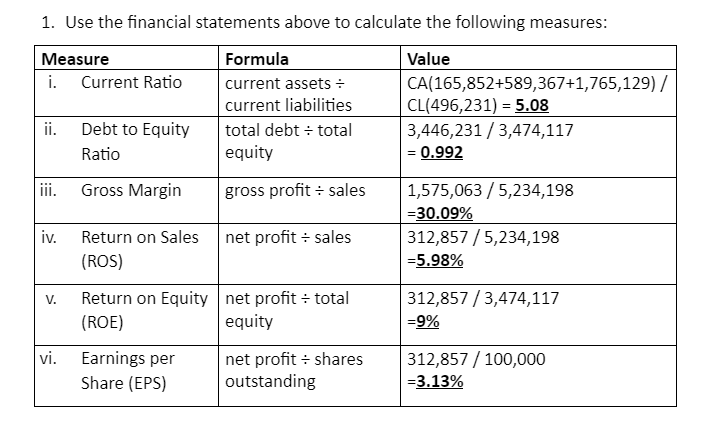

Income Statement Item Sales Cost of Goods Sold Gross Profit Selling Expense General & Administrative Total Operating Expense Operating Profit Less Income Tax (40%) Net Profit Value $5,234,198 $3,659,135 $1,575,063 $227,295 $826,340 $1,053,635 $521,428 $208,571 $312,857 Dividends Paid (100k shares) $100,000 Balance Sheet Account Cash Accounts Receivable Inventory Plant & Equipment Less Depreciation Net Plant & Equipment Total Assets Value Account $165,852 Accounts Payable $589,367 Long-Term Debt $1,765,129 Total Liabilities $5,500,000 Common Stock $1,100,000 Retained Earnings $4,400,000 Total Equity Value $496,231 $2,950,000 $3,446,231 $2,000,000 $1,474,117 $3,474,117 $6,920,348 $6,920,348 Total Liability & Equity 1. Use the financial statements above to calculate the following measures: Measure Formula Value i. Current Ratio current assets - CA(165,852+589,367+1,765,129) / current liabilities CL(496,231) = = 5.08 ii. Debt to Equity total debt = total 3,446,231 / 3,474,117 Ratio equity = 0.992 iii. Gross Margin gross profit = sales 1,575,063 / 5,234,198 =30.09% 312,857/5,234,198 =5.98% iv. net profit = sales Return on Sales (ROS) V. Return on Equity net profit = total (ROE) ) equity 312,857 / 3,474,117 =9% vi. Earnings per Share (EPS) net profit + shares outstanding 312,857 / 100,000 =3.13% Income Statement Item Sales Cost of Goods Sold Gross Profit Selling Expense General & Administrative Total Operating Expense Operating Profit Less Income Tax (40%) Net Profit Value $5,234,198 $3,659,135 $1,575,063 $227,295 $826,340 $1,053,635 $521,428 $208,571 $312,857 Dividends Paid (100k shares) $100,000 Balance Sheet Account Cash Accounts Receivable Inventory Plant & Equipment Less Depreciation Net Plant & Equipment Total Assets Value Account $165,852 Accounts Payable $589,367 Long-Term Debt $1,765,129 Total Liabilities $5,500,000 Common Stock $1,100,000 Retained Earnings $4,400,000 Total Equity Value $496,231 $2,950,000 $3,446,231 $2,000,000 $1,474,117 $3,474,117 $6,920,348 $6,920,348 Total Liability & Equity 1. Use the financial statements above to calculate the following measures: Measure Formula Value i. Current Ratio current assets - CA(165,852+589,367+1,765,129) / current liabilities CL(496,231) = = 5.08 ii. Debt to Equity total debt = total 3,446,231 / 3,474,117 Ratio equity = 0.992 iii. Gross Margin gross profit = sales 1,575,063 / 5,234,198 =30.09% 312,857/5,234,198 =5.98% iv. net profit = sales Return on Sales (ROS) V. Return on Equity net profit = total (ROE) ) equity 312,857 / 3,474,117 =9% vi. Earnings per Share (EPS) net profit + shares outstanding 312,857 / 100,000 =3.13%