Question

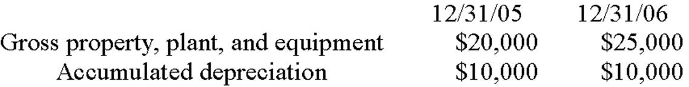

Below is selected information taken from the balance sheet of LongLi Corporation as of 12/31/06. From the operating section of the statement of cash flows,

Below is selected information taken from the balance sheet of LongLi Corporation as of 12/31/06. From the operating section of the statement of cash flows, you determine that the depreciation expense for the year was $2,000 and loss on sales of assets was $5,000. The investing section reveals that the company purchased equipment for $14,000 and sold equipment for $2,000. In the footnotes to the financial statements, the company states: At the beginning of 2006, we determined that the useful life of our assets was higher than originally believed. Accordingly we have increased the useful life from 10 years to 15 years in 2006. a. What was the gross book value of the equipment that was sold? b. What was the net book value of the equipment that was sold? c. With respect to the change in the useful lives of the assets: i. What is the effect on 2005's financial statements? ii. What is the effect on 2006's financial statements?

Gross property, plant, and equipment Accumulated depreciation 12/31/05 $20,000 $10,000 12/31/06 $25,000 $10,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started