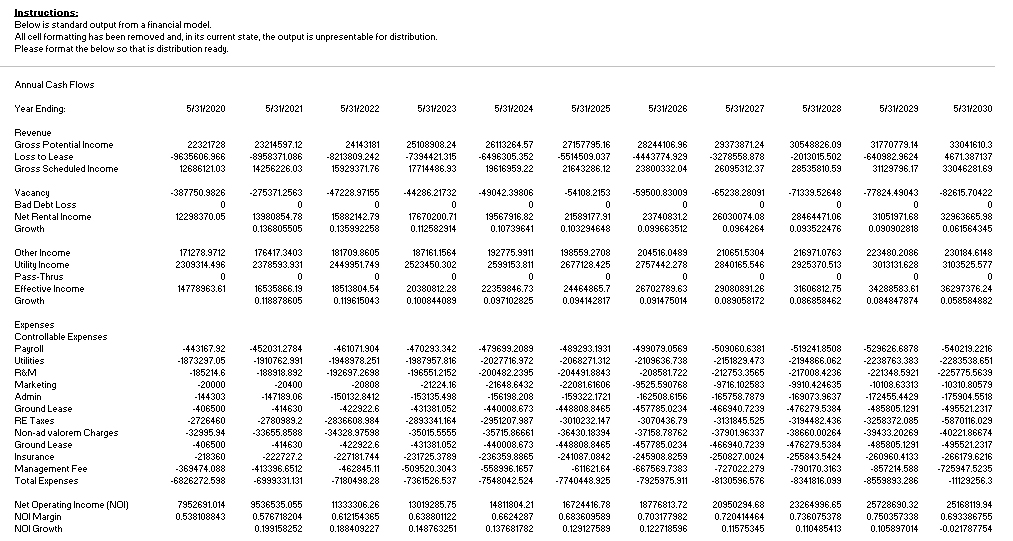

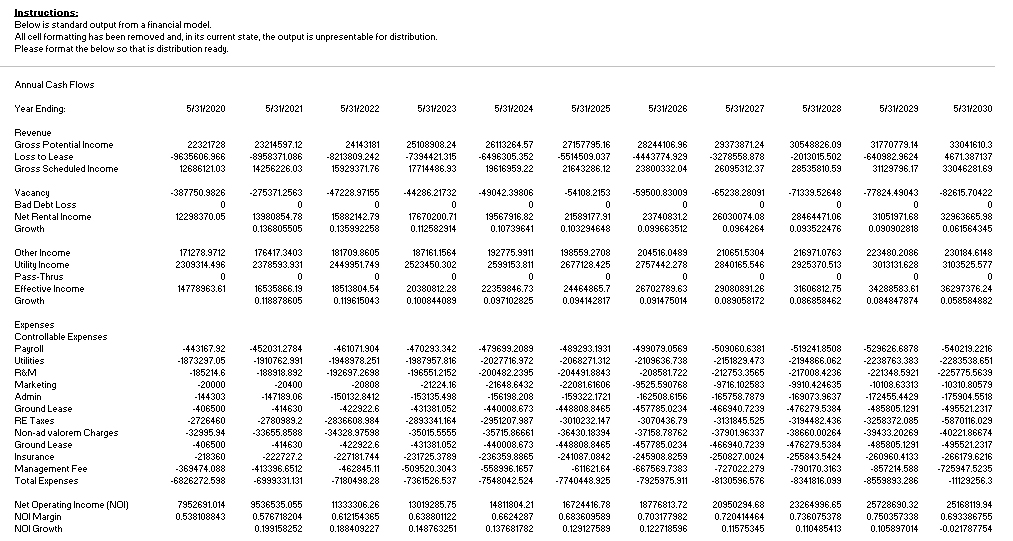

Below is standard output from a financial model. All cell formatting has been removed and, in its current state, the output is unpresentable for distribution. Please format the below so that is distribution ready. 26113264.57 -6496305.352 19616959.22 30548826.09 2013015.502 640982.9624 28535810.59 25108908.24 29373871.24 3278558.878 26095312.37 9635606.966 -8958371.086 5514509.037 21643286.12 -4443774.929 4671.387137 15929371.76 387750.9826 -275371.2563 -47228.97155 15882142.79 44286.21732 49042.39806 54108.2153 -59500.8300965238.28091 -71339.52648-77824.49043 -82615.70422 284644710 0.093522476 Net Rental Income 13980854.78 17670200.71 26030074.08 23740831.2 0.099663512 31051971.68 32963665.98 0.061564345 0.10739641 0.103294648 0.090902818 176417.3403 2378593.931 181709.8605 2449951.749 187161.1564 2523450.302 2757442.278 3013131.628 24464865.7 34288583.61 36297376.24 26702789.63 0.091475014 29080891.286 0.089058172 14778963.61 16535866.19 0.118878605 18513804.54 0.119615043 31606812.75 0.100844089 0.086858462 0 0.084847874 0.058584882 Controllable Expenses -443167.92 1873297.05 -452031.2784 1910762.991 470293.342 -479699.2089 489293.1931499079.0569 2068271.312 540219.2216 2283538.651 -221348.5921-225775.5639 ayro -2194866.062 -2238763.383 -217008.4236 9910.424635 169073.9637 1948978.251 192697.2698 1987957.816 -2109636.738 -2151829.473 -200482.2395 -21648.6432 156198.208 -20000 9716.102583 165758.7879 17245544 485805.1291 147189.06 159322.1721 3010232.147 4488088 162508.6156 -457785.023 3070436.79 422922.6 431381.052 466940.7239-476279.5384 -2726460 -2780989.2-2836608.984-2893341.164-2951207.987 39433.20269 402 485805.1291-495521.2317 -260960.4133 588 40221.86674 -34328.97598 422922.6 37901.96337 466940.7239-476279.5384 38660.00264 255843.5424 8341816.099 8559893.286 431381.052 65 -457785.0234 - 6359.8865 -245908.8259 667569.7383 266179.6216 725947.5235 369474.088 -6826272.598 413396.6512 -6999331.131 509520.3043 7180498.28 7361526.537 558996.1657 7548042.524 462845.11 727022.279 -8130596.576 7740448.325 16724416.78 0.683609589 0.129127589 18776813.72 0.703177982 0.122718596 Net Operating Income [NOI) 9536535.055 209 13019285.75 0.638801122 14811804.21 0.6624287 50294.6823264996.65 0.736075378 0.110485413 0.750357338 0.693386755 0.105897014 -0.021787754 0.538108843 0.612154365 0.188409227 0.11575345 Below is standard output from a financial model. All cell formatting has been removed and, in its current state, the output is unpresentable for distribution. Please format the below so that is distribution ready. 26113264.57 -6496305.352 19616959.22 30548826.09 2013015.502 640982.9624 28535810.59 25108908.24 29373871.24 3278558.878 26095312.37 9635606.966 -8958371.086 5514509.037 21643286.12 -4443774.929 4671.387137 15929371.76 387750.9826 -275371.2563 -47228.97155 15882142.79 44286.21732 49042.39806 54108.2153 -59500.8300965238.28091 -71339.52648-77824.49043 -82615.70422 284644710 0.093522476 Net Rental Income 13980854.78 17670200.71 26030074.08 23740831.2 0.099663512 31051971.68 32963665.98 0.061564345 0.10739641 0.103294648 0.090902818 176417.3403 2378593.931 181709.8605 2449951.749 187161.1564 2523450.302 2757442.278 3013131.628 24464865.7 34288583.61 36297376.24 26702789.63 0.091475014 29080891.286 0.089058172 14778963.61 16535866.19 0.118878605 18513804.54 0.119615043 31606812.75 0.100844089 0.086858462 0 0.084847874 0.058584882 Controllable Expenses -443167.92 1873297.05 -452031.2784 1910762.991 470293.342 -479699.2089 489293.1931499079.0569 2068271.312 540219.2216 2283538.651 -221348.5921-225775.5639 ayro -2194866.062 -2238763.383 -217008.4236 9910.424635 169073.9637 1948978.251 192697.2698 1987957.816 -2109636.738 -2151829.473 -200482.2395 -21648.6432 156198.208 -20000 9716.102583 165758.7879 17245544 485805.1291 147189.06 159322.1721 3010232.147 4488088 162508.6156 -457785.023 3070436.79 422922.6 431381.052 466940.7239-476279.5384 -2726460 -2780989.2-2836608.984-2893341.164-2951207.987 39433.20269 402 485805.1291-495521.2317 -260960.4133 588 40221.86674 -34328.97598 422922.6 37901.96337 466940.7239-476279.5384 38660.00264 255843.5424 8341816.099 8559893.286 431381.052 65 -457785.0234 - 6359.8865 -245908.8259 667569.7383 266179.6216 725947.5235 369474.088 -6826272.598 413396.6512 -6999331.131 509520.3043 7180498.28 7361526.537 558996.1657 7548042.524 462845.11 727022.279 -8130596.576 7740448.325 16724416.78 0.683609589 0.129127589 18776813.72 0.703177982 0.122718596 Net Operating Income [NOI) 9536535.055 209 13019285.75 0.638801122 14811804.21 0.6624287 50294.6823264996.65 0.736075378 0.110485413 0.750357338 0.693386755 0.105897014 -0.021787754 0.538108843 0.612154365 0.188409227 0.11575345