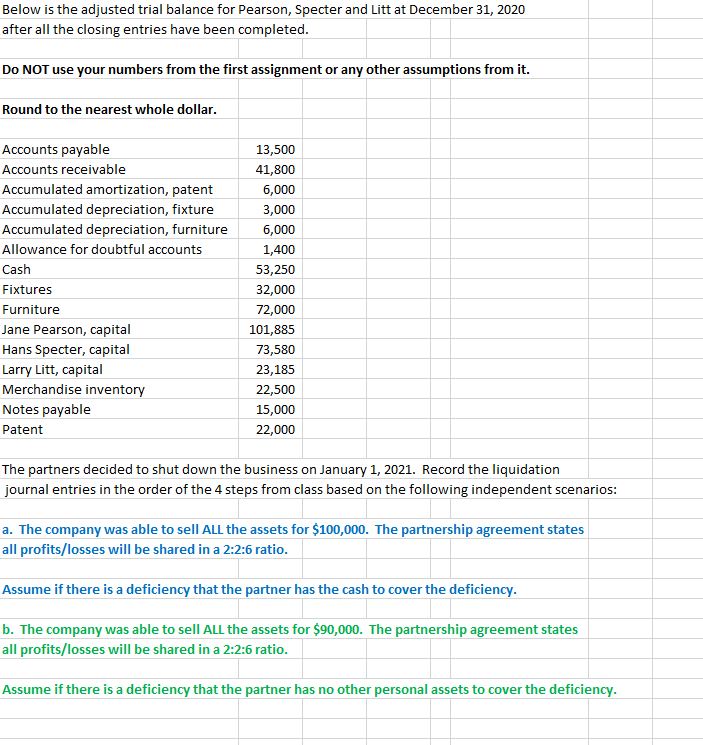

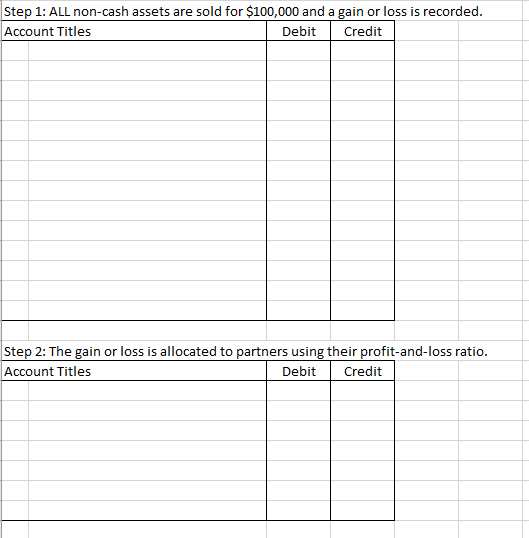

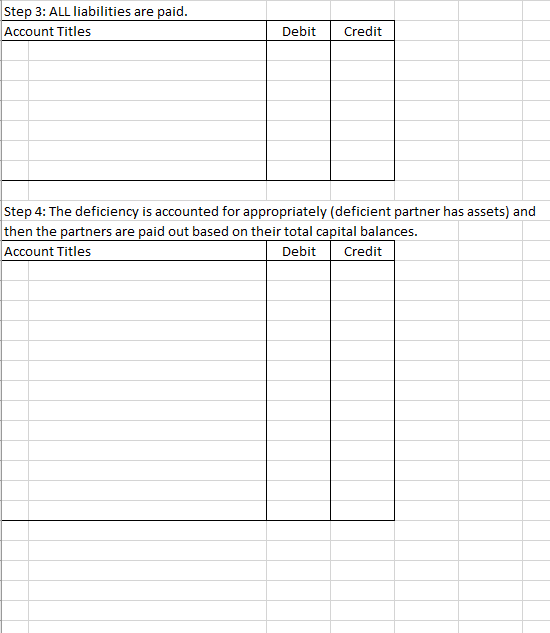

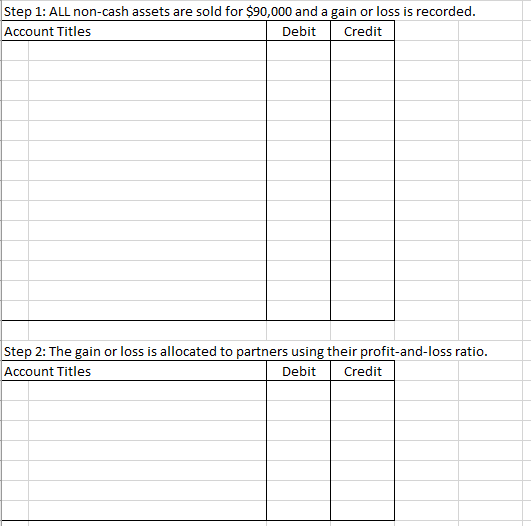

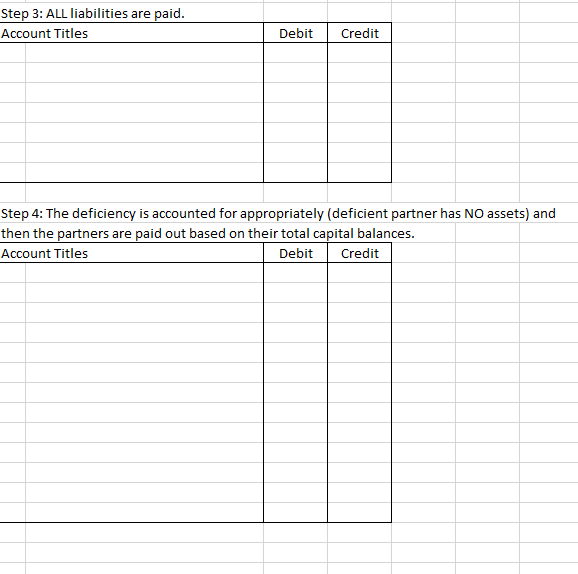

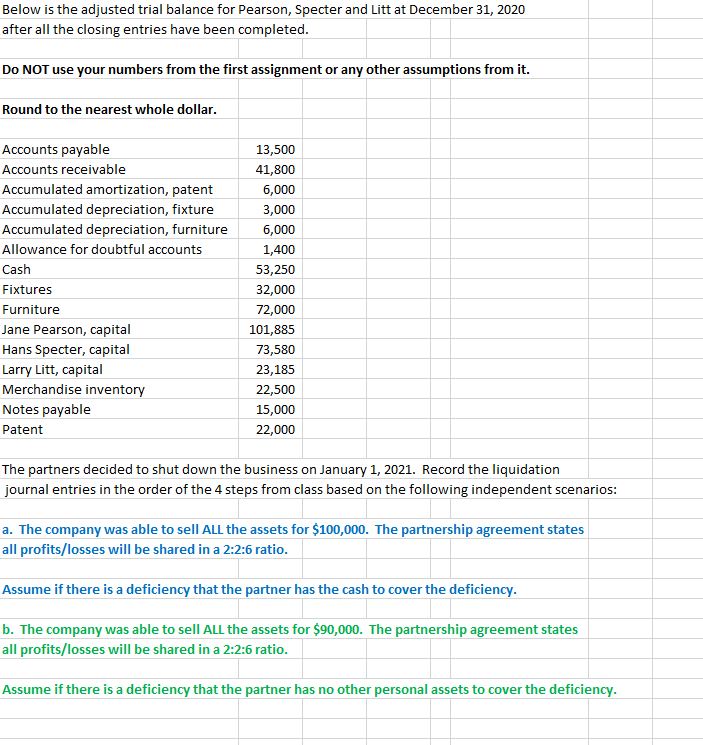

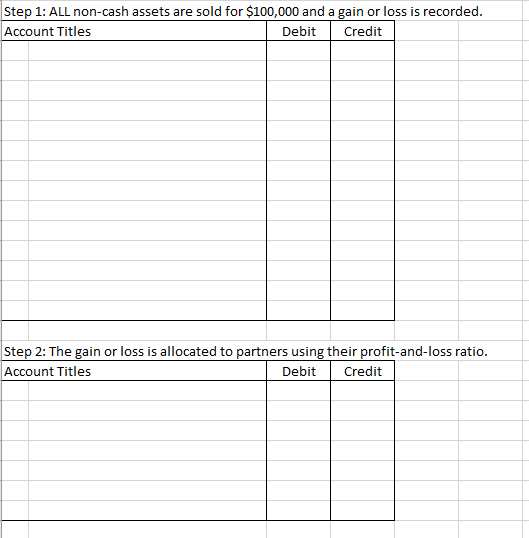

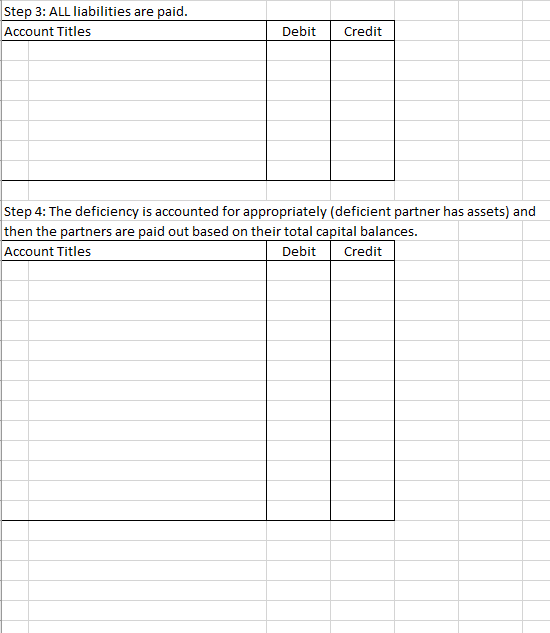

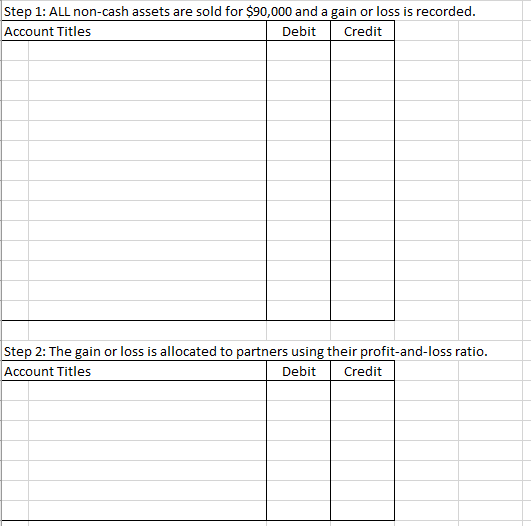

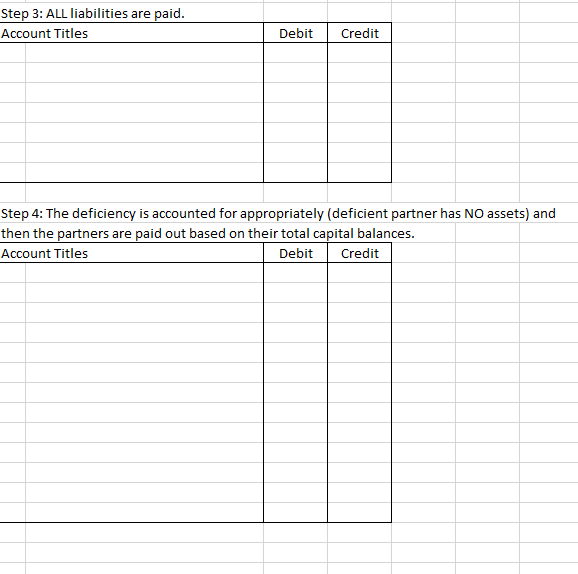

Below is the adjusted trial balance for Pearson, Specter and Litt at December 31, 2020 after all the closing entries have been completed. DO NOT use your numbers from the first assignment or any other assumptions from it. Round to the nearest whole dollar. Accounts payable Accounts receivable Accumulated amortization, patent Accumulated depreciation, fixture Accumulated depreciation, furniture Allowance for doubtful accounts Cash Fixtures Furniture Jane Pearson, capital Hans Specter, capital Larry Litt, capital Merchandise inventory Notes payable Patent 13,500 41,800 6,000 3,000 6,000 1,400 53,250 32,000 72,000 101,885 73,580 23,185 22,500 15,000 22,000 The partners decided to shut down the business on January 1, 2021. Record the liquidation journal entries in the order of the 4 steps from class based on the following independent scenarios: a. The company was able to sell ALL the assets for $100,000. The partnership agreement states all profits/losses will be shared in a 2:2:6 ratio. Assume if there is a deficiency that the partner has the cash to cover the deficiency. b. The company was able to sell ALL the assets for $90,000. The partnership agreement states all profits/losses will be shared in a 2:2:6 ratio. Assume if there is a deficiency that the partner has no other personal assets to cover the deficiency. Step 1: ALL non-cash assets are sold for $100,000 and a gain or loss is recorded. Account Titles Debit Credit Step 2: The gain or loss is allocated to partners using their profit-and-loss ratio. Account Titles Debit Credit Step 3: ALL liabilities are paid. Account Titles Debit Credit Step 4: The deficiency is accounted for appropriately (deficient partner has assets) and then the partners are paid out eir total capital balances. Account Titles Debit Credit on Step 1: ALL non-cash assets are sold for $90,000 and a gain or loss is recorded. Account Titles Debit Credit Step 2: The gain or loss is allocated to partners using their profit-and-loss ratio. Account Titles Debit Credit Step 3: ALL liabilities are paid. Account Titles Debit Credit Step 4: The deficiency is accounted for appropriately (deficient partner has NO assets) and then the partners are paid out based on their total capital balances. Account Titles Debit Credit Below is the adjusted trial balance for Pearson, Specter and Litt at December 31, 2020 after all the closing entries have been completed. DO NOT use your numbers from the first assignment or any other assumptions from it. Round to the nearest whole dollar. Accounts payable Accounts receivable Accumulated amortization, patent Accumulated depreciation, fixture Accumulated depreciation, furniture Allowance for doubtful accounts Cash Fixtures Furniture Jane Pearson, capital Hans Specter, capital Larry Litt, capital Merchandise inventory Notes payable Patent 13,500 41,800 6,000 3,000 6,000 1,400 53,250 32,000 72,000 101,885 73,580 23,185 22,500 15,000 22,000 The partners decided to shut down the business on January 1, 2021. Record the liquidation journal entries in the order of the 4 steps from class based on the following independent scenarios: a. The company was able to sell ALL the assets for $100,000. The partnership agreement states all profits/losses will be shared in a 2:2:6 ratio. Assume if there is a deficiency that the partner has the cash to cover the deficiency. b. The company was able to sell ALL the assets for $90,000. The partnership agreement states all profits/losses will be shared in a 2:2:6 ratio. Assume if there is a deficiency that the partner has no other personal assets to cover the deficiency. Step 1: ALL non-cash assets are sold for $100,000 and a gain or loss is recorded. Account Titles Debit Credit Step 2: The gain or loss is allocated to partners using their profit-and-loss ratio. Account Titles Debit Credit Step 3: ALL liabilities are paid. Account Titles Debit Credit Step 4: The deficiency is accounted for appropriately (deficient partner has assets) and then the partners are paid out eir total capital balances. Account Titles Debit Credit on Step 1: ALL non-cash assets are sold for $90,000 and a gain or loss is recorded. Account Titles Debit Credit Step 2: The gain or loss is allocated to partners using their profit-and-loss ratio. Account Titles Debit Credit Step 3: ALL liabilities are paid. Account Titles Debit Credit Step 4: The deficiency is accounted for appropriately (deficient partner has NO assets) and then the partners are paid out based on their total capital balances. Account Titles Debit Credit