Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Below is the table that is being used for the above exercise. Thanks for your help! I know its a large assignment and I've made

Below is the table that is being used for the above exercise. Thanks for your help! I know its a large assignment and I've made tons of errors, so please no rush.

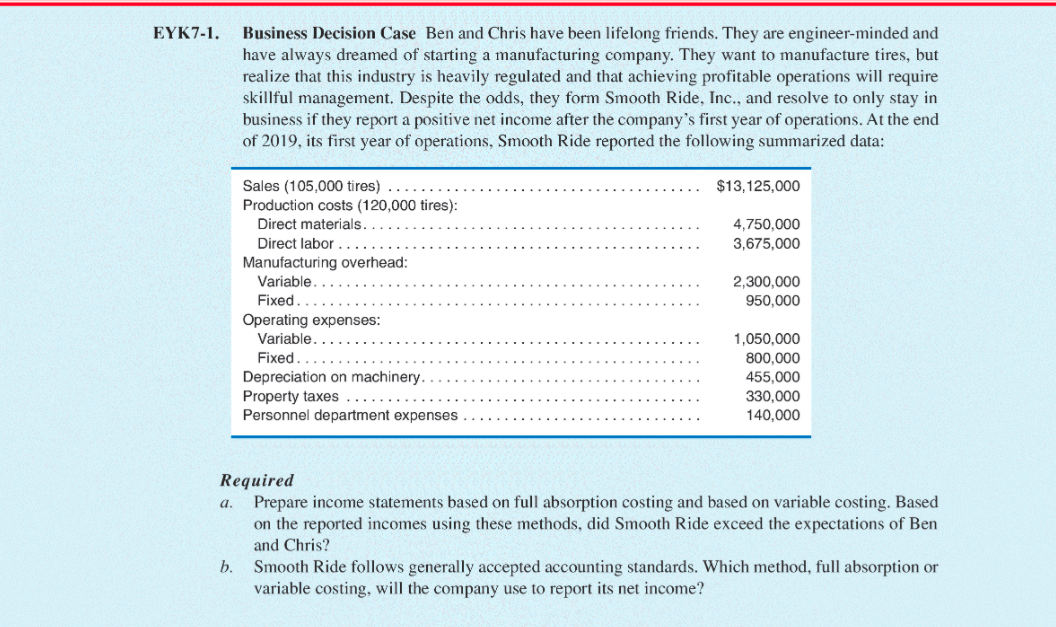

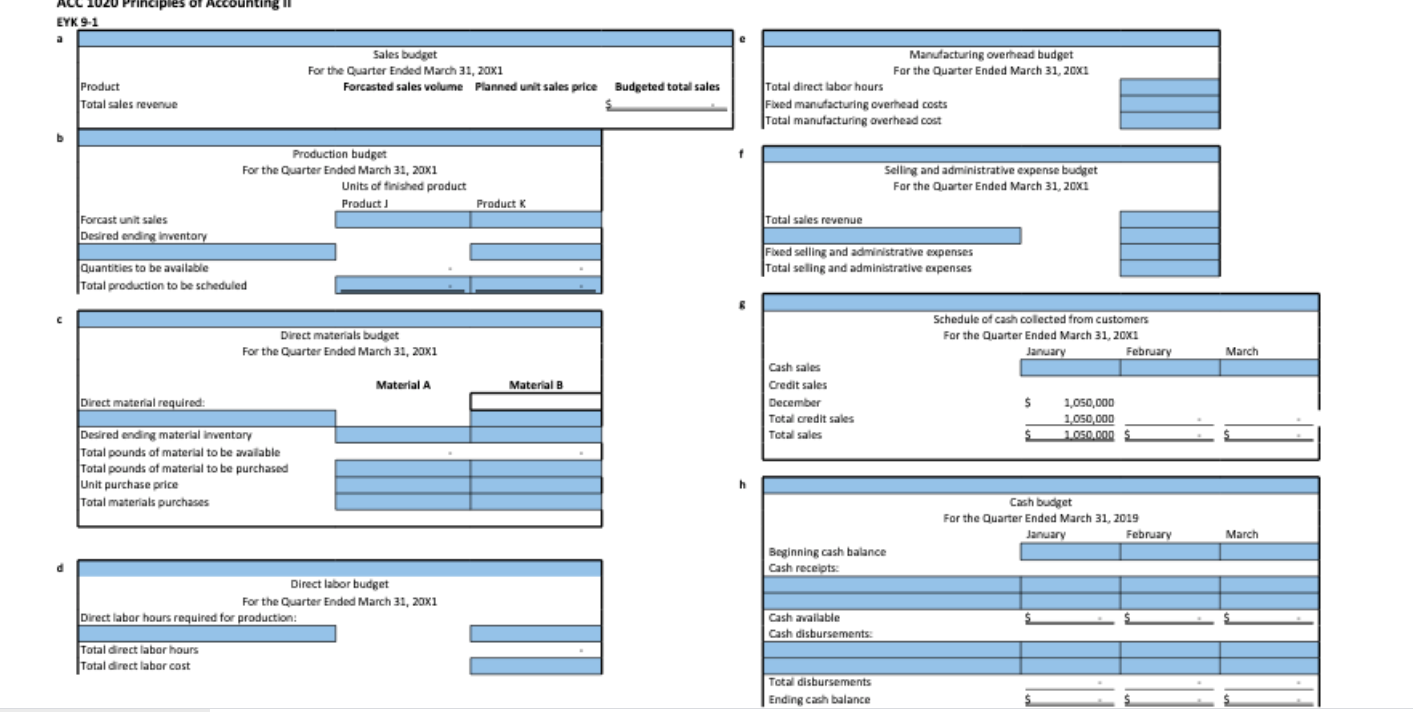

EYK7-1. Business Decision Case Ben and Chris have been lifelong friends. They are engineer-minded and have always dreamed of starting a manufacturing company. They want to manufacture tires, but realize that this industry is heavily regulated and that achieving profitable operations will require skillful management. Despite the odds, they form Smooth Ride, Inc., and resolve to only stay in business if they report a positive net income after the company's first year of operations. At the end of 2019, its first year of operations, Smooth Ride reported the following summarized data: $13,125,000 4,750,000 3,675,000 Sales (105,000 tires) Production costs (120,000 tires): Direct materials. Direct labor Manufacturing overhead: Variable Fixed Operating expenses: Variable Fixed Depreciation on machinery. Property taxes Personnel department expenses 2,300,000 950,000 1,050,000 800,000 455,000 330,000 140,000 a. Required Prepare income statements based on full absorption costing and based on variable costing. Based on the reported incomes using these methods, did Smooth Ride exceed the expectations of Ben and Chris? b. Smooth Ride follows generally accepted accounting standards. Which method, full absorption or variable costing, will the company use to report its net income? 1020 Principles of Accounting EYK 9-1 Sales budget For the Quarter Ended March 31, 20X1 Forcasted sales volume Planned unit sales price Budgeted total sales Product Total sales revenue Manufacturing overhead budget For the Quarter Ended March 31, 20X1 Total direct labor hours Fixed manufacturing overhead costs Total manufacturing overhead cost Production budget For the Quarter Ended March 31, 20x1 Units of finished product Product Selling and administrative expense budget For the Quarter Ended March 31, 20X1 Product K Total sales revenue Forcast unit sales Desired ending Inventory Fbeed selling and administrative expenses Total seling and administrative expenses Quantities to be available Total production to be scheduled Direct materials budget For the Quarter Ended March 31, 20x1 Schedule of cash collected from customers For the Quarter Ended March 31, 20KI January February March Material A Material B Direct material required: Cash sales Credit sales December Total credit sales Total sales $ 1,050,000 1 050 000 1.050,000 $ Desired ending material inventory Total pounds of material to be available Total pounds of material to be purchased Unit purchase price Total materials purchases h Cash budget For the Quarter Ended March 31, 2019 January February March Beginning cash balance Cash receipts: d Direct labor budget For the Quarter Ended March 31, 20x1 , Direct labor hours required for production: Cash available Cash disbursements: Total direct labor hours Total direct labor cost Total disbursements Ending cash balance

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started