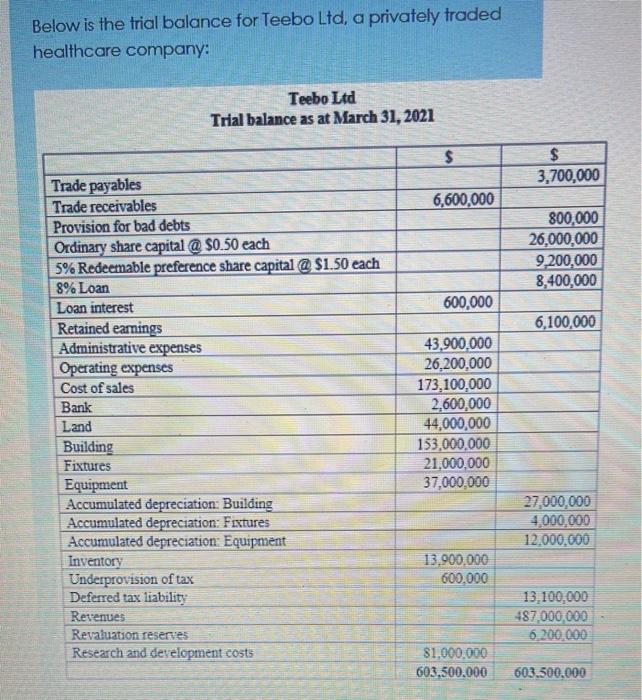

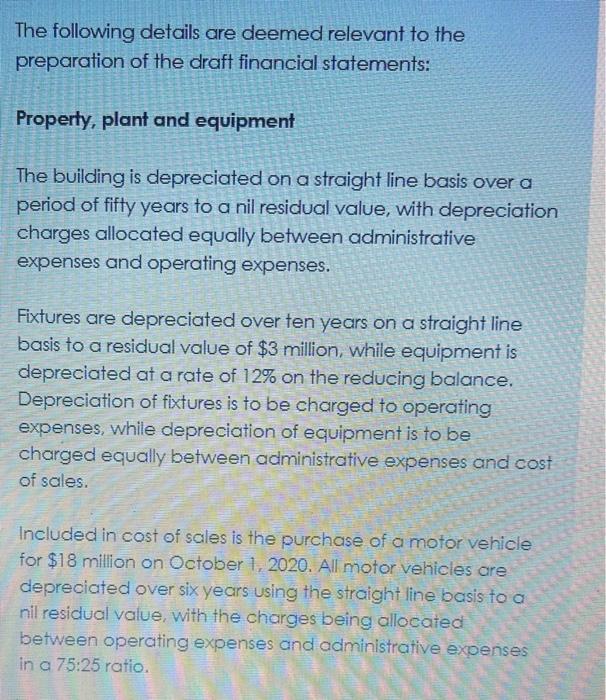

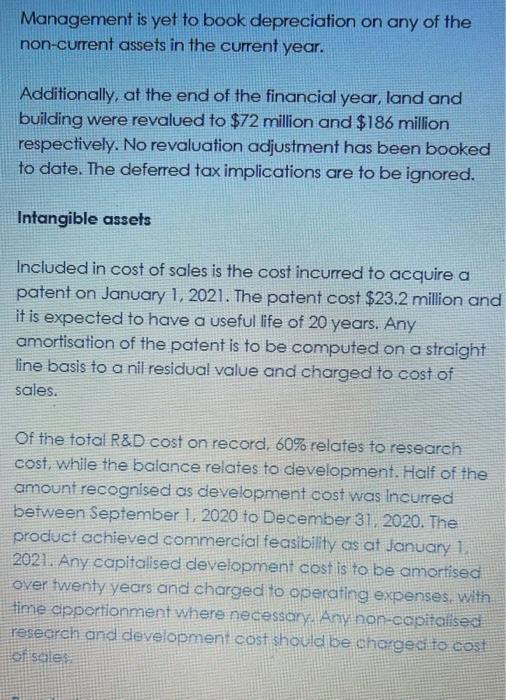

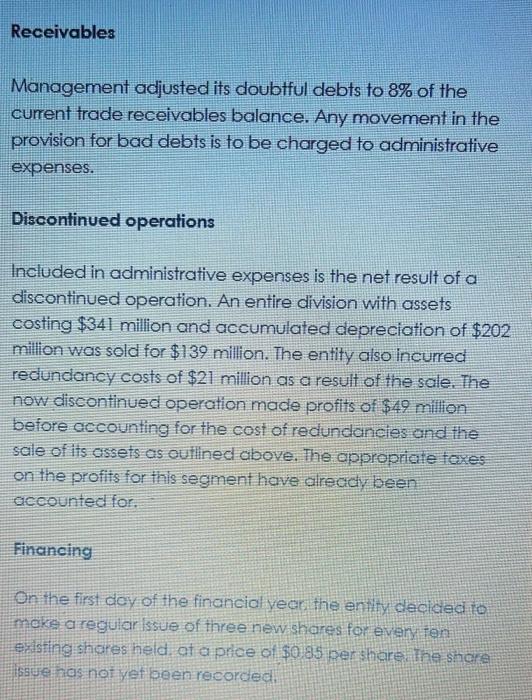

Below is the trial balance for Teebo Ltd, a privately traded healthcare company: Teebo Ltd Trial balance as at March 31, 2021 $ $ 3,700,000 6,600,000 800,000 26,000,000 9.200,000 8,400,000 600,000 6,100,000 Trade payables Trade receivables Provision for bad debts Ordinary share capital @ $0.50 each 5% Redeemable preference share capital @ $1.50 each 8% Loan Loan interest Retained earings Administrative expenses Operating expenses Cost of sales Bank Land Building Fixtures Equipment Accumulated depreciation: Building Accumulated depreciation: Fixtures Accumulated depreciation Equipment Inventory Underprovision of tax Deferred tax liability Revenues Revaluation reserves Research and development costs 43,900.000 26,200,000 173,100,000 2,600,000 44,000,000 153,000,000 21,000,000 37,000,000 27,000,000 4,000,000 12.000.000 13.900.000 600.000 13.100.000 487,000,000 6.100.000 81,000,000 603.500.000 603.500.000 The following details are deemed relevant to the preparation of the draft financial statements: Property, plant and equipment The building is depreciated on a straight line basis over a period of fifty years to a nil residual value, with depreciation charges allocated equally between administrative expenses and operating expenses. Fixtures are depreciated over ten years on a straight line basis to a residual value of $3 million, while equipment is depreciated at a rate of 12% on the reducing balance. Depreciation of fixtures is to be charged to operating expenses, while depreciation of equipment is to be charged equally between administrative expenses and cost of sales. Included in cost of sales is the purchase of a motor vehicle for $18 million on October 1, 2020. All motor vehicles are depreciated over six years using the straight line basis to a nil residual value, with the charges being allocated between operating expenses and administrative expenses in a 75:25 ratio. Management is yet to book depreciation on any of the non-current assets in the current year. Additionally, at the end of the financial year, land and building were revalued to $72 million and $186 million respectively. No revaluation adjustment has been booked to date. The deferred tax implications are to be ignored. Intangible assets Included in cost of sales is the cost incurred to acquire a patent on January 1, 2021. The patent cost $23.2 million and it is expected to have a useful life of 20 years. Any amortisation of the patent is to be computed on a straight line basis to a nil residual value and charged to cost of sales. Of the total R&D cost on record, 60% relates to research cost, while the balance relates to development. Half of the amount recognised as development cost was incurred between September 1, 2020 to December 31, 2020. The product achieved commercial feasibility as at January 1 2021. Any capitalised development cost is to be amortised over twenty years and charged to operating expenses, with time apportionment where necessary. Any non-capitalised research and development cost should be charged to cost of sale Receivables Management adjusted its doubtful debts to 8% of the current trade receivables balance. Any movement in the provision for bad debts is to be charged to administrative expenses. Discontinued operations Included in administrative expenses is the net result of a discontinued operation. An entire division with assets costing $341 million and accumulated depreciation of $202 million was sold for $139 million. The entity also incurred redundancy costs of $21 million as a result of the sale. The now discontinued operation made profits of $49 million before accounting for the cost of redundancies and the sale of its assets as outlined above. The appropriate texes on the profits for this segment have already been accounted for Financing On the first day of the financial veer the entity decided to make a regular issue of three new shares for every con existing shores held at a price of $0.85 pershare the share Issue has not yet been recorded. Dividends on both the redeemable preference shares and the ordinary shares were declared on March 31, 2021, but both remain unrecorded. In the case of the ordinary shares, dividends were declared at a rate of four cents per share in issue at that date. Payments are expected to be made two months after the date of declaration. The loan interest paid during the period was incorrectly debited in a separate account under that name, in addition to the fact that the unpaid balance remains unaccounted for Taxation The entity has provided for current taxes to the tune of $5.9 million. Accumulated taxable temporary differences at the year end amounted to $37 million. The current income tax rate is 25%. The adjustments relating to tax are yet to be made. Other An impending lawsuit has given rise to the need to create a probable liability to the tune of $23 million to be recognised in operating expenses. REQUIRED Prepare all journal entries that would be generated from the transactions and adjustments detailed above. Supporting workings should be shown where opplcable to justify the figures used in the foumal entries Below is the trial balance for Teebo Ltd, a privately traded healthcare company: Teebo Ltd Trial balance as at March 31, 2021 $ $ 3,700,000 6,600,000 800,000 26,000,000 9.200,000 8,400,000 600,000 6,100,000 Trade payables Trade receivables Provision for bad debts Ordinary share capital @ $0.50 each 5% Redeemable preference share capital @ $1.50 each 8% Loan Loan interest Retained earings Administrative expenses Operating expenses Cost of sales Bank Land Building Fixtures Equipment Accumulated depreciation: Building Accumulated depreciation: Fixtures Accumulated depreciation Equipment Inventory Underprovision of tax Deferred tax liability Revenues Revaluation reserves Research and development costs 43,900.000 26,200,000 173,100,000 2,600,000 44,000,000 153,000,000 21,000,000 37,000,000 27,000,000 4,000,000 12.000.000 13.900.000 600.000 13.100.000 487,000,000 6.100.000 81,000,000 603.500.000 603.500.000 The following details are deemed relevant to the preparation of the draft financial statements: Property, plant and equipment The building is depreciated on a straight line basis over a period of fifty years to a nil residual value, with depreciation charges allocated equally between administrative expenses and operating expenses. Fixtures are depreciated over ten years on a straight line basis to a residual value of $3 million, while equipment is depreciated at a rate of 12% on the reducing balance. Depreciation of fixtures is to be charged to operating expenses, while depreciation of equipment is to be charged equally between administrative expenses and cost of sales. Included in cost of sales is the purchase of a motor vehicle for $18 million on October 1, 2020. All motor vehicles are depreciated over six years using the straight line basis to a nil residual value, with the charges being allocated between operating expenses and administrative expenses in a 75:25 ratio. Management is yet to book depreciation on any of the non-current assets in the current year. Additionally, at the end of the financial year, land and building were revalued to $72 million and $186 million respectively. No revaluation adjustment has been booked to date. The deferred tax implications are to be ignored. Intangible assets Included in cost of sales is the cost incurred to acquire a patent on January 1, 2021. The patent cost $23.2 million and it is expected to have a useful life of 20 years. Any amortisation of the patent is to be computed on a straight line basis to a nil residual value and charged to cost of sales. Of the total R&D cost on record, 60% relates to research cost, while the balance relates to development. Half of the amount recognised as development cost was incurred between September 1, 2020 to December 31, 2020. The product achieved commercial feasibility as at January 1 2021. Any capitalised development cost is to be amortised over twenty years and charged to operating expenses, with time apportionment where necessary. Any non-capitalised research and development cost should be charged to cost of sale Receivables Management adjusted its doubtful debts to 8% of the current trade receivables balance. Any movement in the provision for bad debts is to be charged to administrative expenses. Discontinued operations Included in administrative expenses is the net result of a discontinued operation. An entire division with assets costing $341 million and accumulated depreciation of $202 million was sold for $139 million. The entity also incurred redundancy costs of $21 million as a result of the sale. The now discontinued operation made profits of $49 million before accounting for the cost of redundancies and the sale of its assets as outlined above. The appropriate texes on the profits for this segment have already been accounted for Financing On the first day of the financial veer the entity decided to make a regular issue of three new shares for every con existing shores held at a price of $0.85 pershare the share Issue has not yet been recorded. Dividends on both the redeemable preference shares and the ordinary shares were declared on March 31, 2021, but both remain unrecorded. In the case of the ordinary shares, dividends were declared at a rate of four cents per share in issue at that date. Payments are expected to be made two months after the date of declaration. The loan interest paid during the period was incorrectly debited in a separate account under that name, in addition to the fact that the unpaid balance remains unaccounted for Taxation The entity has provided for current taxes to the tune of $5.9 million. Accumulated taxable temporary differences at the year end amounted to $37 million. The current income tax rate is 25%. The adjustments relating to tax are yet to be made. Other An impending lawsuit has given rise to the need to create a probable liability to the tune of $23 million to be recognised in operating expenses. REQUIRED Prepare all journal entries that would be generated from the transactions and adjustments detailed above. Supporting workings should be shown where opplcable to justify the figures used in the foumal entries