Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Below one is the question that you need to solve. Below one is a example question/answer and format that how you need to solve this

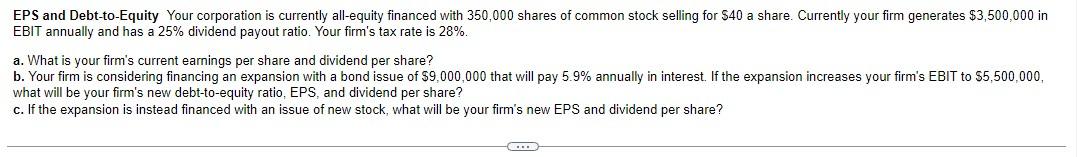

Below one is the question that you need to solve.

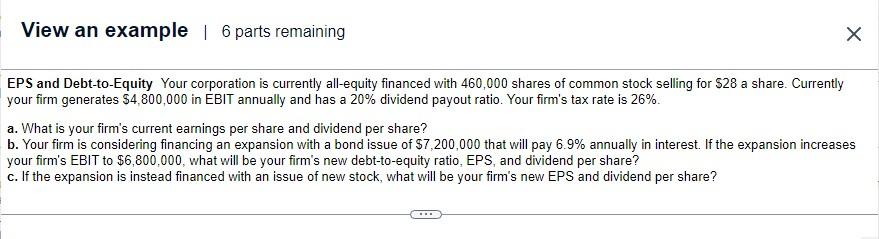

Below one is a example question/answer and format that how you need to solve this math

example question

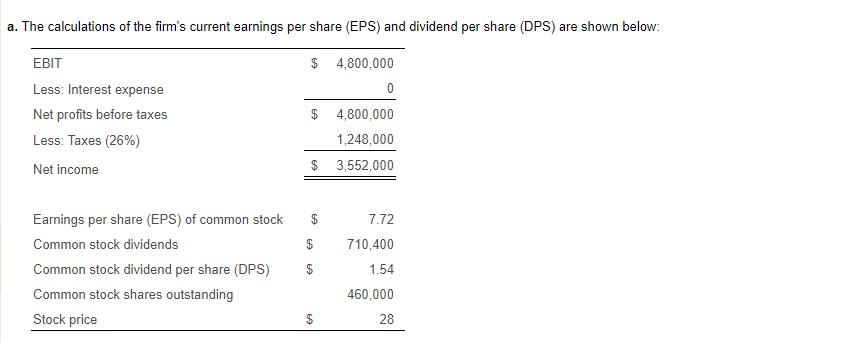

example answer

example answer

Above i have shown a sample as well, if your answer is correct and you followed the format i will not miss to give you like for sure. thanks in advance.

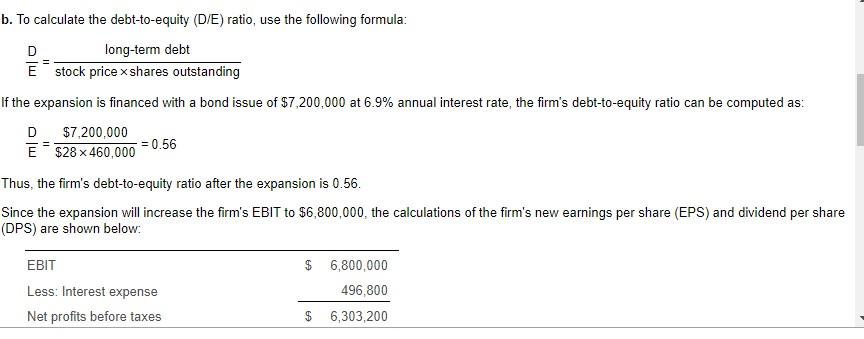

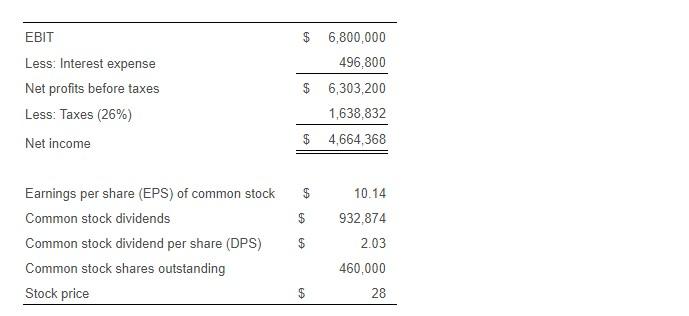

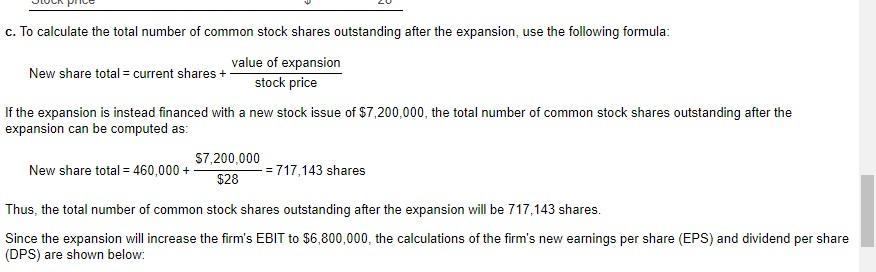

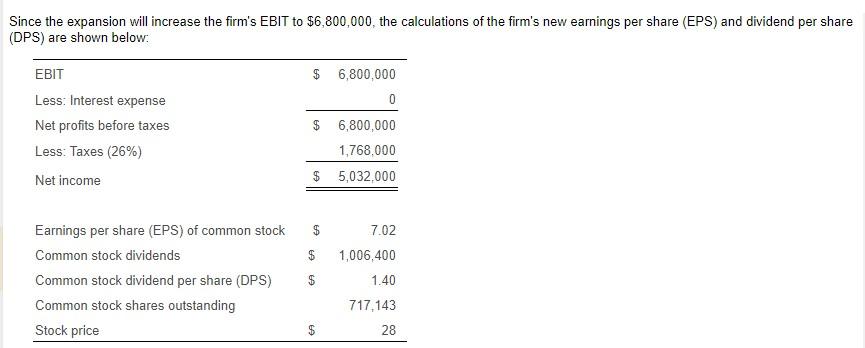

EPS and Debt-to-Equity Your corporation is currently all-equity financed with 350,000 shares of common stock selling for $40 a share. Currently your firm generates $3,500,000 in EBIT annually and has a 25% dividend payout ratio. Your firm's tax rate is 28%. a. What is your firm's current earnings per share and dividend per share? b. Your firm is considering financing an expansion with a bond issue of $9,000,000 that will pay 5.9% annually in interest. If the expansion increases your firm's EBIT to $5,500,000, what will be your firm's new debt-to-equity ratio, EPS, and dividend per share? c. If the expansion is instead financed with an issue of new stock, what will be your firm's new EPS and dividend per share? View an example | 6 parts remaining EPS and Debt-to-Equity Your corporation is currently all-equity financed with 460,000 shares of common stock selling for $28 a share. Currently your firm generates $4,800,000 in EBIT annually and has a 20% dividend payout ratio. Your firm's tax rate is 26%. a. What is your firm's current earnings per share and dividend per share? b. Your firm is considering financing an expansion with a bond issue of $7,200,000 that will pay 6.9% annually in interest. If the expansion increases your firm's EBIT to $6,800,000, what will be your firm's new debt-to-equity ratio, EPS, and dividend per share? c. If the expansion is instead financed with an issue of new stock, what will be your firm's new EPS and dividend per share? a. The calculations of the firm's current earnings per share (EPS) and dividend per share (DPS) are shown below: b. To calculate the debt-to-equity (D/E) ratio, use the following formula: ED=stockpricesharesoutstandinglong-termdebt If the expansion is financed with a bond issue of $7,200,000 at 6.9% annual interest rate, the firm's debt-to-equity ratio can be computed as: ED=$28460,000$7,200,000=0.56 Thus, the firm's debt-to-equity ratio after the expansion is 0.56. Since the expansion will increase the firm's EBIT to $6,800,000, the calculations of the firm's new earnings per share (EPS) and dividend per share (DPS) are shown below: \begin{tabular}{lrr} \hline EBIT & $6,800,000 \\ Less: Interest expense & 496,800 \\ \cline { 2 - 3 } Net profits before taxes & $6,303,200 \\ Less: Taxes (26\%) & $1,638,832 \\ \cline { 2 - 3 } Net income & $4,664,368 \\ \hline \hline \end{tabular} Earnings per share (EPS) of common stock $10.14 Commonstockdividends$932,874 Common stock dividend per share (DPS) $2.03 Common stock shares outstanding 460,000 Stock price New share total = current shares +stockpricevalueofexpansion If the expansion is instead financed with a new stock issue of $7,200,000, the total number of common stock shares outstanding after the expansion can be computed as: New share total =460,000+$28$7,200,000=717,143 shares Thus, the total number of common stock shares outstanding after the expansion will be 717,143 shares. Since the expansion will increase the firm's EBIT to $6,800,000, the calculations of the firm's new earnings per share (EPS) and dividend per share (DPS) are shown below: Since the expansion will increase the firm's EBIT to $6,800,000, the calculations of the firm's new earnings per share (EPS) and dividend per share (DPS) are shown below

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started