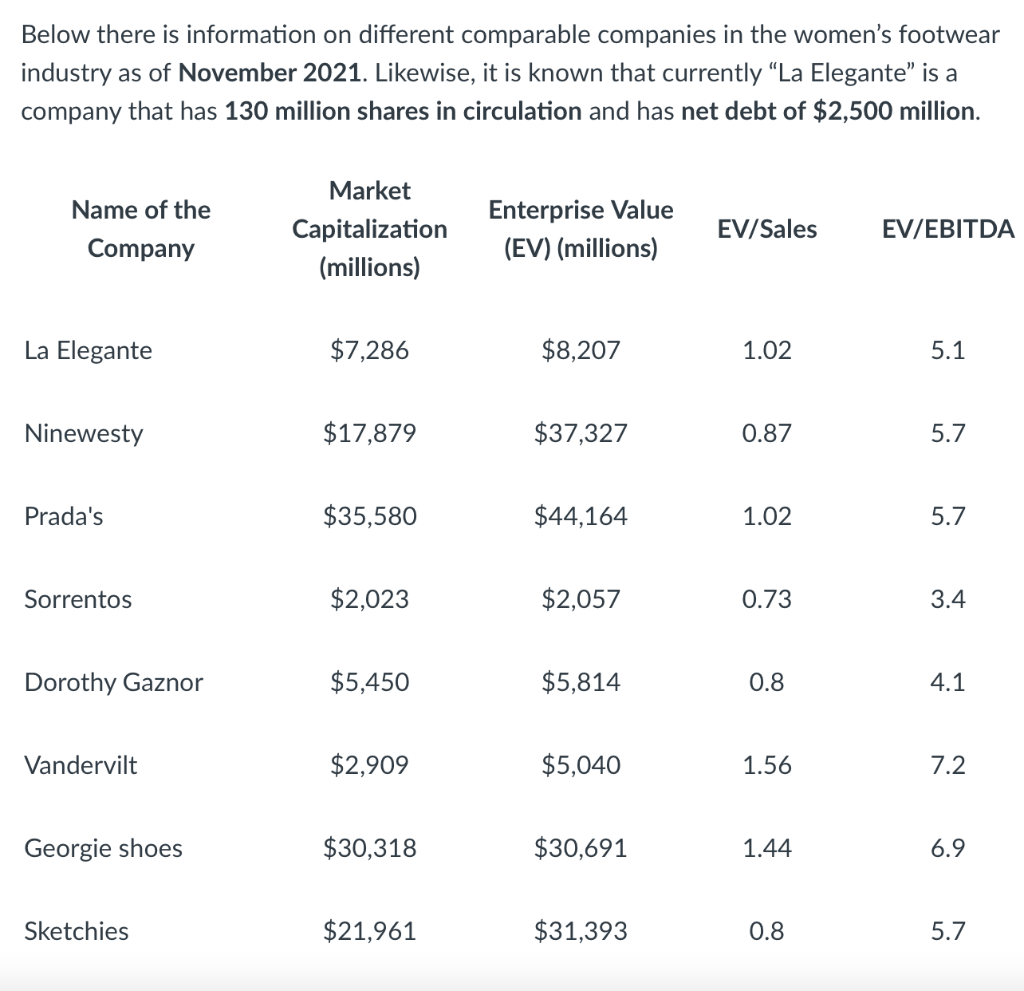

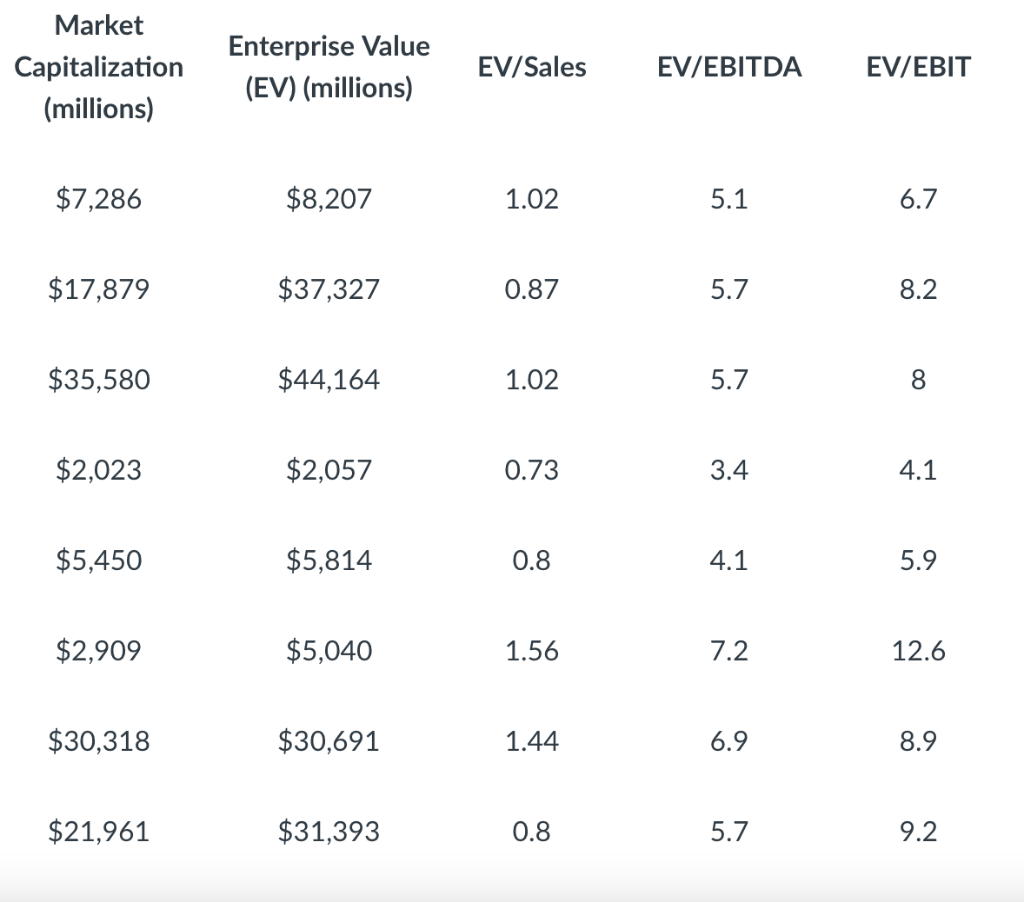

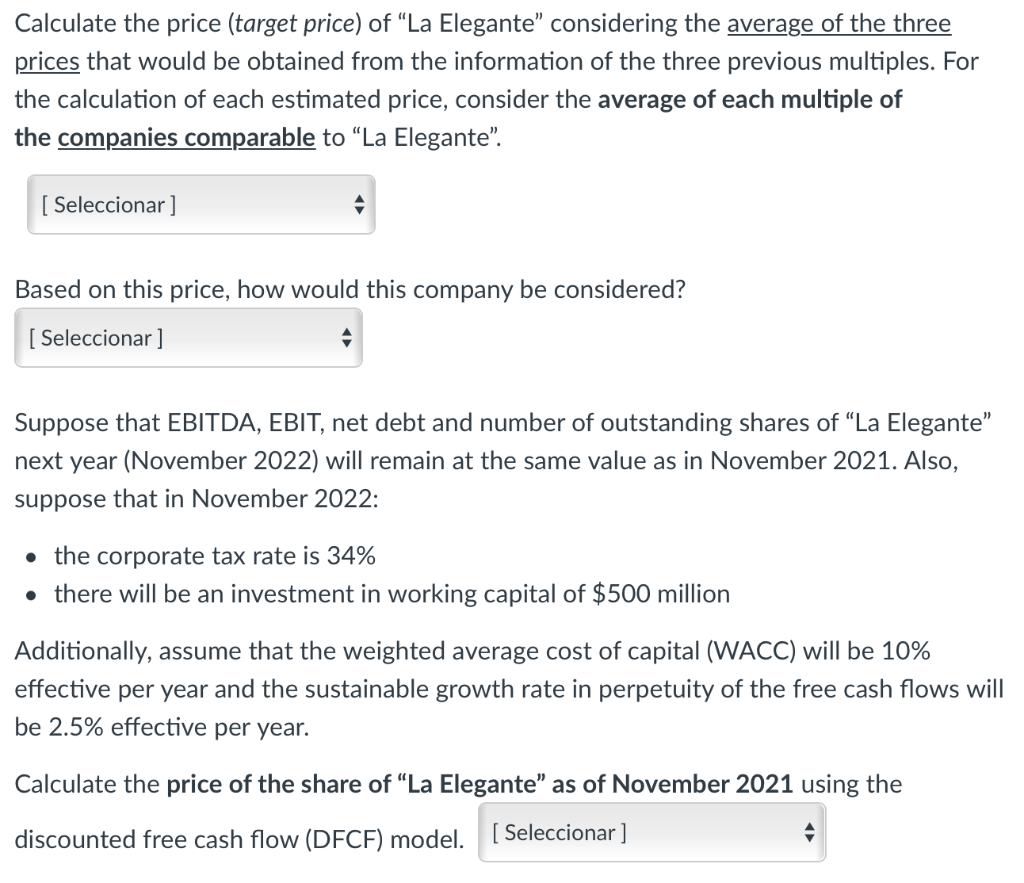

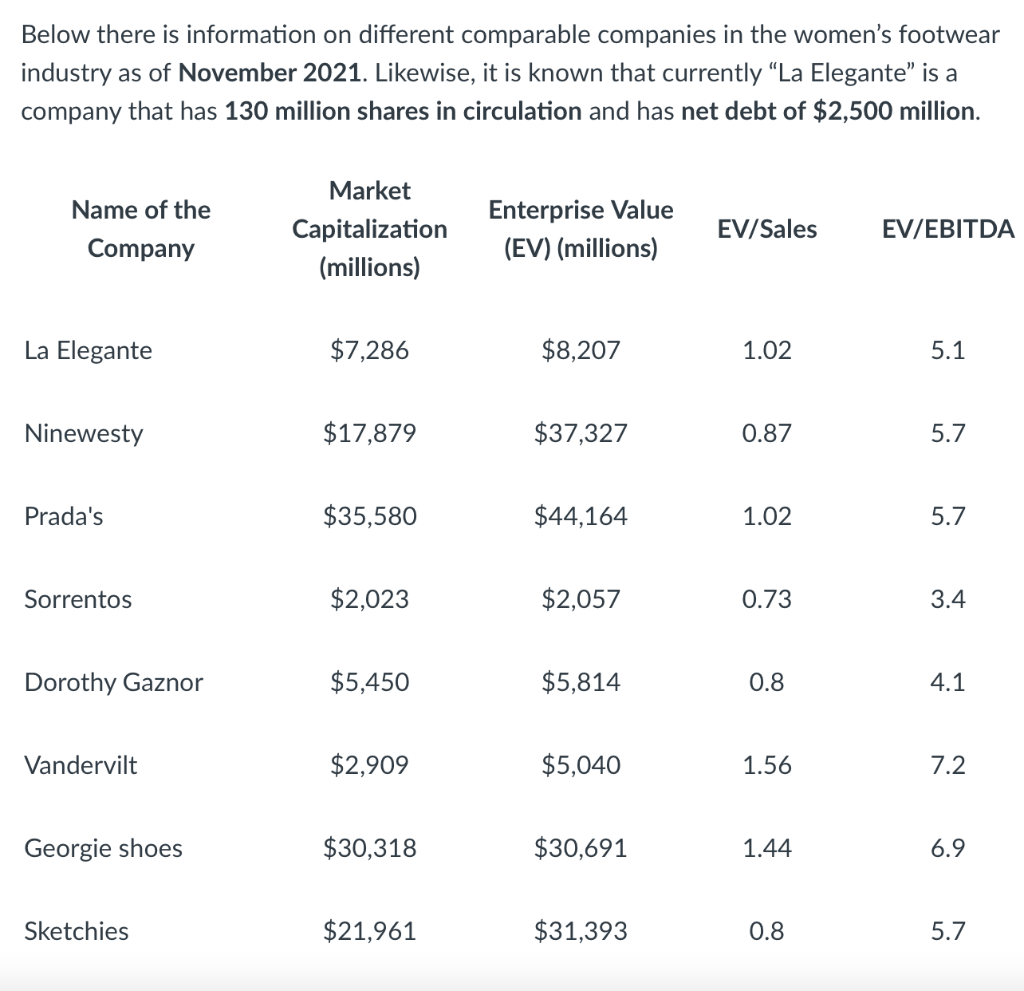

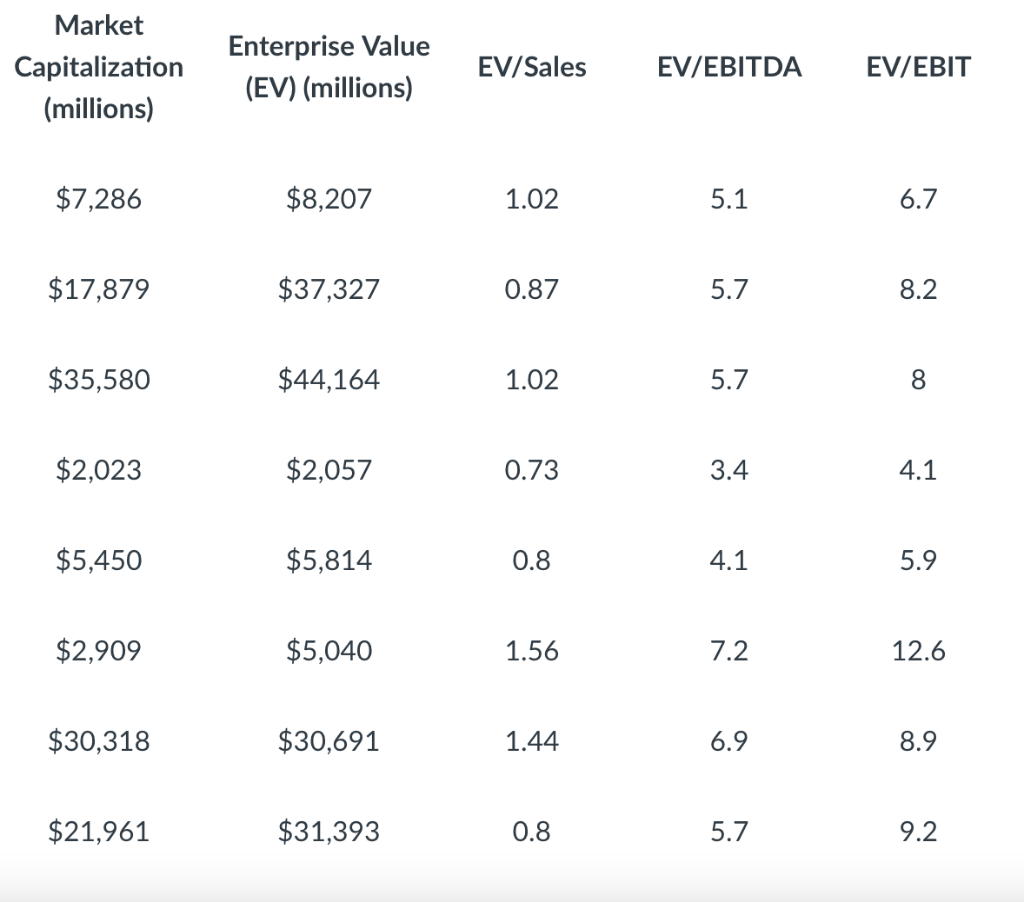

Below there is information on different comparable companies in the women's footwear industry as of November 2021. Likewise, it is known that currently La Elegante is a company that has 130 million shares in circulation and has net debt of $2,500 million. Name of the Company Market Capitalization (millions) Enterprise Value (EV) (millions) EV/Sales EV/EBITDA La Elegante $7,286 $8,207 1.02 5.1 Ninewesty $17,879 $37,327 0.87 5.7 Prada's $35,580 $44,164 1.02 5.7 Sorrentos $2,023 $2,057 0.73 3.4 Dorothy Gaznor $5,450 $5,814 0.8 4.1 Vandervilt $2,909 $5,040 1.56 7.2 Georgie shoes $30,318 $30,691 1.44 6.9 Sketchies $21,961 $31,393 0.8 5.7 Market Capitalization (millions) Enterprise Value (EV) (millions) EV/Sales EV/EBITDA EV/EBIT $7,286 $8,207 1.02 5.1 6.7 $17,879 $37,327 0.87 5.7 8.2 $35,580 $44,164 1.02 5.7 8 $2,023 $2,057 0.73 3.4 4.1 $5,450 $5,814 0.8 4.1 5.9 $2,909 $5,040 1.56 7.2 12.6 $30,318 $30,691 1.44 6.9 8.9 $21,961 $31,393 0.8 5.7 9.2 Calculate the price (target price) of La Elegante considering the average of the three prices that would be obtained from the information of the three previous multiples. For the calculation of each estimated price, consider the average of each multiple of the companies comparable to "La Elegante. [ Seleccionar ] Based on this price, how would this company be considered? [ Seleccionar ] Suppose that EBITDA, EBIT, net debt and number of outstanding shares of La Elegante next year (November 2022) will remain at the same value as in November 2021. Also, suppose that in November 2022: the corporate tax rate is 34% there will be an investment in working capital of $500 million Additionally, assume that the weighted average cost of capital (WACC) will be 10% effective per year and the sustainable growth rate in perpetuity of the free cash flows will be 2.5% effective per year. Calculate the price of the share of La Elegante as of November 2021 using the discounted free cash flow (DFCF) model. [Seleccionar] Below there is information on different comparable companies in the women's footwear industry as of November 2021. Likewise, it is known that currently La Elegante is a company that has 130 million shares in circulation and has net debt of $2,500 million. Name of the Company Market Capitalization (millions) Enterprise Value (EV) (millions) EV/Sales EV/EBITDA La Elegante $7,286 $8,207 1.02 5.1 Ninewesty $17,879 $37,327 0.87 5.7 Prada's $35,580 $44,164 1.02 5.7 Sorrentos $2,023 $2,057 0.73 3.4 Dorothy Gaznor $5,450 $5,814 0.8 4.1 Vandervilt $2,909 $5,040 1.56 7.2 Georgie shoes $30,318 $30,691 1.44 6.9 Sketchies $21,961 $31,393 0.8 5.7 Market Capitalization (millions) Enterprise Value (EV) (millions) EV/Sales EV/EBITDA EV/EBIT $7,286 $8,207 1.02 5.1 6.7 $17,879 $37,327 0.87 5.7 8.2 $35,580 $44,164 1.02 5.7 8 $2,023 $2,057 0.73 3.4 4.1 $5,450 $5,814 0.8 4.1 5.9 $2,909 $5,040 1.56 7.2 12.6 $30,318 $30,691 1.44 6.9 8.9 $21,961 $31,393 0.8 5.7 9.2 Calculate the price (target price) of La Elegante considering the average of the three prices that would be obtained from the information of the three previous multiples. For the calculation of each estimated price, consider the average of each multiple of the companies comparable to "La Elegante. [ Seleccionar ] Based on this price, how would this company be considered? [ Seleccionar ] Suppose that EBITDA, EBIT, net debt and number of outstanding shares of La Elegante next year (November 2022) will remain at the same value as in November 2021. Also, suppose that in November 2022: the corporate tax rate is 34% there will be an investment in working capital of $500 million Additionally, assume that the weighted average cost of capital (WACC) will be 10% effective per year and the sustainable growth rate in perpetuity of the free cash flows will be 2.5% effective per year. Calculate the price of the share of La Elegante as of November 2021 using the discounted free cash flow (DFCF) model. [Seleccionar]