Bottle-Up Inc., was organized on January 7, 2008, and made its S election on January 24, 2008. The necessary consents to the election were filed

Bottle-Up Inc., was organized on January 7, 2008, and made its S election on January 24, 2008. The necessary consents to the election were filed in a timely manner. Its address is 1234 Hill Street, City, ST 33333. Bottle-Up uses the calendar year as tax year, the accrual method of accounting, and the first-in, first-out (FIFO) inventory method. Bottle-Up manufactures ornamental glass bottles. It made no changes to its inventory costing methods this year. It uses the specific identification method for bad debt for book and tax purposes. Herman Hiebert is the tax matters person. Financial statements for the current year are below. Ignore the U.S. (domestic) production activities deduction. Prepare a 2017 S Corporation tax return for Bottle-Up

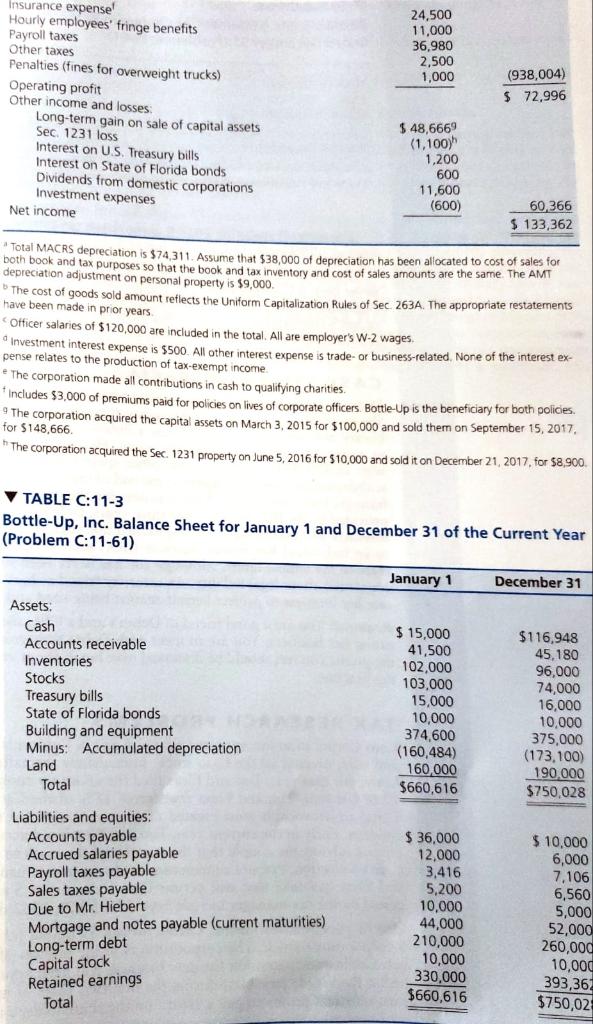

December 31 :

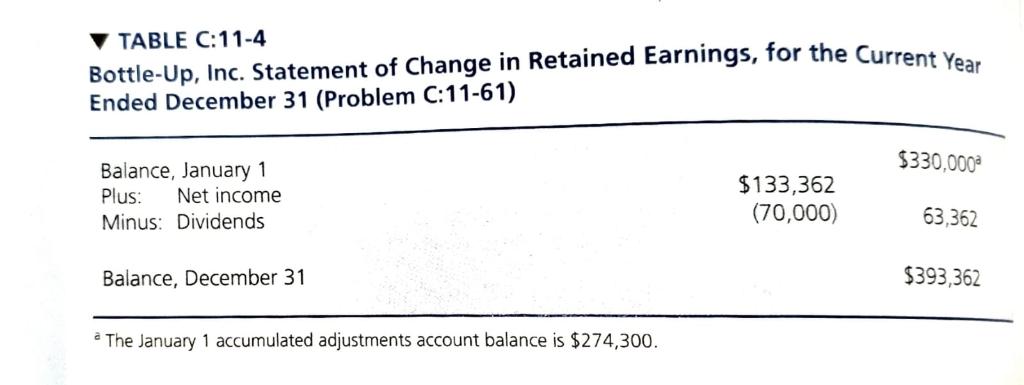

Retained Earnings 393,362

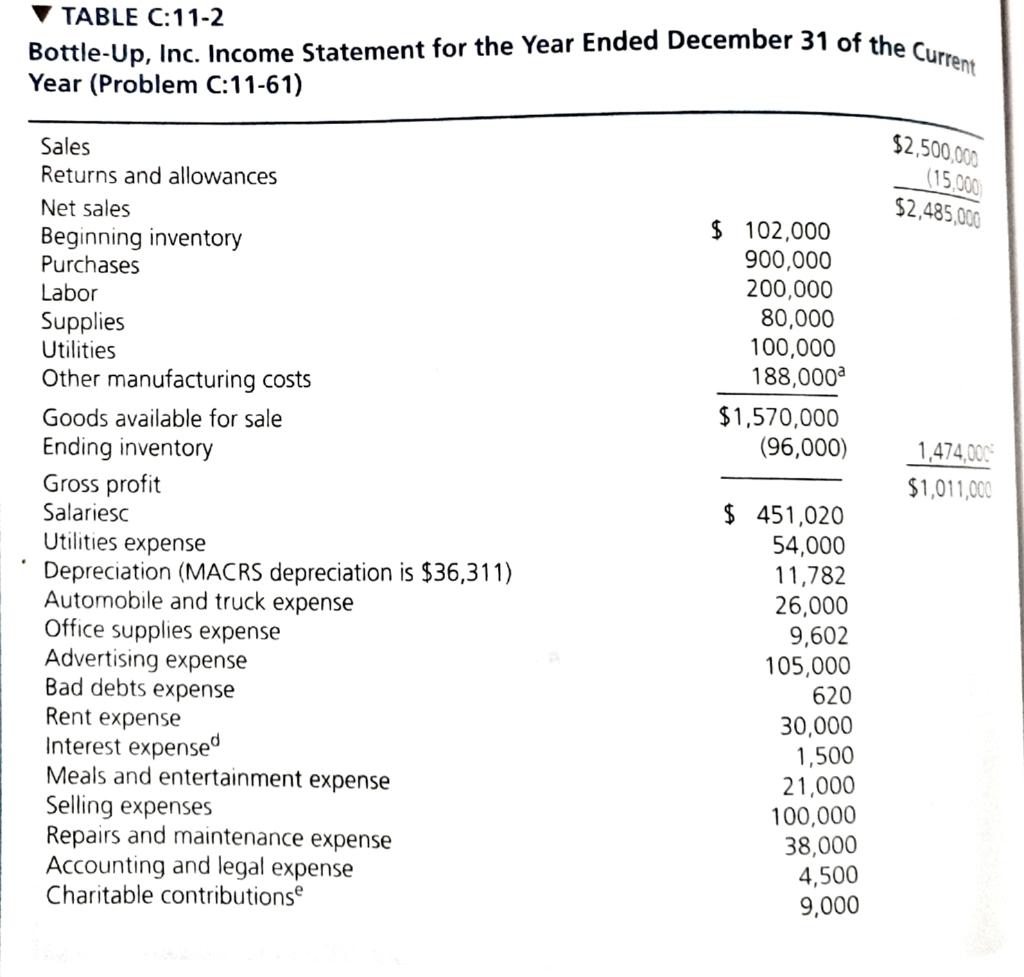

Bottle-Up, Inc. Income Statement for the Year Ended December 31 of the Current TABLE C:11-2 Year (Problem C:11-61) $2,500,000 Sales (15,000 $2,485,000 Returns and allowances Net sales $ 102,000 900,000 200,000 80,000 100,000 188,000a Beginning inventory Purchases Labor Supplies Utilities Other manufacturing costs $1,570,000 (96,000) Goods available for sale Ending inventory 1,474,00 $1,011,000 Gross profit Salariesc Utilities expense $ 451,020 Depreciation (MACRS depreciation is $36,311) Automobile and truck expense Office supplies expense Advertising expense Bad debts expense 54,000 11,782 26,000 9,602 105,000 620 Rent expense Interest expensed Meals and entertainment expense Selling expenses Repairs and maintenance expense Accounting and legal expense Charitable contributionse 30,000 1,500 21,000 100,000 38,000 4,500 9,000

Step by Step Solution

3.50 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION TOTAL LIABILITY CALCULATED BY MULTIPLYING THE TAXABLE INCOME BY THE TAX RATE COMPUTE T...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started