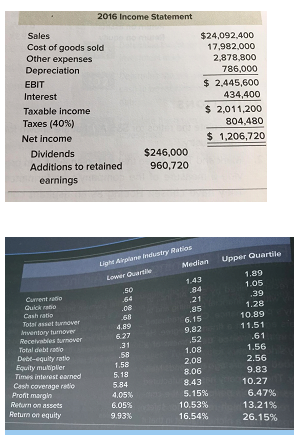

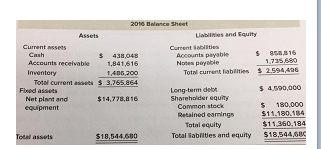

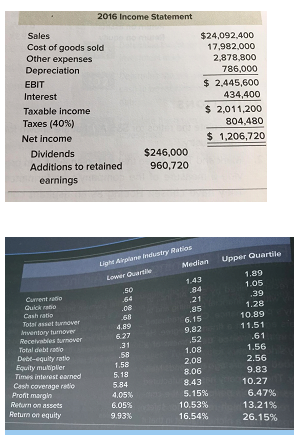

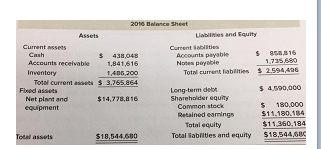

Below, you will find the Income statement and balance sheet of COBRA Inc for the end of 2016 and a table of industry averages. Calculate and interpret the following ratios Current ratio Inventory turnover ratio Total asset turnover ratio Times interest earned Return on assets Sustainable growth rate

the first two parts are answered here ( https://www.chegg.com/homework-help/questions-and-answers/find-income-statement-balance-sheet-cobra-inc-end-2016-table-industry-averages-calculate-i-q72662949?trackid=niUxckUB )

For each ratio explain why the ratio can be interpreted as positive or negative compared to the economy. Calculate Return on equity and by using the dupont identity explain why ROE is above/below the industry averages.( Like the comparison between Yahoo and Google example in the slides.)

2016 Income Statement Sales Cost of goods sold Other expenses Depreciation EBIT Interest Taxable income Taxes (40%) Net income Dividends Additions to retained earnings $24,092.400 17.982,000 2,878,800 786,000 $ 2.445,600 434,400 $ 2,011,200 804,480 $ 1,206,720 $246,000 960,720 Light Airplane Industry Ruties Lower Quartie Median 50 Upper Quartile 1.89 1.05 .39 1.28 10.89 11.51 .61 08 Currento Quick to Cash ratio Total asset urnover Inventory tumore Receivables turnover Total debt radio Debe-equity ratio Equity multiplier Time interest earned Cash coverage radio Profit margin Return on assets Return on equity 21 .85 6.15 9.82 .52 1.08 2.08 8.06 4.89 6.27 31 .58 1.58 5.18 5.84 4.05% 6.05% 9.93% 8.43 5.15% 10.53% 16.54% 1.56 2.56 9.83 10.27 6.47% 13.21% 26.15% 2016 Balance Sheet Assets Liables and Equity Current sets Current abilities Cash $ 438,048 Accounts payable S853816 Accounts receivable 1,841.616 Notes payable 1.735.680 Inventory 1,406 200 Total current libres 2.594,406 Total current sta $ 3.765.864 Fixed assets Long-term debt $ 4.990,000 Net plant and $14,778,816 Shareholder equity equipment Common stock $ 180,000 Retained earnings $11.180.134 Total equity $11.360.184 To assets $18,544.600 Total abtitles and equity $18,544.6BC 2016 Income Statement Sales Cost of goods sold Other expenses Depreciation EBIT Interest Taxable income Taxes (40%) Net income Dividends Additions to retained earnings $24,092.400 17.982,000 2,878,800 786,000 $ 2.445,600 434,400 $ 2,011,200 804,480 $ 1,206,720 $246,000 960,720 Light Airplane Industry Ruties Lower Quartie Median 50 Upper Quartile 1.89 1.05 .39 1.28 10.89 11.51 .61 08 Currento Quick to Cash ratio Total asset urnover Inventory tumore Receivables turnover Total debt radio Debe-equity ratio Equity multiplier Time interest earned Cash coverage radio Profit margin Return on assets Return on equity 21 .85 6.15 9.82 .52 1.08 2.08 8.06 4.89 6.27 31 .58 1.58 5.18 5.84 4.05% 6.05% 9.93% 8.43 5.15% 10.53% 16.54% 1.56 2.56 9.83 10.27 6.47% 13.21% 26.15% 2016 Balance Sheet Assets Liables and Equity Current sets Current abilities Cash $ 438,048 Accounts payable S853816 Accounts receivable 1,841.616 Notes payable 1.735.680 Inventory 1,406 200 Total current libres 2.594,406 Total current sta $ 3.765.864 Fixed assets Long-term debt $ 4.990,000 Net plant and $14,778,816 Shareholder equity equipment Common stock $ 180,000 Retained earnings $11.180.134 Total equity $11.360.184 To assets $18,544.600 Total abtitles and equity $18,544.6BC