Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 1 (1 point) Longleaf Homes owns a chain of senior housing complexes in the Seattle, Washington area. This firm is debating whether it should

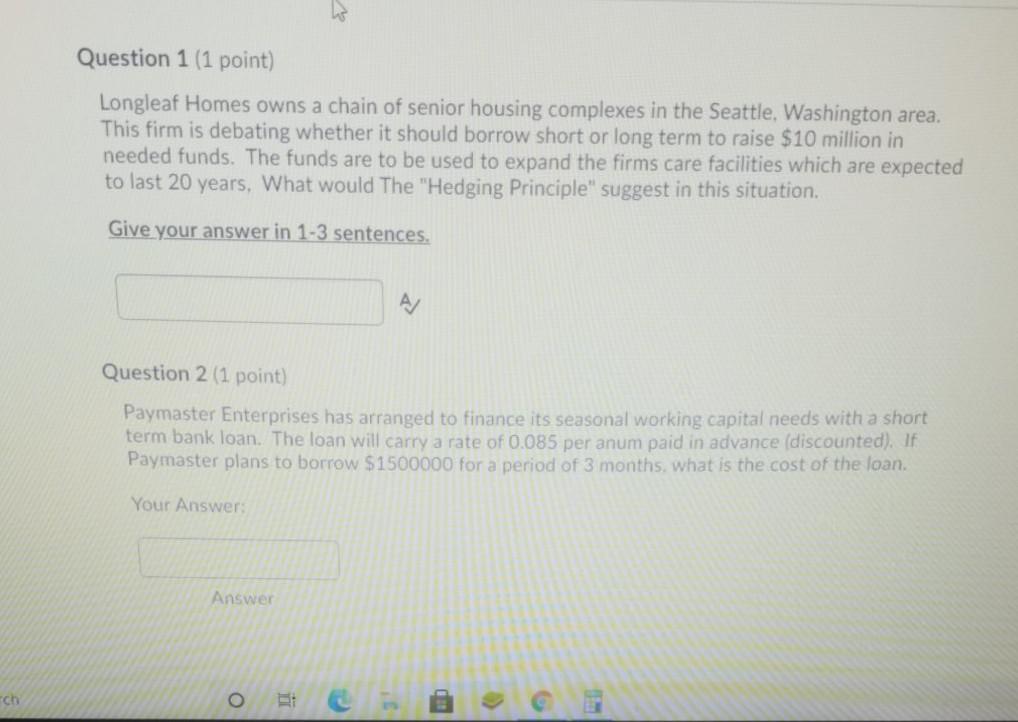

Question 1 (1 point) Longleaf Homes owns a chain of senior housing complexes in the Seattle, Washington area. This firm is debating whether it should borrow short or long term to raise $10 million in needed funds. The funds are to be used to expand the firms care facilities which are expected to last 20 years. What would The "Hedging Principle" suggest in this situation. Give your answer in 1-3 sentences. A/ Question 2 (1 point) Paymaster Enterprises has arranged to finance its seasonal working capital needs with a short term bank loan. The loan will carry a rate of 0.085 per anum paid in advance (discounted). If Paymaster plans borrow $1500000 for a period of 3 months, what is the cost of the loan. Your Answer Answer ch o

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started