Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Belton, Inc. is the purchase of equipment with the following characteristics: Initial cash investment $1,750,000 Working capital requirement $100,000 * Annual projected cash inflows $4475,000

Belton, Inc. is the purchase of equipment with the following characteristics:

Initial cash investment $1,750,000

Working capital requirement $100,000 *

Annual projected cash inflows $4475,000

Special repair cost needed at the end of year 4 $250,000 *

Salvage value $ 150,000

Length of the project 7 years

Required rate of return 10%

Assume the working capital will be released at the end of the project

Is this an inflow or outflow?

Is this single sum or annuity?

Calculating the Net Present Value

Please show all calculations.

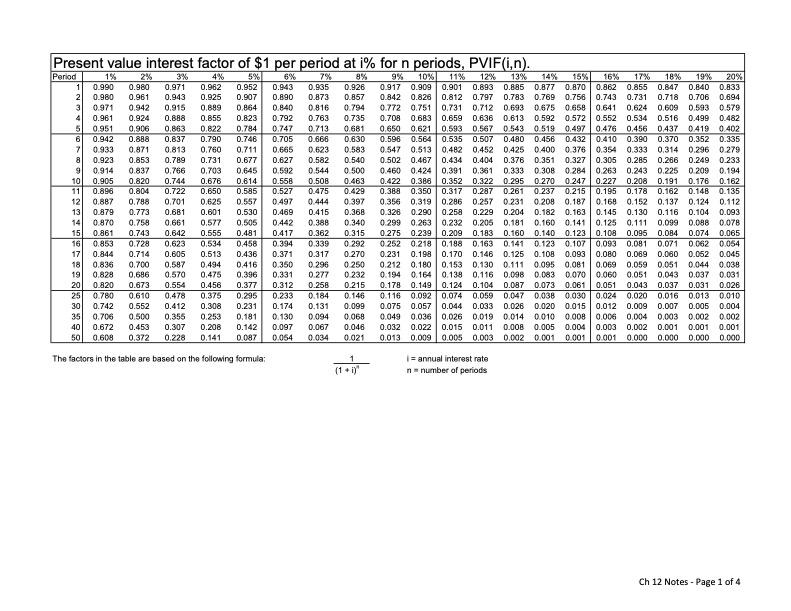

Present value interest factor of $1 per period at i% for n periods, PVIF(i,n). Period 1% 2% 1 0.990 0.980 0.971 2 0.980 0.961 0.943 3 4 0.961 0.924 0.971 0.942 0.915 0.889 5 0.951 0.906 4% 5% 6% 7% 8% 9% 10% 11% 12% 13% 14% 15% 16% 17% 18% 19% 20% 0.962 0.952 0.943 0.935 0.926 0.917 0.909 0.901 0.893 0.885 0.877 0.870 0.862 0.855 0.847 0.840 0.833 0.925 0.907 0.890 0.873 0.857 0.842 0.826 0.812 0.797 0.783 0.769 0.756 0.743 0.731 0.718 0.706 0.694 0.864 0.840 0.816 0.794 0.772 0.751 0.731 0.712 0.693 0.675 0.658 0.641 0.624 0.609 0.593 0.579 0.888 0.855 0.823 0.792 0.763 0.735 0.708 0.683 0.659 0.636 0.613 0.592 0.572 0.552 0.534 0.516 0.499 0.482 0.863 0.822 0.784 0.747 0.713 0.681 0.650 0.621 0.593 0.567 0.543 0.519 0.497 0.476 0.456 0.437 0.419 0.402 6 0.942 0.888 0.837 0.790 0.746 0.705 0.666 0.630 0.596 0.564 0.535 0.507 0.480 0.456 0.432 0.410 0.390 0.370 0.352 0.335 7 0.933 0.871 0.813 0.760 0.711 0.665 0.623 0.583 0.547 0.513 0,482 0,452 0.425 0.400 0.376 0.354 0.333 0.314 0.296 0.279 8 0.923 0.853 0.789 0.731 0.677 0.627 0.582 0.540 0.502 0.467 0.434 0.404 0.376 0.351 0.327 0.305 0.285 0.266 0.249 0.233 9 0.914 0.837 0.766 0.703 0.645 0.592 0.544 0.500 0.460 0.424 0.391 0.361 0.333 0.308 0.284 0.263 0.243 0.225 0.209 0.194 10 0.905 0.820 0.744 0.676 0.614 0.558 0.508 0.463 0.422 0.386 0.352 0.322 0.295 0.270 0.247 0.227 0.208 0.191 0.176 0.162 11 0.896 0.804 0.722 0.650 0.585 0.527 0.475 0.429 0.388 0.350 0.317 0.287 0.261 0.237 0.215 0.195 0.178 0.162 0.148 0.135 12 0.887 0.788 0.701 0.625 0.557 0.497 0.444 0.397 0.356 0.319 0.286 0.257 0.231 0.208 0.187 0.168 0.152 0.137 0.124. 0.112 0.879 0.773 0.681 0.601 0.530 0.469 0.415 0.368 0.326 0.290 0.258 0.229 0.204 0.182 0.163 0.145 0.130 0.116 0.104 0.093 0.870 0.758 0.661 0.577 0,505 0.442 0.388 0.340 0.299 0.263 0.232 0.205 0.181 0.160 0.141 0.125 0.111 0.099 0.088 0.078 0.861 0.743 0.642 0.555 0.481 0.417 0.362 0.315 0.275 0.239 0.209 0.183 0.160 0.140 0.123 0.108 0.095 0.084 0.074 0.065 16 0.853 0.728 0.623 0.534 0.458 0.394 0.339 0.292 0.252 0.218 0.188 0.163 0.141 0.123 0.107 0.093 0.081 0.071 0.062 0.054 17 0.844 0.714 0.605 0.513 0.436 0.371 0.317 0.270 0.231 0.198 0.170 0.146 0.125 0.108 0.093 0.080 0.069 0.060 0.052 0.045 18 0.836 0.700 0.587 0.494 0.416 0.350 0.296 0.250 0.212 0.180 0.153 0.130 0.111 0.095 0.081 0.069 0.059 0.051 0.044 0.038 19 0.828 0.686 0.570 0.475 0.396 0.331 0.277 0.232 0.194 0.164 0.138 0.116 0.098 0.083 0.070 0.060 0.051 0.043 0.037 0.031 20 0.820 0.673 0.554 0.456 0.377 0.312 0.258 0.215 0.178 0.149 0.124 0.104 0.087 0.073 0.061 0.051 0.043 0.037 0.031 0.026 25 0.780 0.610 0,478 0.375 0.295 0.233 0.184 0.146 0.116 0.092 0.074 0.059 0.047 0.038 0.030 0.024 0.020 0.016 0.013 0.010 30 0.742 0.552 0.412 0.308 0.231 0.174 0.131 0.099 0.075 0.057 0.044 0.033 0.026 0.020 0.015 0.012 0.009 0.007 0.005 0.004 0.706 0,500 0.355 0.253 0.181 0.130 0.094 0.068 0.049 0.036 0.026 0.019 0.014 0.010 0.008 0.006 0.004 0.003 0.002 0.002 0.672 0.453 0.307 0.208 0.142 0.097 0.067 0.046 0.032 0.022 0.015 0.011 0.008 0.005 0.004 0.003 0.002 0.001 0.001 0.001 0.608 0.372 0.228 0.141 0.087 0.054 0.034 0.021 0.013 0.009 0.005 0.003 0.002 0.001 0.001 0.001 0.000 0.000 0.000 0.000 2 13415 6 7 8 9 30 50 35 40 50 The factors in the table are based on the following formula: 1 (1+i)" i= annual interest rate n = number of periods Ch 12 Notes - Page 1 of 4

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Based on the information provided the cash flows associated with the project elements are as follows ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started