Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Ben and Carla Manchester plan to buy a condominium. They will obtain a $217,000, 20-year mortgage at 5.5 percent. Their annual property taxes are expected

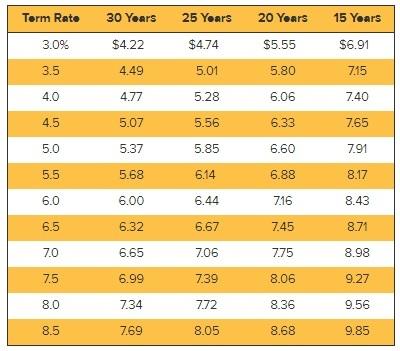

Ben and Carla Manchester plan to buy a condominium. They will obtain a $217,000, 20-year mortgage at 5.5 percent. Their annual property taxes are expected to be $1,812. Property insurance is $840 a year, and the condo association fee is $275 a month. Based on these items, determine the total monthly housing payment for the Manchesters. Use Exhibit 9-9. (Round time value factor to 2 decimal places and final answer to the nearest whole number.)

Total housing payment:

Torm Rato 30 Yoars 15 Years 3.0% $4.22 25 Yoars $4.74 5.01 20 Yours $5.55 5.80 $6.91 715 3.5 4.49 4.0 4.77 5.28 6.06 7.40 4.5 5.07 5.56 6.33 7.65 5.0 5.37 5.85 6.60 7.91 5.5 5.68 6.14 6.88 8.17 6.0 6.00 6.44 7.16 8.43 6.5 6.32 6.67 7.45 8.71 7.0 6.65 7.06 7.75 8.98 7.5 6.99 7.39 8.06 9.27 8.0 7.34 7.72 8.36 9.56 9.85 OF 8.5 7.69 8.05 8.68Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started