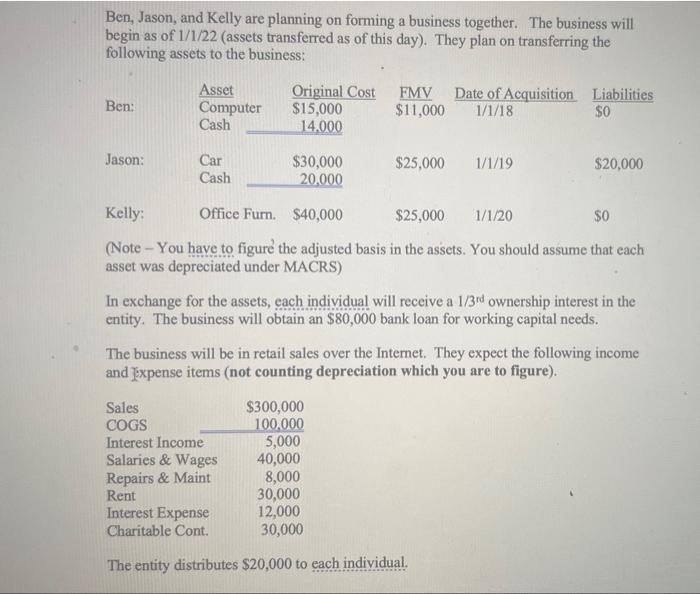

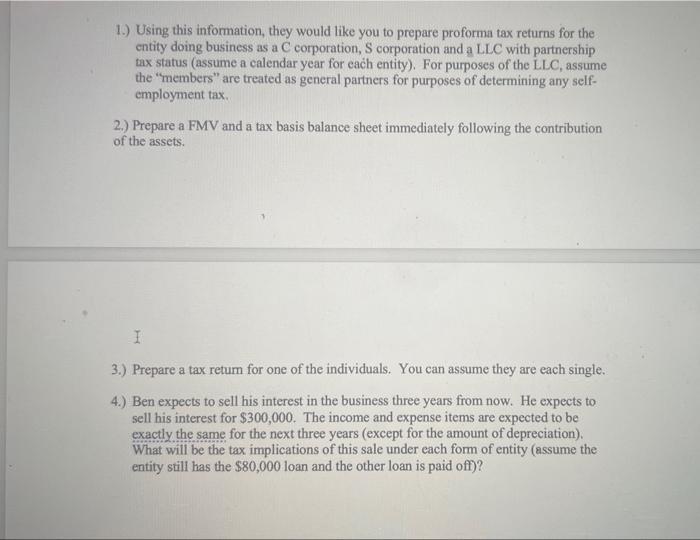

Ben, Jason, and Kelly are planning on forming a business together. The business will begin as of 1/1/22 (assets transferred as of this day). They plan on transferring the following assets to the business: (Note - You have to figure the adjusted basis in the assets. You should assume that each asset was depreciated under MACRS) In exchange for the assets, each individual will receive a 1/3nd ownership interest in the entity. The business will obtain an $80,000 bank loan for working capital needs. The business will be in retail sales over the Internet. They expect the following income and jxpense items (not counting depreciation which you are to figure). The entity distributes $20,000 to each individual. 1.) Using this information, they would like you to prepare proforma tax returns for the entity doing business as a C corporation, S corporation and a LLC with partnership tax status (assume a calendar year for each entity). For purposes of the LLC, assume the "members" are treated as general partners for purposes of determining any selfemployment tax. 2.) Prepare a FMV and a tax basis balance sheet immediately following the contribution of the assets. 3.) Prepare a tax retum for one of the individuals. You can assume they are each single. 4.) Ben expects to sell his interest in the business three years from now. He expects to sell his interest for $300,000. The income and expense items are expected to be exactly the same for the next three years (except for the amount of depreciation). What will be the tax implications of this sale under each form of entity (assume the entity still has the $80,000 loan and the other loan is paid off)? Ben, Jason, and Kelly are planning on forming a business together. The business will begin as of 1/1/22 (assets transferred as of this day). They plan on transferring the following assets to the business: (Note - You have to figure the adjusted basis in the assets. You should assume that each asset was depreciated under MACRS) In exchange for the assets, each individual will receive a 1/3nd ownership interest in the entity. The business will obtain an $80,000 bank loan for working capital needs. The business will be in retail sales over the Internet. They expect the following income and jxpense items (not counting depreciation which you are to figure). The entity distributes $20,000 to each individual. 1.) Using this information, they would like you to prepare proforma tax returns for the entity doing business as a C corporation, S corporation and a LLC with partnership tax status (assume a calendar year for each entity). For purposes of the LLC, assume the "members" are treated as general partners for purposes of determining any selfemployment tax. 2.) Prepare a FMV and a tax basis balance sheet immediately following the contribution of the assets. 3.) Prepare a tax retum for one of the individuals. You can assume they are each single. 4.) Ben expects to sell his interest in the business three years from now. He expects to sell his interest for $300,000. The income and expense items are expected to be exactly the same for the next three years (except for the amount of depreciation). What will be the tax implications of this sale under each form of entity (assume the entity still has the $80,000 loan and the other loan is paid off)