Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Benchmark Select a bond benchmark and if you want to work ahead, a stock benchmark. Consider the types of securities you will have in

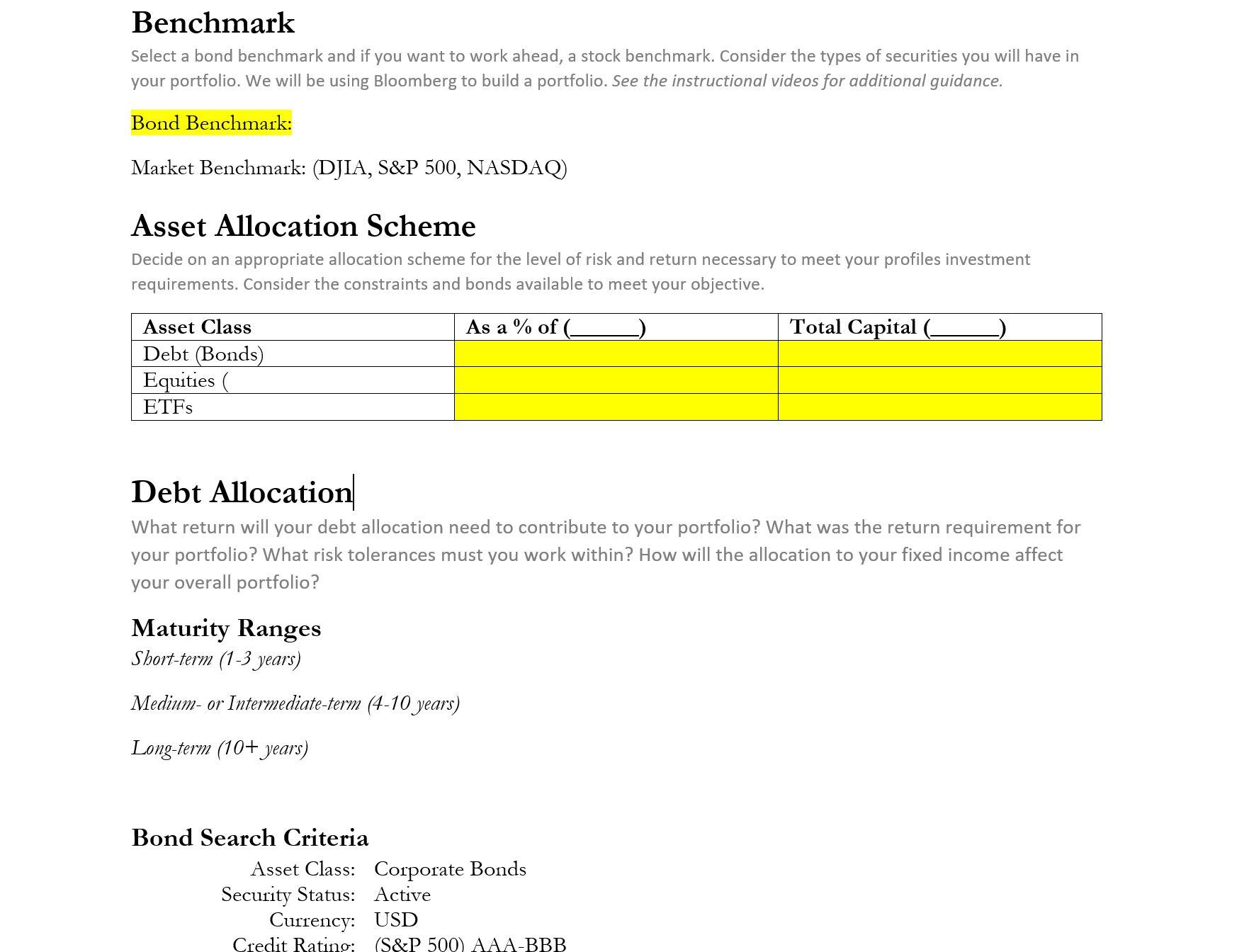

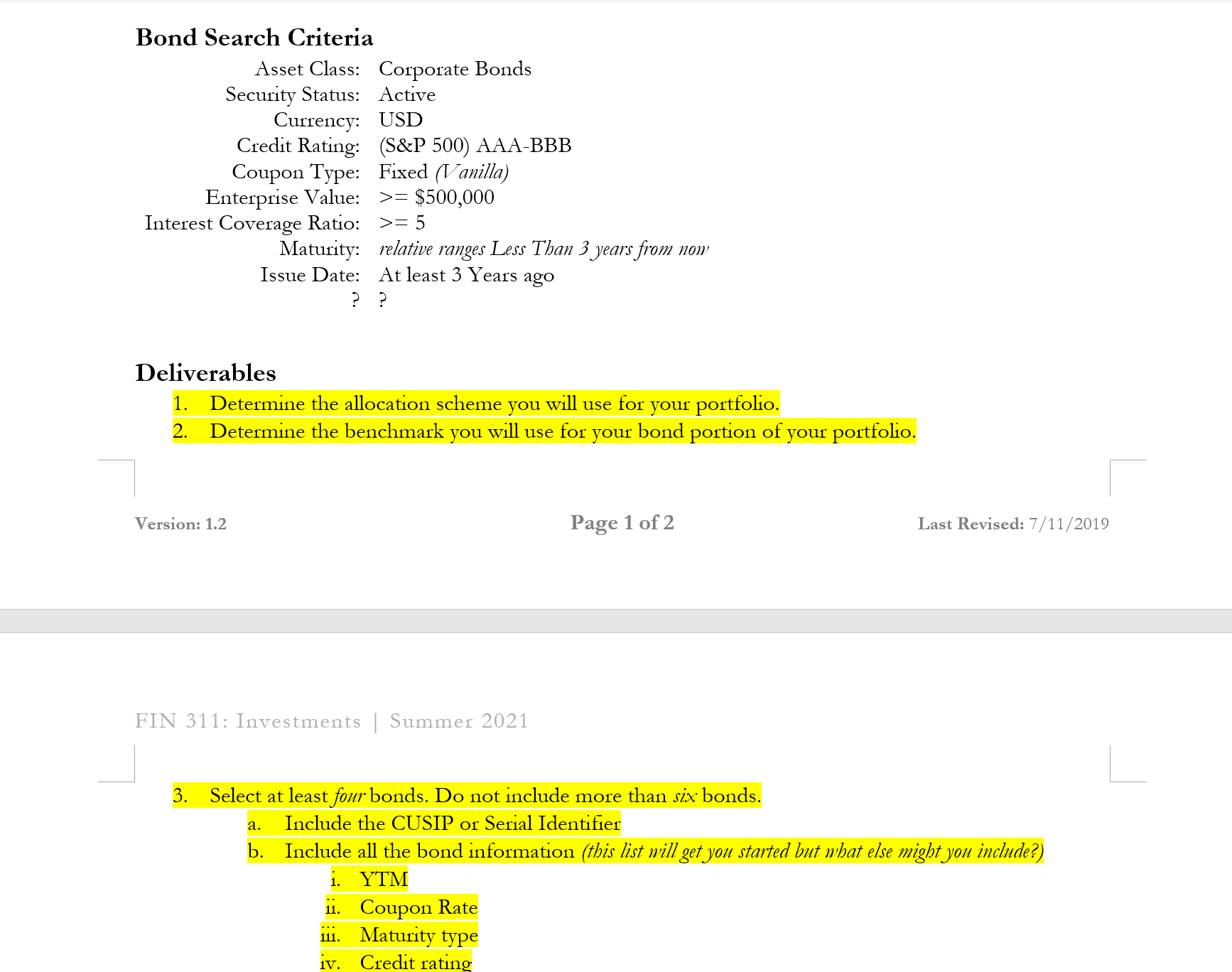

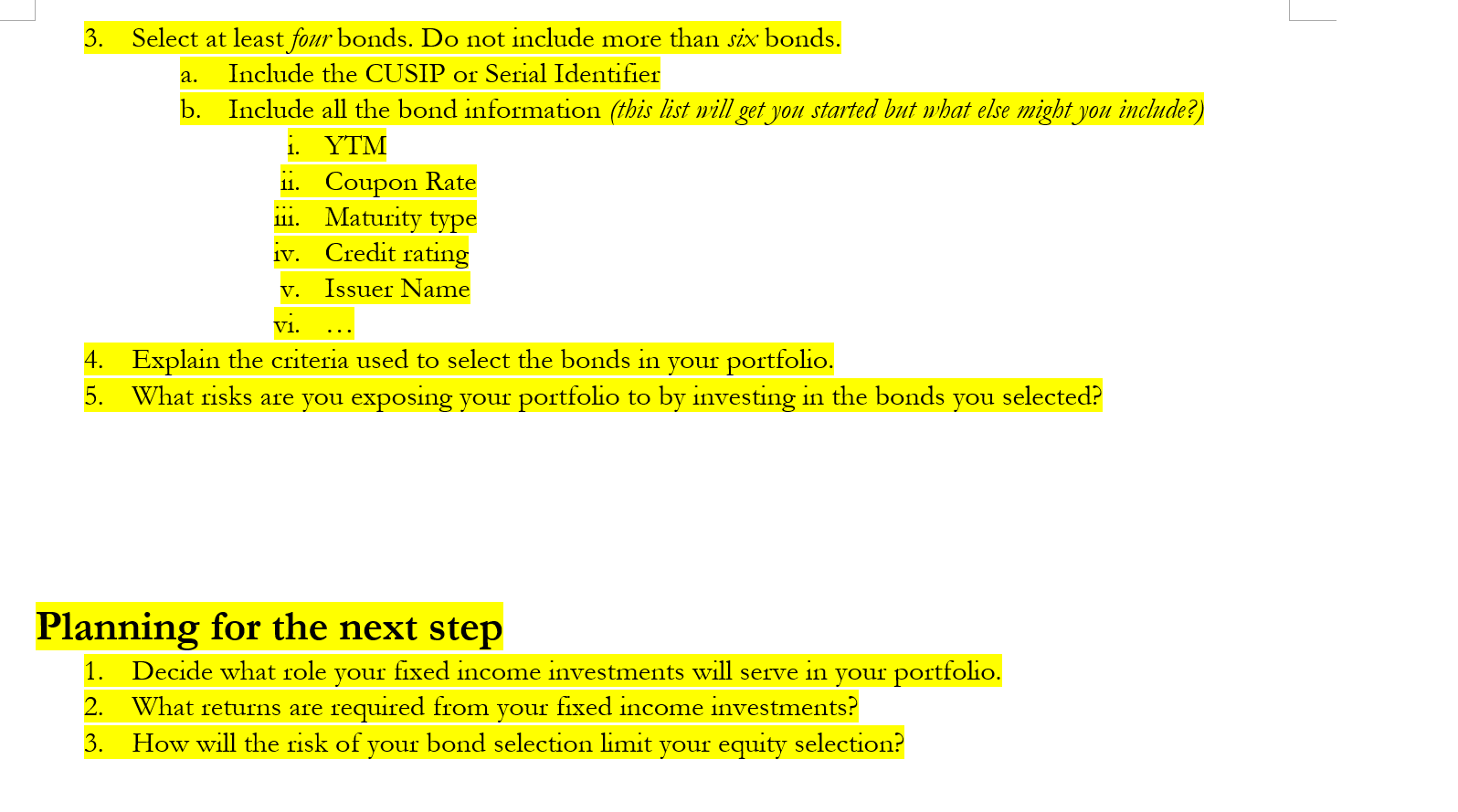

Benchmark Select a bond benchmark and if you want to work ahead, a stock benchmark. Consider the types of securities you will have in your portfolio. We will be using Bloomberg to build a portfolio. See the instructional videos for additional guidance. Bond Benchmark: Market Benchmark: (DJIA, S&P 500, NASDAQ) Asset Allocation Scheme Decide on an appropriate allocation scheme for the level of risk and return necessary to meet your profiles investment requirements. Consider the constraints and bonds available to meet your objective. Asset Class Debt (Bonds) As a % of (_ Total Capital Equities ( ETFs Debt Allocation What return will your debt allocation need to contribute to your portfolio? What was the return requirement for your portfolio? What risk tolerances must you work within? How will the allocation to your fixed income affect your overall portfolio? Maturity Ranges Short-term (1-3 years) Medium- or Intermediate-term (4-10 years) Long-term (10+ years) Bond Search Criteria Asset Class: Corporate Bonds Security Status: Active Currency: USD Credit Rating: (S&P 500) AAA-BBB Bond Search Criteria Asset Class: Corporate Bonds Security Status: Active Currency: USD Credit Rating: (S&P 500) AAA-BBB Coupon Type: Fixed (Vanilla) Enterprise Value: >= $500,000 Interest Coverage Ratio: >= 5 Maturity: Issue Date: relative ranges Less Than 3 years from now At least 3 Years ago ? ? Deliverables 1. Determine the allocation scheme you will use for your portfolio. 2. Determine the benchmark you will use for your bond portion of Version: 1.2 Page 1 of 2 your portfolio. Last Revised: 7/11/2019 FIN 311: Investments | Summer 2021 3. Select at least four bonds. Do not include more than six bonds. a. Include the CUSIP or Serial Identifier b. Include all the bond information (this list will get you started but what else might you include?) i. YTM ii. Coupon Rate iii. Maturity type iv. Credit rating 3. Select at least four bonds. Do not include more than six bonds. a. Include the CUSIP or Serial Identifier b. Include all the bond information (this list will get you started but what else might you include?) i. YTM ii. Coupon Rate iii. Maturity type 1V. Credit rating V. Issuer Name vi. 4. Explain the criteria used to select the bonds in your portfolio. 5. What risks are you exposing your portfolio to by investing in the bonds you selected? Planning for the next step 1. Decide what role your fixed income investments will serve in your portfolio. 2. What returns are required from your fixed income investments? 3. How will the risk of your bond selection limit your equity selection?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started