Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Benedict Corporation is a calendar year C corporation and has had gross receipts in excess of $27 million for the past decade. The corporation

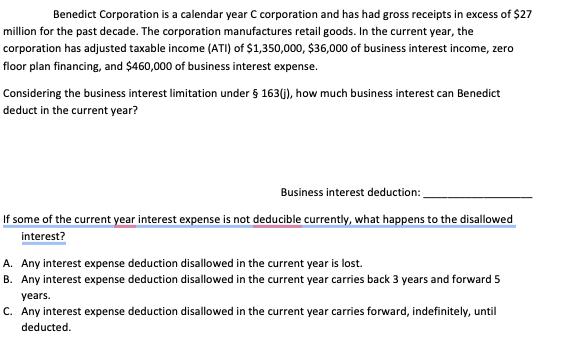

Benedict Corporation is a calendar year C corporation and has had gross receipts in excess of $27 million for the past decade. The corporation manufactures retail goods. In the current year, the corporation has adjusted taxable income (ATI) of $1,350,000, $36,000 of business interest income, zero floor plan financing, and $460,000 of business interest expense. Considering the business interest limitation under 163(j), how much business interest can Benedict deduct in the current year? Business interest deduction: If some of the current year interest expense is not deducible currently, what happens to the disallowed interest? A. Any interest expense deduction disallowed in the current year is lost. B. Any interest expense deduction disallowed in the current year carries back 3 years and forward 5 years. C. Any interest expense deduction disallowed in the current year carries forward, indefinitely, until deducted.

Step by Step Solution

★★★★★

3.39 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

First lets review the business interest deduction limitation under 163j This provision limits the am...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started