Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Benefits provided to domestic partners of employees do not have the same tax advantages as benefits provided to their spouses. What must be true for

Benefits provided to domestic partners of employees do not have the same tax advantages as benefits provided to their spouses.

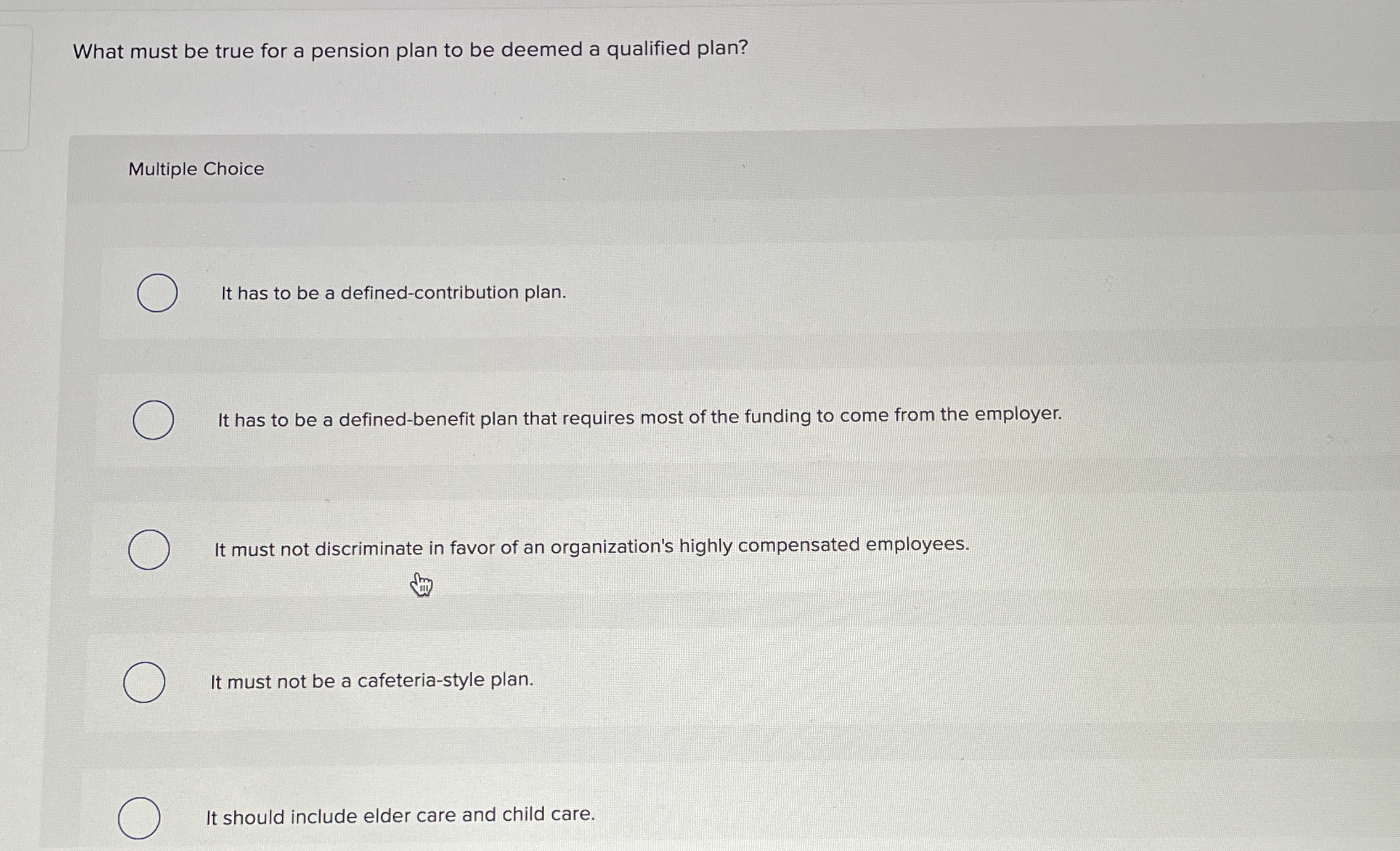

What must be true for a pension plan to be deemed a qualified plan?

Multiple Choice

It has to be a definedcontribution plan.

It has to be a definedbenefit plan that requires most of the funding to come from the employer.

It must not discriminate in favor of an organization's highly compensated employees.

It must not be a cafeteriastyle plan.

It should include elder care and child care.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started