Beng Engineering Supplies Pte Ltd is a company incorporated in Singapore and adopts the Singapore Financial Reporting Standards (FRSs). The trial balance of Beng Engineering

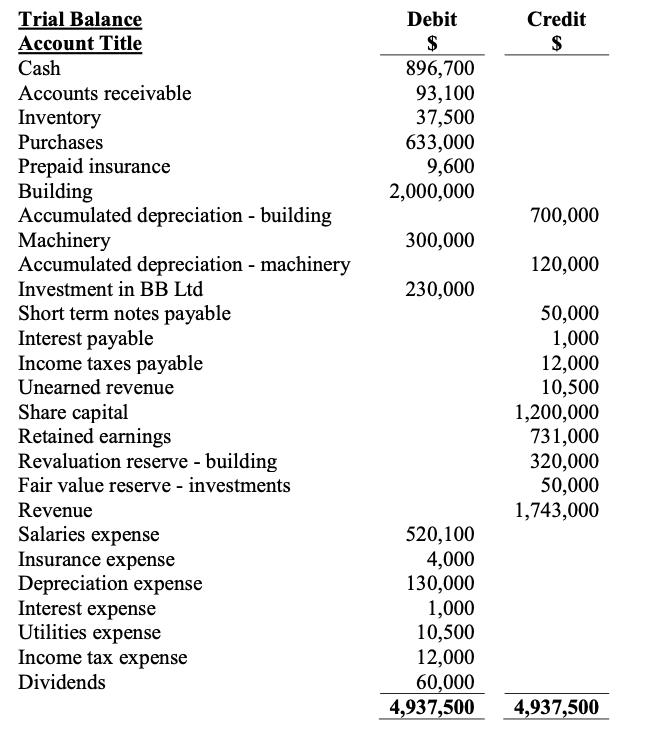

Beng Engineering Supplies Pte Ltd is a company incorporated in Singapore and adopts the Singapore Financial Reporting Standards (FRSs). The trial balance of Beng Engineering Supplies Pte Ltd as at 31 December 20X1 is given below.

Before you finalise the accounts, you are given the following additional information which has not been taken into account in the accounting books:

Additional information:

(1) On 23 December 20X1, the company delivered an outstanding order for a customer worth $5,500. The customer had previously paid for the order and the payment received was recorded.

(2) On 27 December 20X1, Joe Machinery Pte Ltd invested in the company by supplying a machinery worth $40,000. Beng Engineering Supplies Pte Ltd in turn issued its ordinary shares to Joe Machinery Pte Ltd.

(3) On 28 December 20X1, the company received an invoice for its utilities amounting to $950.

(4) On 29 December 20X1, a customer paid $4,000 for goods to be delivered on 6 January 20X2.

(5) The investment in BB Ltd was treated as a fair value through other comprehensive income investment. On 31 December 20X1, the fair value of the investment was $250,000.

(6) The company adopts the periodic inventory system. The inventory at the end of the year amounted to $10,000.

Trial Balance Account Title Cash Debit Credit 2$ 896,700 93,100 37,500 633,000 9,600 2,000,000 Accounts receivable Inventory Purchases Prepaid insurance Building Accumulated depreciation - building Machinery Accumulated depreciation - machinery Investment in BB Ltd 700,000 300,000 120,000 230,000 Short term notes payable Interest payable Income taxes payable Unearned revenue Share capital Retained earnings Revaluation reserve - building 50,000 1,000 12,000 10,500 1,200,000 731,000 320,000 50,000 1,743,000 Fair value reserve - investments Revenue Salaries expense Insurance expense Depreciation expense Interest expense Utilities expense Income tax expense 520,100 4,000 130,000 1,000 10,500 12,000 60,000 4,937,500 Dividends 4,937,500

Step by Step Solution

3.50 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Answer a 1 No adjustment entry 2 Machine40000 Share Capital40000 To record the acquisition of machine through issuance of shares 3 Utilities expense950 Utilities payable950 To record the accrual of ut...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started