Answered step by step

Verified Expert Solution

Question

1 Approved Answer

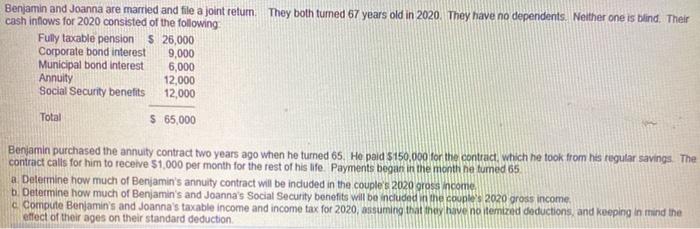

Benjamin and Joanna are married and file a joint return. They both turned 67 years old in 2020. They have no dependents. Neither one

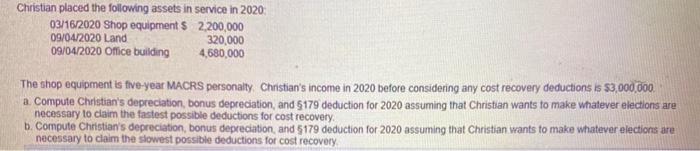

Benjamin and Joanna are married and file a joint return. They both turned 67 years old in 2020. They have no dependents. Neither one is blind. Their cash inflows for 2020 consisted of the following Fully taxable pension $ 26,000 9,000 6,000 12,000 12,000 $ 65,000 Corporate bond interest Municipal bond interest Annuity Social Security benefits Total Benjamin purchased the annuity contract two years ago when he turned 65. He paid $150,000 for the contract, which he took from his regular savings. The contract calls for him to receive $1,000 per month for the rest of his life. Payments began in the month he tumed 65. a. Determine how much of Benjamin's annuity contract will be included in the couple's 2020 gross income. b. Determine how much of Benjamin's and Joanna's Social Security benefits will be included in the couple's 2020 gross income. c. Compute Benjamin's and Joanna's taxable income and income tax for 2020, assuming that they have no itemized deductions, and keeping in mind the effect of their ages on their standard deduction. Christian placed the following assets in service in 2020: 03/16/2020 Shop equipment $ 09/04/2020 Land 09/04/2020 Office building 2,200,000 320,000 4,680,000 The shop equipment is five-year MACRS personalty. Christian's income in 2020 before considering any cost recovery deductions is $3,000,000. a. Compute Christian's depreciation, bonus depreciation, and 5179 deduction for 2020 assuming that Christian wants to make whatever elections are necessary to claim the fastest possible deductions for cost recovery. b. Compute Christian's depreciation, bonus depreciation, and $179 deduction for 2020 assuming that Christian wants to make whatever elections are necessary to claim the slowest possible deductions for cost recovery.

Step by Step Solution

★★★★★

3.42 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

aBenjamins annuity payments are included in the couples gross income for 2020 The total amount of th...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started