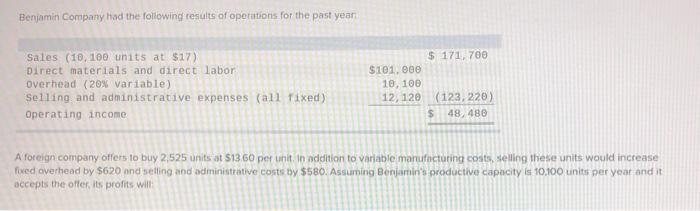

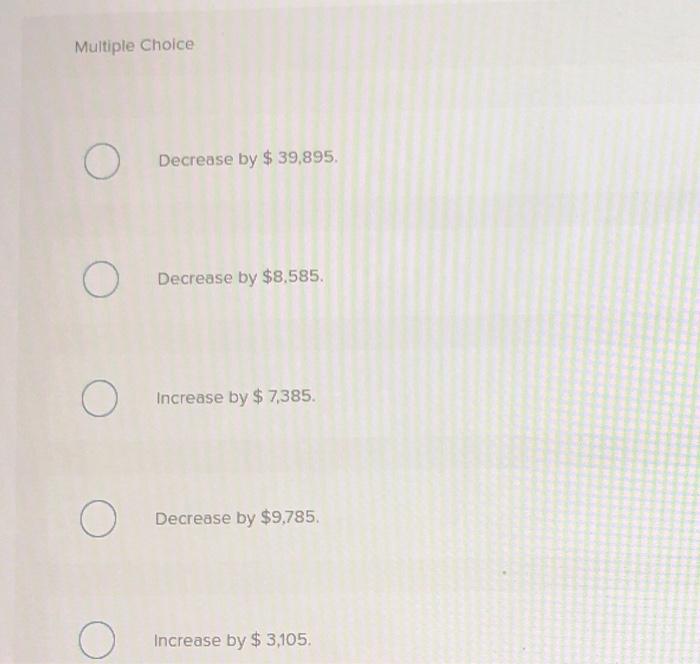

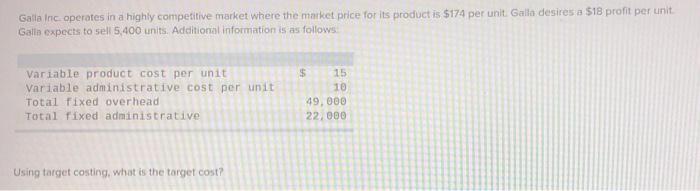

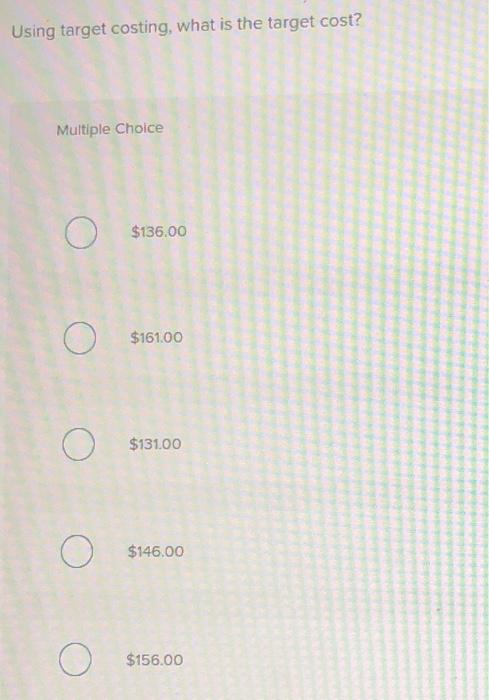

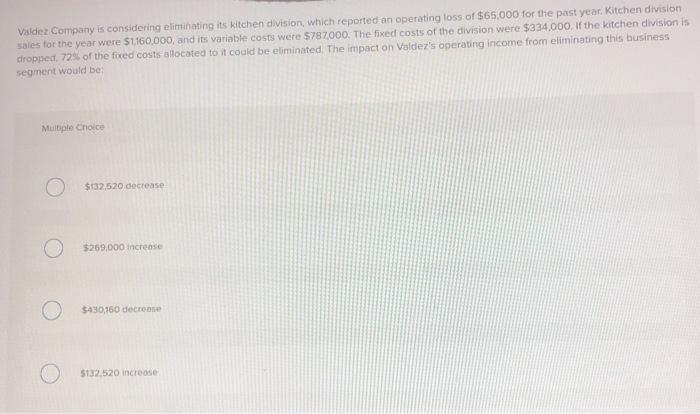

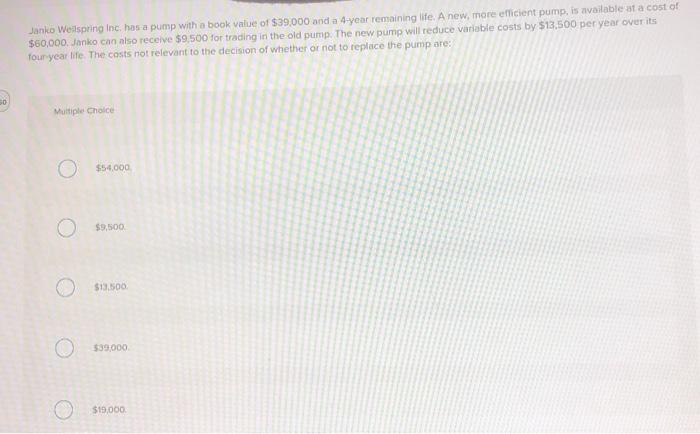

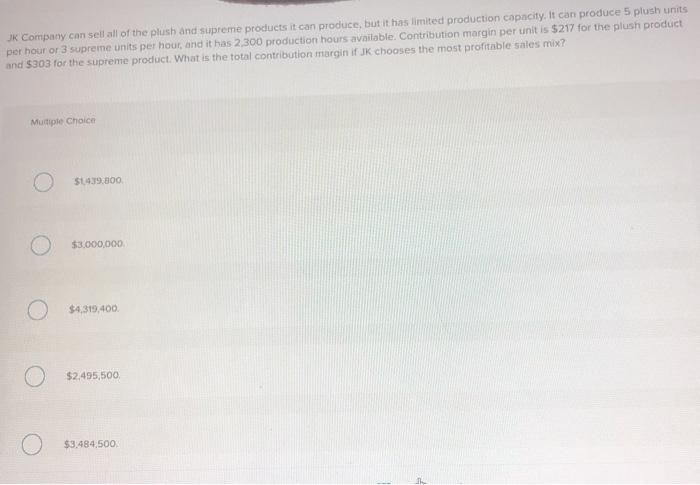

Benjamin Company had the following results of operations for the past year Sales (10,100 units at $17) Direct materials and direct labor Overhead (20% variable) Selling and administrative expenses (all fixed) Operating income 5 171, 700 $101.000 10,100 12,120 (123,220) s 48.480 A foreign company offers to buy 2,525 units at $13.60 per unit. In addition to variable manufacturing costs, Selling these units would increase fived overhead by $620 and selling and administrative costs by $580. Assuming Benjamin's productive capacity is 10.100 units per year and it accepts the offer, its profits will Multiple Choice Decrease by $ 39,895. Decrease by $8.585. Increase by $ 7,385. O Decrease by $9,785. a O Increase by $ 3,105. Galle Inc operates in a highly competitive market where the market price for its product is $174 per unit Galla desires a $18 profit per unit Galln expects to sell 5,400 units. Additional information is as follows: Variable product cost per unit Variable administrative cost per unit Total fixed overhead Total fixed administrative $ 15 10 49,000 22,000 Using target costing, what is the target cost? Using target costing, what is the target cost? Multiple Choice $136.00 O $161.00 $131.00 O $146.00 O $156.00 Valdez Company is considering eliminating its kitchen division, which reported an operating loss of $65,000 for the past year. Kitchen division sales for the year were $1160,000, and its variable costs were $787,000. The fixed costs of the division were $334,000. If the kitchen division is dropped, 72% of the fixed costs allocated to it could be eliminated. The impact on Voldez's operating income from eliminating this business segment would be Multiple Choice O $132.520 decrease $269,000 increase $430,160 decrease $132.520 increase Janko Weilspring Inc, has a pump with a book value of $39,000 and a 4-year remaining life. A new, more efficient pump, is available at a cost of $60,000. Janko can also receive $9.500 for trading in the old pump. The new pump will reduce variable costs by $13,500 per year over its four year life. The costs not relevant to the decision of whether or not to replace the pump are: 50 Multiple Choice $54,000 O $3,500. $13.500 o $39.000 $19.000 $19,000 JK Company can sell all of the plush and supreme products it can produce, but it has limited production capacity. It can produce 5 plush units per hour or 3 supreme units per hour, and it has 2,300 production hours available. Contribution margin per unit is $217 for the plush product and $303 for the supreme product. What is the total contribution margin if UK chooses the most profitable sales mix? Multiple Choice $1439.800 $3.000.000 $4,319,400 $2.495,500 $3.484,500