Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Benson Airline Company is considering expanding its territory. The company has the opportunity to purchase one of two different used airplanes. The first airplane

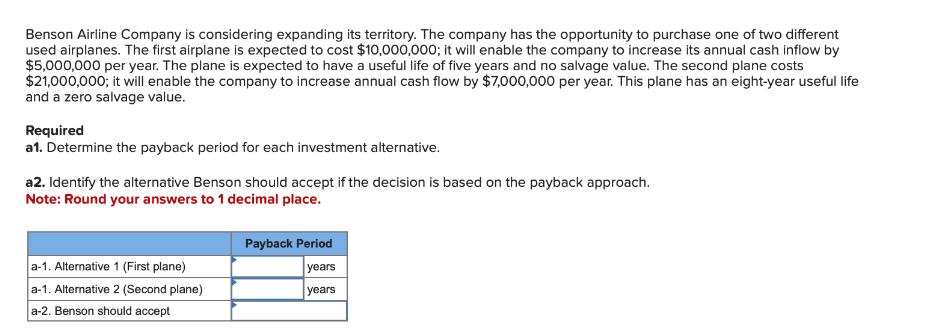

Benson Airline Company is considering expanding its territory. The company has the opportunity to purchase one of two different used airplanes. The first airplane is expected to cost $10,000,000; it will enable the company to increase its annual cash inflow by $5,000,000 per year. The plane is expected to have a useful life of five years and no salvage value. The second plane costs $21,000,000; it will enable the company to increase annual cash flow by $7,000,000 per year. This plane has an eight-year useful life and a zero salvage value. Required a1. Determine the payback period for each investment alternative. a2. Identify the alternative Benson should accept if the decision is based on the payback approach. Note: Round your answers to 1 decimal place. a-1. Alternative 1 (First plane) I a-1. Alternative 2 (Second plane) a-2. Benson should accept Payback Period years years

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a1 Alternative 1 First plane Initial Investment 10000000 Annual Cash Inflow 5000000 Payback ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

6642bcbed6d2b_975046.pdf

180 KBs PDF File

6642bcbed6d2b_975046.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started