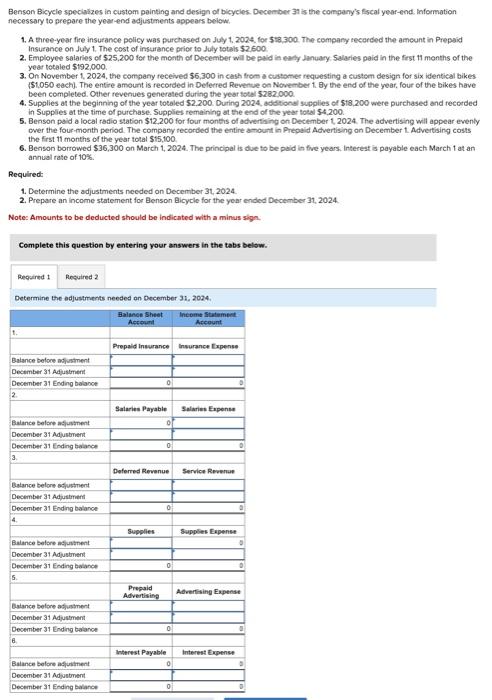

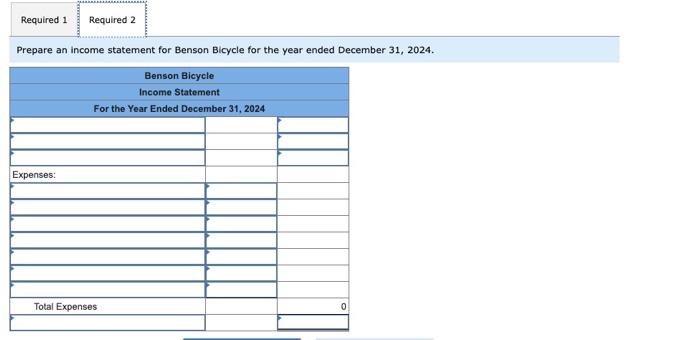

Benson Bicycle specializes in custom pointing and design of bicycles. December 31 is the company's fscal year-end: Information necessary to prepare the year-end adjustments appears below: 1. A three-yoar fire insurance policy was purchased on July 1, 2024, for 518,300 . The company recorded the amcunt in Prepaid Insurance on July 1 . The cost of insurance prier to July totais $2.600. 2. Employee salaries of $25,200 for the month of December will be paid is easy January Salaries paid in the first 11 months of the year totaled $192,000. 3. On November 1, 2024, the company received $6,300 in cash from a customer requesting a custom design for six identical bikes [ $1,050 eachi). The entire amount is recorded in Deferred Revenve on November 1 . By the end of the year, four of the bikes have been completed. Other revenues generated during the year 10ta15282,000 4. Supplies at the beginning of the year totaled $2,200. During 2024, additional supplies of $18,200 were purchased and recorded in Supplies at the time of purchase. Supplies remaining at the end of the year total $4,200. 5. Benson paid a local radio station $12,200 for four months of advertising on Dectember 1,2024 . The advertising will appear evenly over the four-month period. The company tecorded the entire amount in Prepaid Advertising an December 1 . Advertising costs the first 11 months of the year total $15,100. 6. Benson borrowed $36,300 on March 1, 2024. The principal is due to be paid in five years, Interest is payable each March 1 at an annual rate of 10%. Required: 1. Determine the adjustments needed on December 3t, 2024. 2. Prepare an income statement for Benson Bicycle for the year ended December 31, 2024 Note: Amounts to be deducted should be indicated with a minus sign. Complete this question by entering your answers in the tabs below. Determine the adjustments needed an December 31,2024. Prepare an income statement for Benson Blcycle for the year ended December 31, 2024. Benson Bicycle specializes in custom pointing and design of bicycles. December 31 is the company's fscal year-end: Information necessary to prepare the year-end adjustments appears below: 1. A three-yoar fire insurance policy was purchased on July 1, 2024, for 518,300 . The company recorded the amcunt in Prepaid Insurance on July 1 . The cost of insurance prier to July totais $2.600. 2. Employee salaries of $25,200 for the month of December will be paid is easy January Salaries paid in the first 11 months of the year totaled $192,000. 3. On November 1, 2024, the company received $6,300 in cash from a customer requesting a custom design for six identical bikes [ $1,050 eachi). The entire amount is recorded in Deferred Revenve on November 1 . By the end of the year, four of the bikes have been completed. Other revenues generated during the year 10ta15282,000 4. Supplies at the beginning of the year totaled $2,200. During 2024, additional supplies of $18,200 were purchased and recorded in Supplies at the time of purchase. Supplies remaining at the end of the year total $4,200. 5. Benson paid a local radio station $12,200 for four months of advertising on Dectember 1,2024 . The advertising will appear evenly over the four-month period. The company tecorded the entire amount in Prepaid Advertising an December 1 . Advertising costs the first 11 months of the year total $15,100. 6. Benson borrowed $36,300 on March 1, 2024. The principal is due to be paid in five years, Interest is payable each March 1 at an annual rate of 10%. Required: 1. Determine the adjustments needed on December 3t, 2024. 2. Prepare an income statement for Benson Bicycle for the year ended December 31, 2024 Note: Amounts to be deducted should be indicated with a minus sign. Complete this question by entering your answers in the tabs below. Determine the adjustments needed an December 31,2024. Prepare an income statement for Benson Blcycle for the year ended December 31, 2024