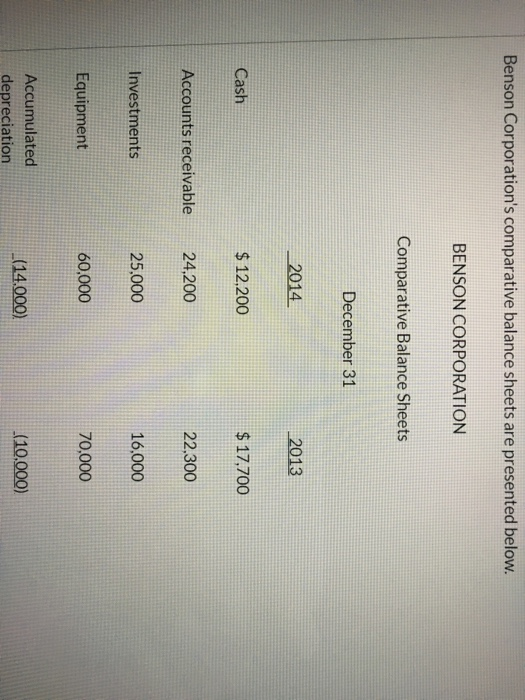

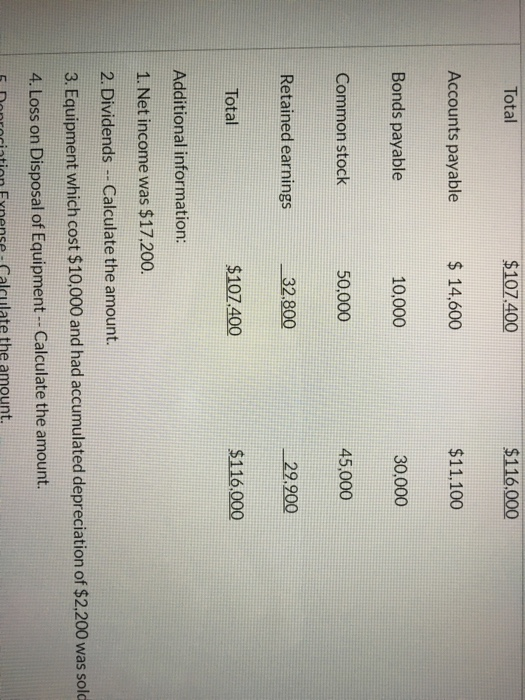

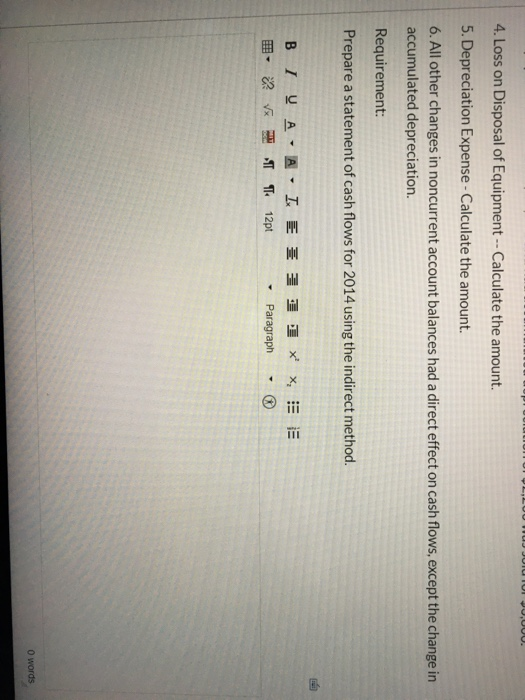

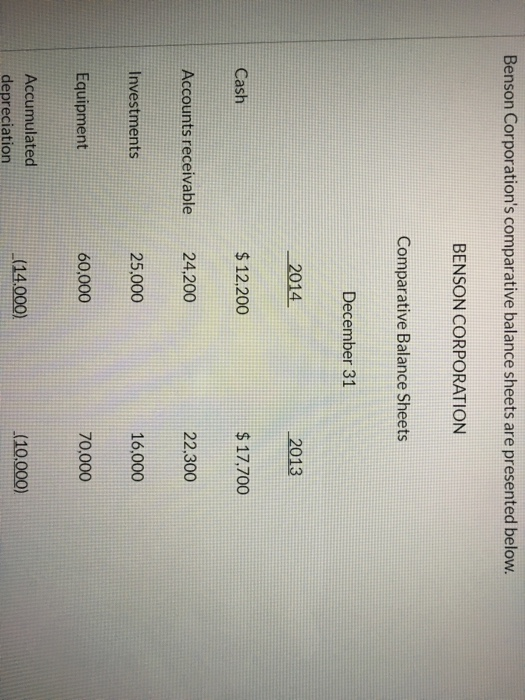

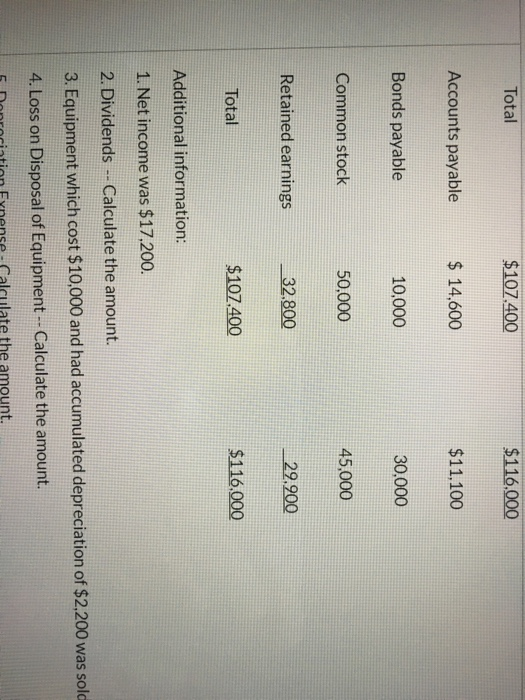

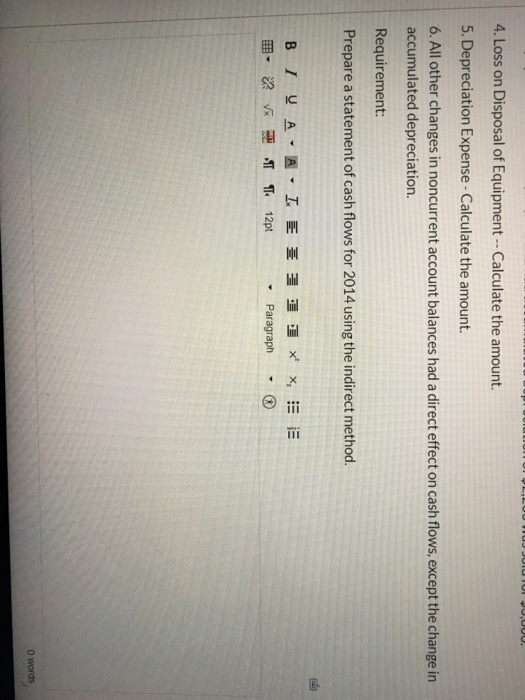

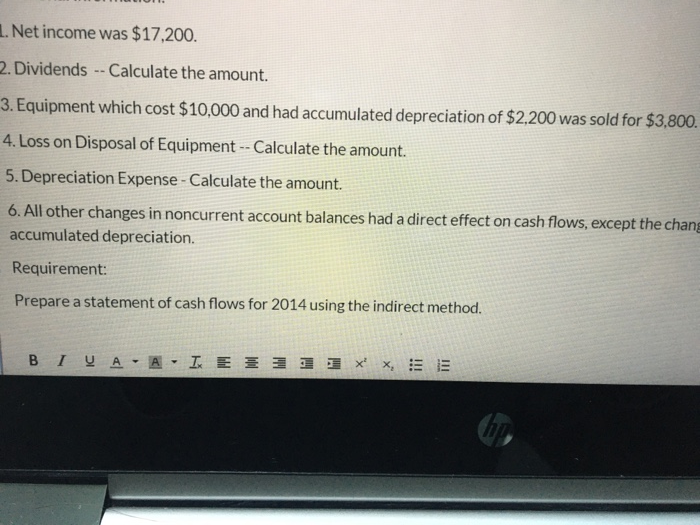

Benson Corporation's comparative balance sheets are presented below. BENSON CORPORATION Comparative Balance Sheets December 31 2014 2013 Cash $ 12,200 $ 17,700 Accounts receivable 24,200 22.300 Investments 25,000 16,000 Equipment 60,000 70,000 Accumulated depreciation (14.000). (10.000) Total $107.400 $116,000 Accounts payable $ 14,600 $11,100 Bonds payable 10,000 30.000 Common stock 50.000 45,000 Retained earnings 32.800 29.900 Total $107.400 $116,000 Additional information: 1. Net income was $17,200. 2. Dividends -- Calculate the amount. 3. Equipment which cost $10,000 and had accumulated depreciation of $2,200 was sold 4. Loss on Disposal of Equipment -- Calculate the amount. L,LUU MUJ JUIU IUI JUUUU. 4. Loss on Disposal of Equipment -- Calculate the amount. 5. Depreciation Expense - Calculate the amount. 6. All other changes in noncurrent account balances had a direct effect on cash flows, except the change in accumulated depreciation. Requirement: Prepare a statement of cash flows for 2014 using the indirect method. B I VA -A- IE 11 xX, DEE - VTT 12pt Paragraph O words Benson Corporation's comparative balance sheets are presented below. BENSON CORPORATION Comparative Balance Sheets December 31 2014 2013 Cash $ 12,200 $ 17,700 Accounts receivable 24,200 22.300 Investments 25,000 16,000 Equipment 60,000 70,000 Accumulated depreciation (14.000). (10.000) Total $107.400 $116,000 Accounts payable $ 14,600 $11,100 Bonds payable 10,000 30.000 Common stock 50,000 45,000 Retained earnings 32.800 29.900 Total $107.400 $116.000 Additional information: 1. Net income was $17,200. 2. Dividends -- Calculate the amount. 3. Equipment which cost $10,000 and had accumulated depreciation of $2,200 was sola 4. Loss on Disposal of Equipment -- Calculate the amount. UL,LUU MUJ JUIU IUI JUUUU. 4. Loss on Disposal of Equipment -- Calculate the amount. 5. Depreciation Expense - Calculate the amount. 6. All other changes in noncurrent account balances had a direct effect on cash flows, except the change in accumulated depreciation. Requirement: Prepare a statement of cash flows for 2014 using the indirect method. B IV AA- IE 11 xXDEE - VT 12pt Paragraph O words 1. Net income was $17,200. 2. Dividends -- Calculate the amount. 3. Equipment which cost $10,000 and had accumulated depreciation of $2,200 was sold for $3,800. 4. Loss on Disposal of Equipment -- Calculate the amount. 5. Depreciation Expense - Calculate the amount. 6. All other changes in noncurrent account balances had a direct effect on cash flows, except the chang accumulated depreciation. Requirement: Prepare a statement of cash flows for 2014 using the indirect method. B I VA-A-I EE XX, DE hu