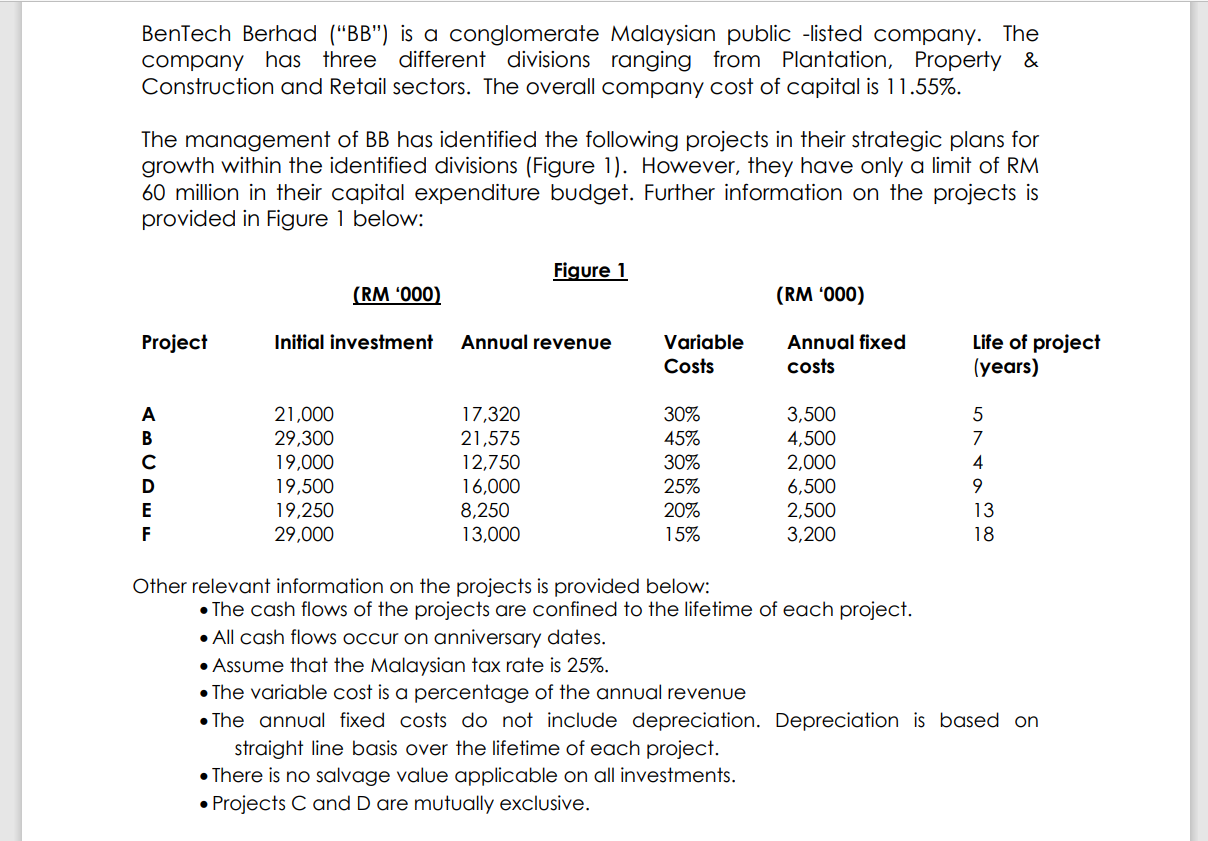

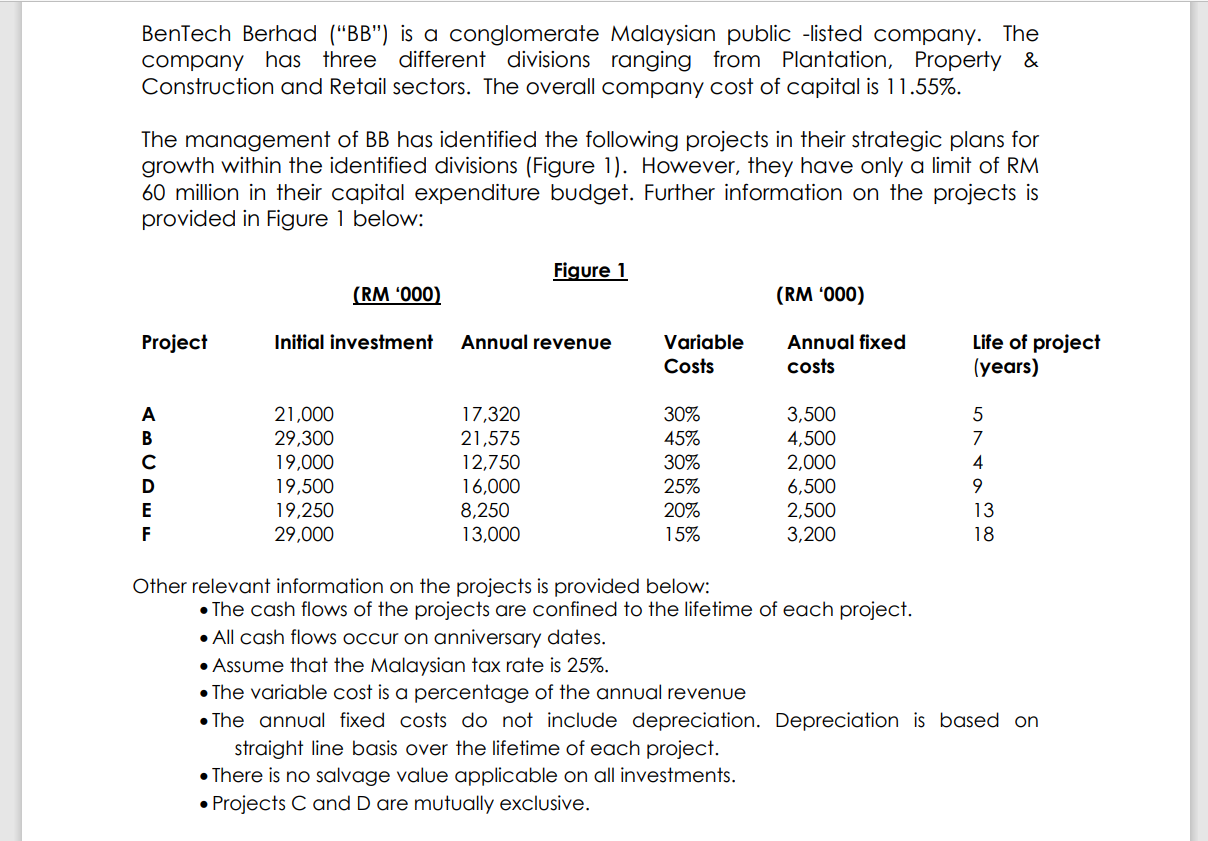

BenTech Berhad ("BB") is a conglomerate Malaysian public -listed company. The company has three different divisions ranging from Plantation, Property \& Construction and Retail sectors. The overall company cost of capital is 11.55%. The management of BB has identified the following projects in their strategic plans for growth within the identified divisions (Figure 1). However, they have only a limit of RM 60 million in their capital expenditure budget. Further information on the projects is provided in Figure 1 below: Other relevant information on the projects is provided below: - The cash flows of the projects are confined to the lifetime of each project. - All cash flows occur on anniversary dates. - Assume that the Malaysian tax rate is 25%. - The variable cost is a percentage of the annual revenue - The annual fixed costs do not include depreciation. Depreciation is based on straight line basis over the lifetime of each project. - There is no salvage value applicable on all investments. - Projects C and D are mutually exclusive. Required: a) Briefly explain the method that BB can use to rank the projects. Based on this method, calculate the NPV and use this approach to rank the six projects. (12 marks) BenTech Berhad ("BB") is a conglomerate Malaysian public -listed company. The company has three different divisions ranging from Plantation, Property \& Construction and Retail sectors. The overall company cost of capital is 11.55%. The management of BB has identified the following projects in their strategic plans for growth within the identified divisions (Figure 1). However, they have only a limit of RM 60 million in their capital expenditure budget. Further information on the projects is provided in Figure 1 below: Other relevant information on the projects is provided below: - The cash flows of the projects are confined to the lifetime of each project. - All cash flows occur on anniversary dates. - Assume that the Malaysian tax rate is 25%. - The variable cost is a percentage of the annual revenue - The annual fixed costs do not include depreciation. Depreciation is based on straight line basis over the lifetime of each project. - There is no salvage value applicable on all investments. - Projects C and D are mutually exclusive. Required: a) Briefly explain the method that BB can use to rank the projects. Based on this method, calculate the NPV and use this approach to rank the six projects. (12 marks)