Answered step by step

Verified Expert Solution

Question

1 Approved Answer

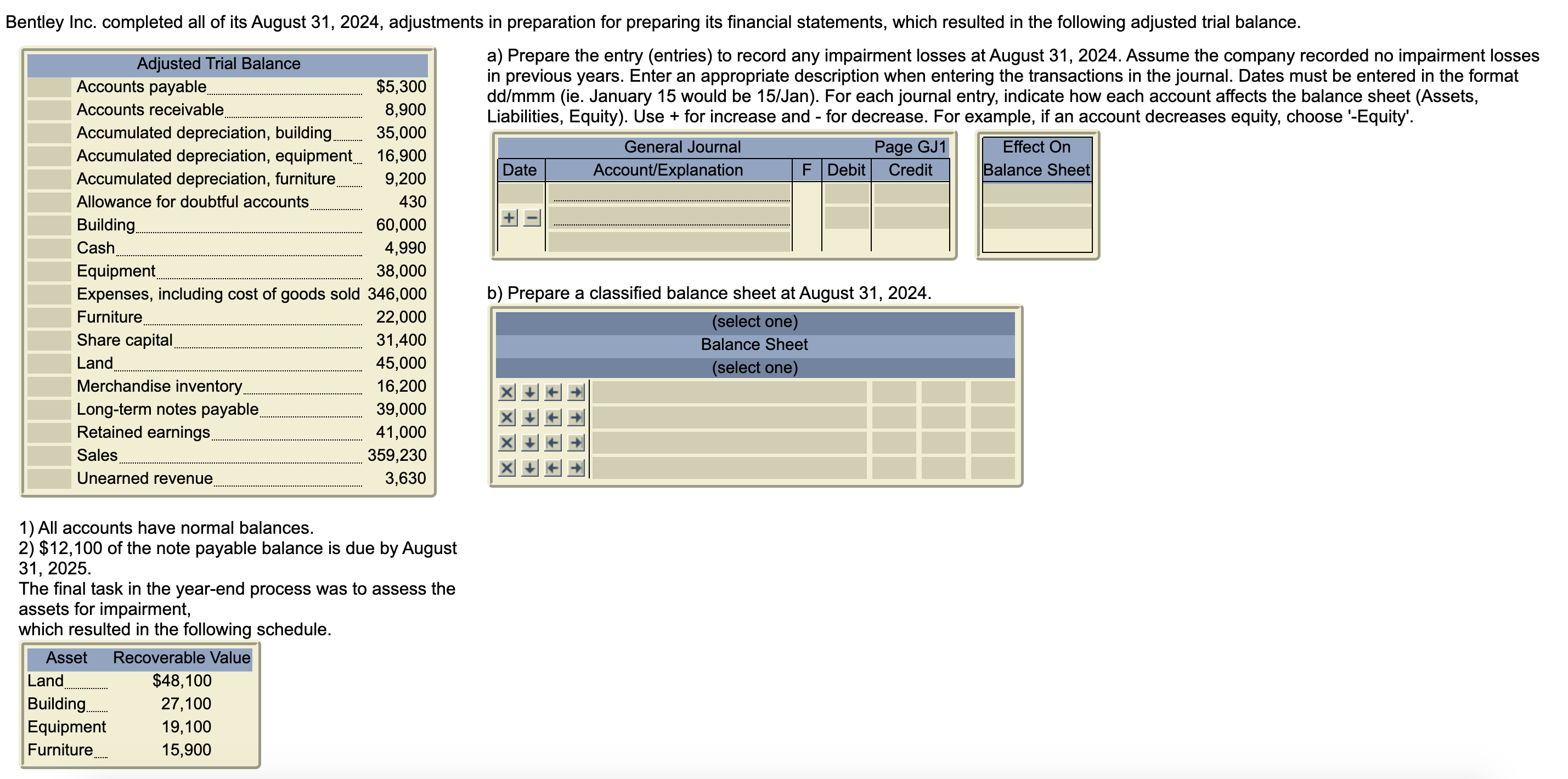

Bentley Inc. completed all of its August 31,2024 , adjustments in preparation for preparing its financial statements, which resulted in the following adjusted trial balance.

Bentley Inc. completed all of its August 31,2024 , adjustments in preparation for preparing its financial statements, which resulted in the following adjusted trial balance. a) Prepare the entry (entries) to record any impairment losses at August 31, 2024. Assume the company recorded no impairment losses in previous years. Enter an appropriate description when entering the transactions in the journal. Dates must be entered in the format \\( \\mathrm{dd} / \\mathrm{mmm} \\) (ie. January 15 would be 15/Jan). For each journal entry, indicate how each account affects the balance sheet (Assets, Liabilities, Equity). Use + for increase and - for decrease. For example, if an account decreases equity, choose '-Equity'. 1) All accounts have normal balances. 2) \\( \\$ 12,100 \\) of the note payable balance is due by August \\( 31,2025 \\). The final task in the year-end process was to assess the assets for impairment, b) Prepare a classified balance sheet at August 31, 2024. which resulted in the following schedule

Bentley Inc. completed all of its August 31,2024 , adjustments in preparation for preparing its financial statements, which resulted in the following adjusted trial balance. a) Prepare the entry (entries) to record any impairment losses at August 31, 2024. Assume the company recorded no impairment losses in previous years. Enter an appropriate description when entering the transactions in the journal. Dates must be entered in the format \\( \\mathrm{dd} / \\mathrm{mmm} \\) (ie. January 15 would be 15/Jan). For each journal entry, indicate how each account affects the balance sheet (Assets, Liabilities, Equity). Use + for increase and - for decrease. For example, if an account decreases equity, choose '-Equity'. 1) All accounts have normal balances. 2) \\( \\$ 12,100 \\) of the note payable balance is due by August \\( 31,2025 \\). The final task in the year-end process was to assess the assets for impairment, b) Prepare a classified balance sheet at August 31, 2024. which resulted in the following schedule Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started