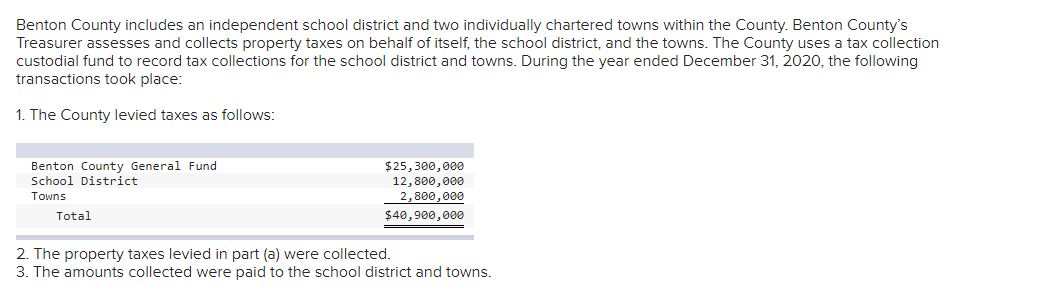

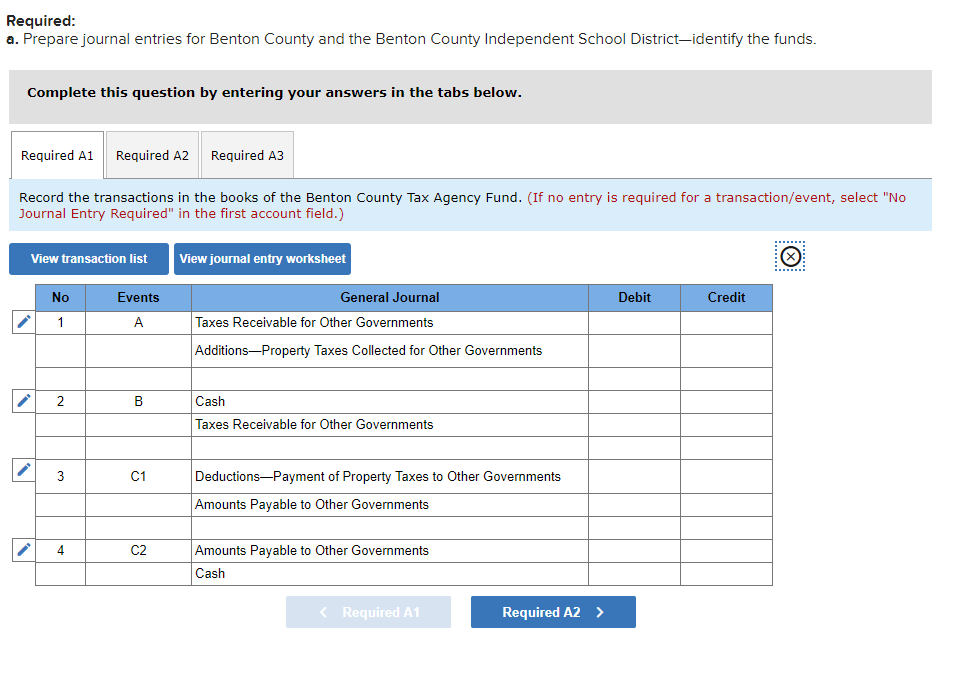

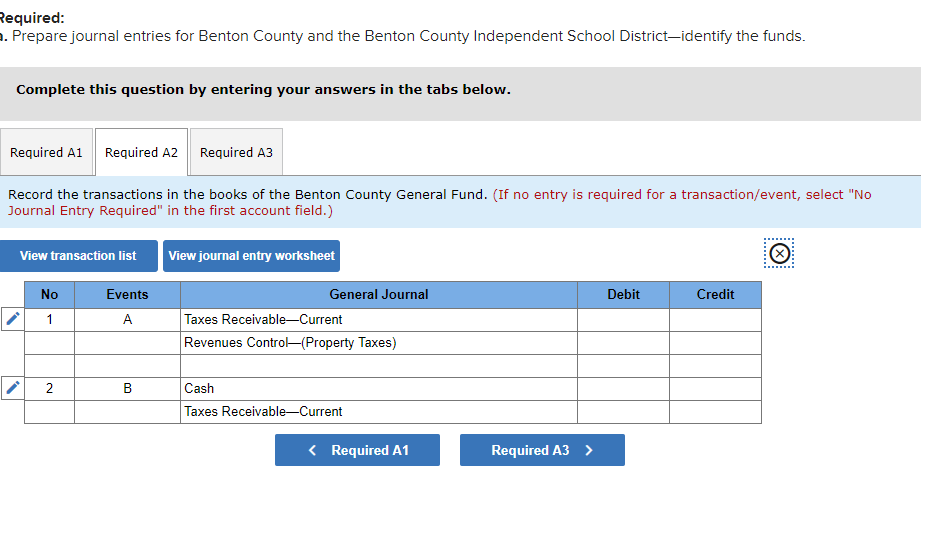

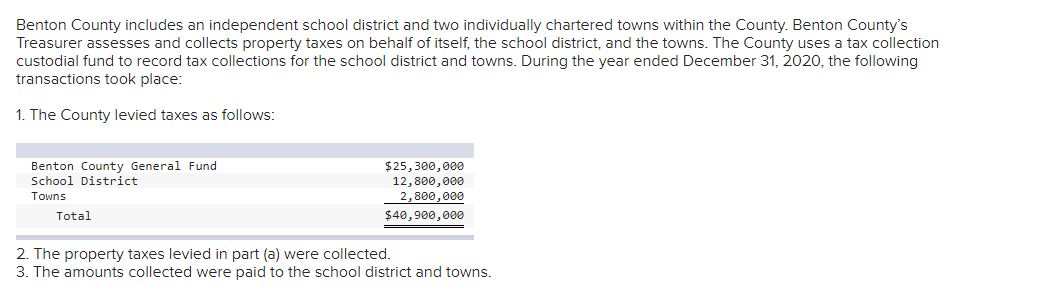

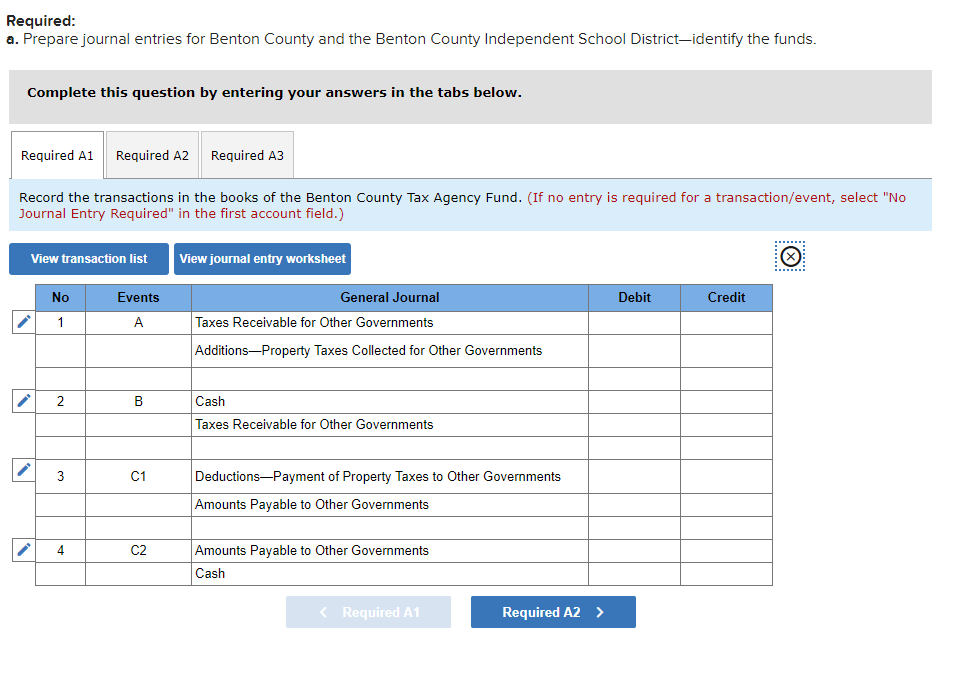

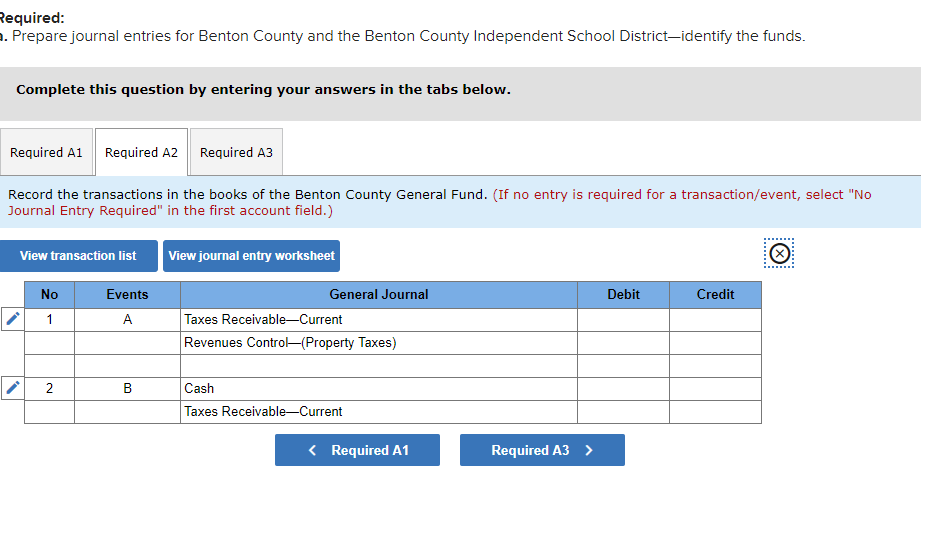

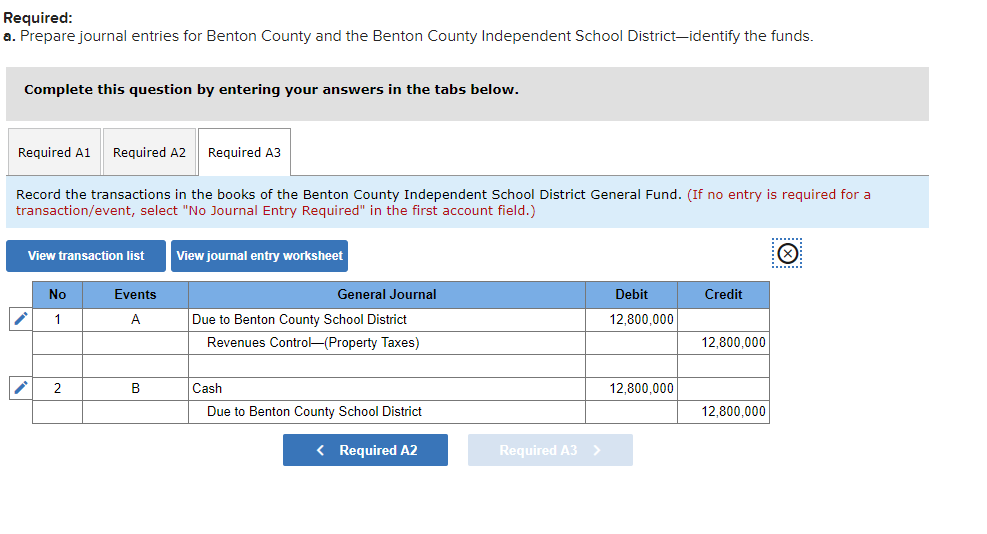

Benton County includes an independent school district and two individually chartered towns within the County. Benton County's Treasurer assesses and collects property taxes on behalf of itself, the school district, and the towns. The County uses a tax collection custodial fund to record tax collections for the school district and towns. During the year ended December 31, 2020, the following transactions took place: 1. The County levied taxes as follows: Benton County General Fund School District Towns Total $25,300,000 12,800,000 2,800,000 $40,900,000 2. The property taxes levied in part (a) were collected 3. The amounts collected were paid to the school district and towns. Required: a. Prepare journal entries for Benton County and the Benton County Independent School District-identify the funds. Complete this question by entering your answers in the tabs below. Required A1 Required A2 Required A3 Record the transactions in the books of the Benton County Tax Agency Fund. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list View journal entry worksheet x Debit Credit No 1 Events A General Journal Taxes Receivable for Other Governments AdditionsProperty Taxes Collected for Other Governments 2. B Cash Taxes Receivable for Other Governments 3 C1 DeductionsPayment of Property Taxes to Other Governments Amounts Payable to Other Governments 4 C2 Amounts Payable to Other Governments Cash Required: . Prepare journal entries for Benton County and the Benton County Independent School District-identify the funds. Complete this question by entering your answers in the tabs below. Required A1 Required A2 Required A3 Record the transactions in the books of the Benton County General Fund. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list View journal entry worksheet Debit Credit No 1 Events A General Journal Taxes ReceivableCurrent Revenues Control(Property Taxes) 2 2 B Cash Taxes Receivable-Current Required: a. Prepare journal entries for Benton County and the Benton County Independent School District-identify the funds. Complete this question by entering your answers in the tabs below. Required A1 Required A2 Required A3 Record the transactions in the books of the Benton County Independent School District General Fund. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list View journal entry worksheet No Events Debit Credit 1 General Journal Due to Benton County School District Revenues Control(Property Taxes) 12,800,000 12,800,000 2 B 12,800,000 Cash Due to Benton County School District 12,800,000