Answered step by step

Verified Expert Solution

Question

1 Approved Answer

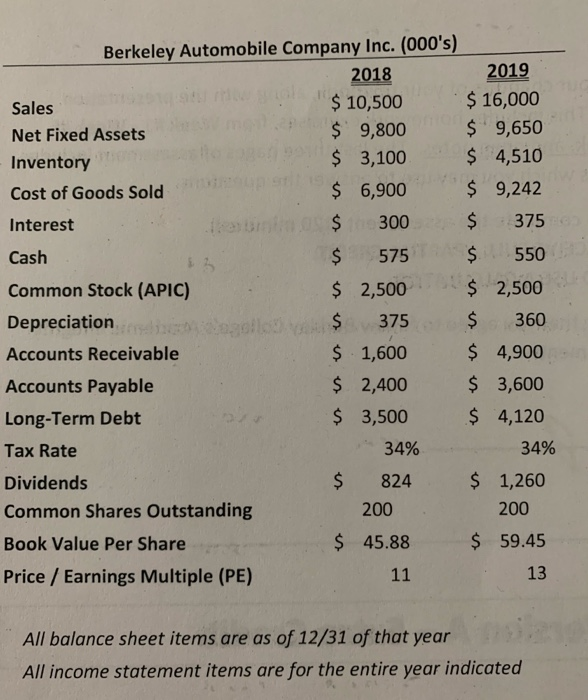

Berkeley Automotive had one of its best yearly performances in 2019!!! Management has decided that it would like to reward its shareholders and make a

Berkeley Automotive had one of its best yearly performances in 2019!!!

Management has decided that it would like to reward its shareholders and make a special payout (dividend). This special "One time dividend" is payable on January 15, 2020 in the amount of $4 million.

1. Will the company need external financing (EFN) to pay this one-time dividend on January 15, 2020?

2. How much external financing (EFN) would they need for January 15, 2020? (Show work)

Berkeley Automobile Company Inc. (000's) 2018 2019 Sales $ 10,500 $ 16,000 Net Fixed Assets $ 9,800 $ 9,650 Inventory $ 3,100 $ 4,510 Cost of Goods Sold $ 6,900 $ 9,242 Interest theatino $ 300 $ 375 Cash $ 575 $ 550 Common Stock (APIC) $ 2,500 $ 2,500 Depreciation $ 375 $ 360 Accounts Receivable $ 1,600 $ 4,900 Accounts Payable $ 2,400 $ 3,600 Long-Term Debt $ 3,500 $ 4,120 Tax Rate 34% 34% Dividends $ 824 $ 1,260 Common Shares Outstanding 200 200 Book Value Per Share $ 45.88 $ 59.45 Price / Earnings Multiple (PE) 13 11 All balance sheet items are as of 12/31 of that year All income statement items are for the entire year indicated Berkeley Automobile Company Inc. (000's) 2018 2019 Sales $ 10,500 $ 16,000 Net Fixed Assets $ 9,800 $ 9,650 Inventory $ 3,100 $ 4,510 Cost of Goods Sold $ 6,900 $ 9,242 Interest theatino $ 300 $ 375 Cash $ 575 $ 550 Common Stock (APIC) $ 2,500 $ 2,500 Depreciation $ 375 $ 360 Accounts Receivable $ 1,600 $ 4,900 Accounts Payable $ 2,400 $ 3,600 Long-Term Debt $ 3,500 $ 4,120 Tax Rate 34% 34% Dividends $ 824 $ 1,260 Common Shares Outstanding 200 200 Book Value Per Share $ 45.88 $ 59.45 Price / Earnings Multiple (PE) 13 11 All balance sheet items are as of 12/31 of that year All income statement items are for the entire year indicatedStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started