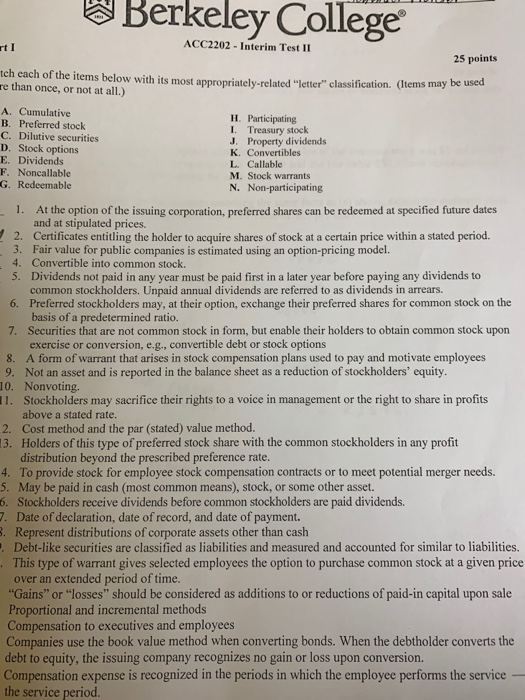

Berkeley College ACC2202 Interim Test II rt I 25 points tch each of the items below with its most appropriately-related "letter" classification. (Items may be used re than once, or not at all.) A. Cumulative B. Preferred stock C. Dilutive securities D. Stock options E. Dividends F. Noncallable G. Redeemable H. Participating I. Treasury stock J. Property dividends K. Convertibles L. Callable M. Stock warrants N. Non-participating 1. At the option of the issuing corporation, preferred shares can be redeemed at specified future dates and at stipulated prices. 2. Certificates entitling the holder to acquire shares of stock at a certain price within a stated period. 3. Fair value for public companies is estimated using an option-pricing model. 4. Convertible into common stock. 5. Dividends not paid in any year must be paid first in a later year before paying any dividends to common stockholders. Unpaid annual dividends are referred to as dividends in arrears. 6. Preferred stockholders may, at their option, exchange their preferred shares for common stock on the basis of a predetermined ratio. 7. Securities that are not common stock in form, but enable their holders to obtain common stock upon exercise or conversion, e.g., convertible debt or stock options 8. A form of warrant that arises in stock compensation plans used to pay and motivate employees 9. Not an asset and is reported in the balance sheet as a reduction of stockholders' equity. 10. Nonvoting. 11. Stockholders may sacrifice their rights to a voice in management or the right to share in profits above a stated rate. 2. Cost method and the par (stated) value method. 13. Holders of this type of preferred stock share with the common stockholders in any profit distribution beyond the prescribed preference rate. 4. To provide stock for employee stock compensation contracts or to meet potential merger needs. 5. May be paid in cash (most common means), stock, or some other asset. 6. Stockholders receive dividends before common stockholders are paid dividends. . Date of declaration, date of record, and date of payment. 3. Represent distributions of corporate assets other than cash . Debt-like securities are classified as liabilities and measured and accounted for similar to liabilities. This type of warrant gives selected employees the option to purchase common stock at a given price over an extended period of time. "Gains" or "losses" should be considered as additions to or reductions of paid-in capital upon sale Proportional and incremental methods Compensation to executives and employees Companies use the book value method when converting bonds. When the debtholder converts the debt to equity, the issuing company recognizes no gain or loss upon conversion. Compensation expense is recognized in the periods in which the employee performs the service the service period