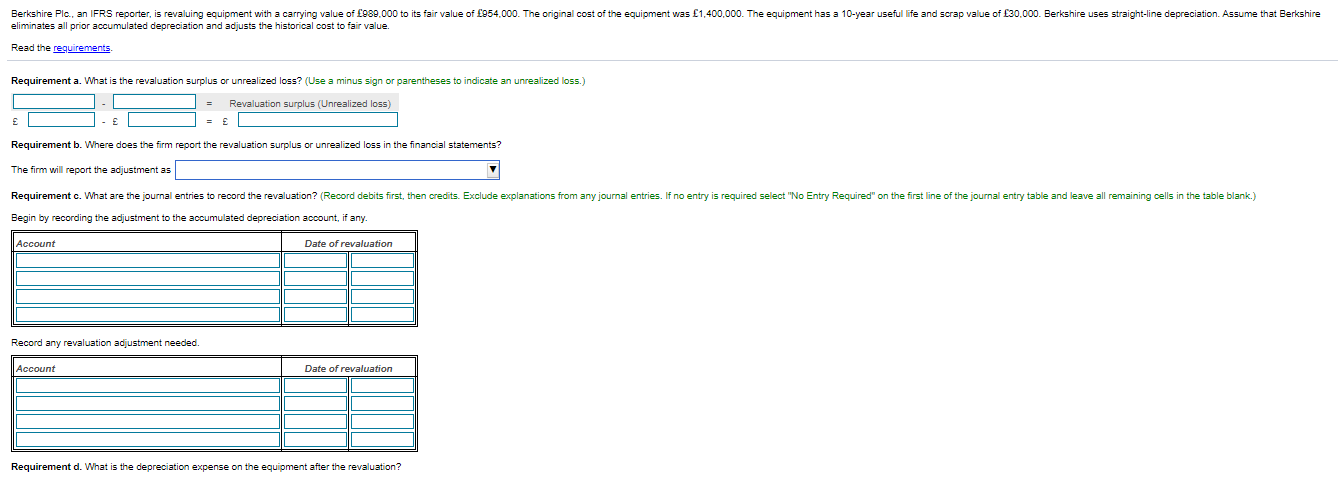

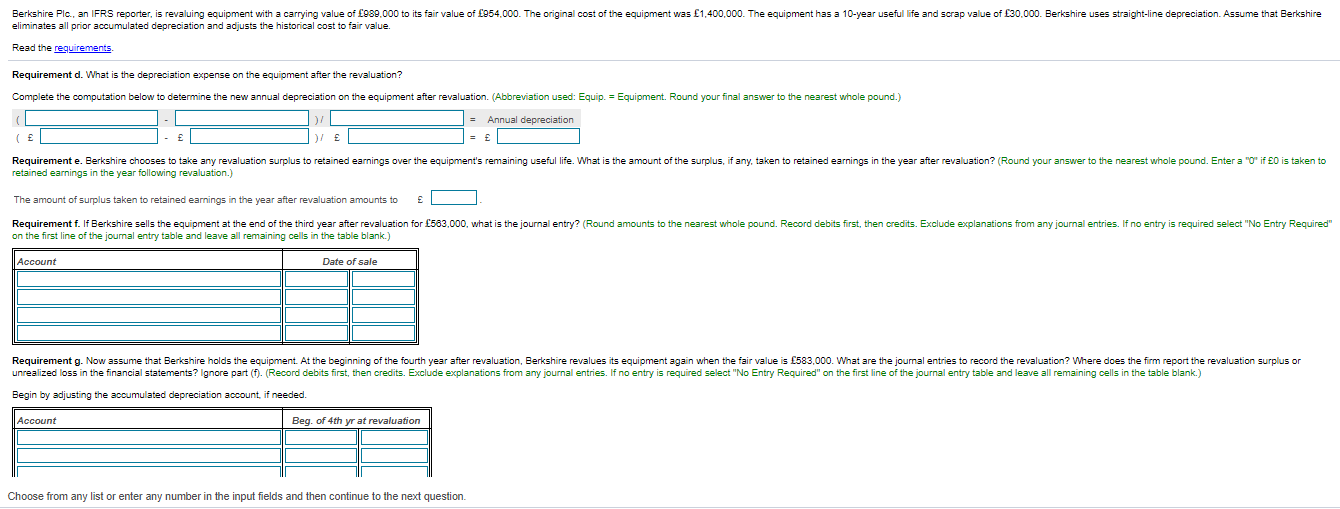

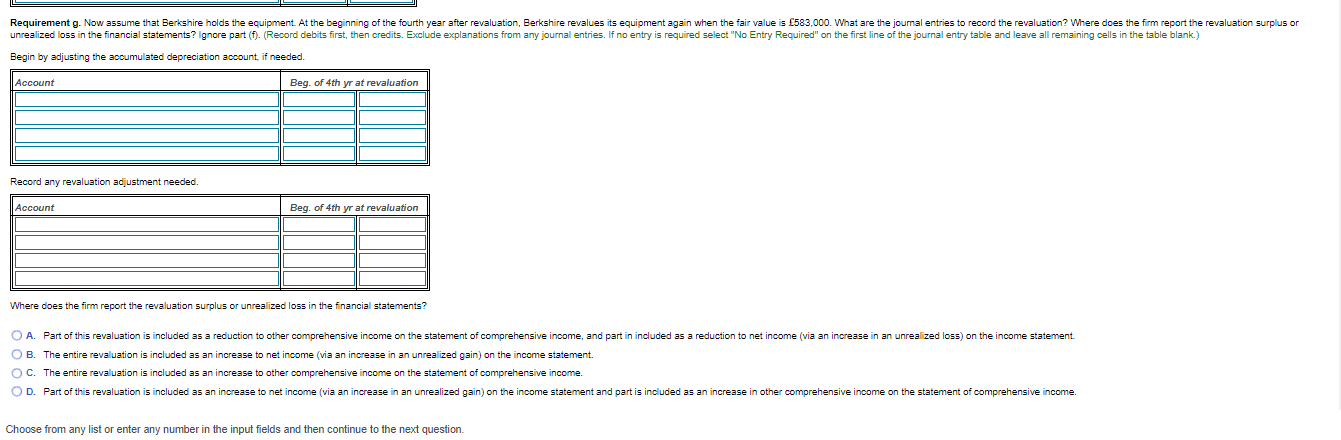

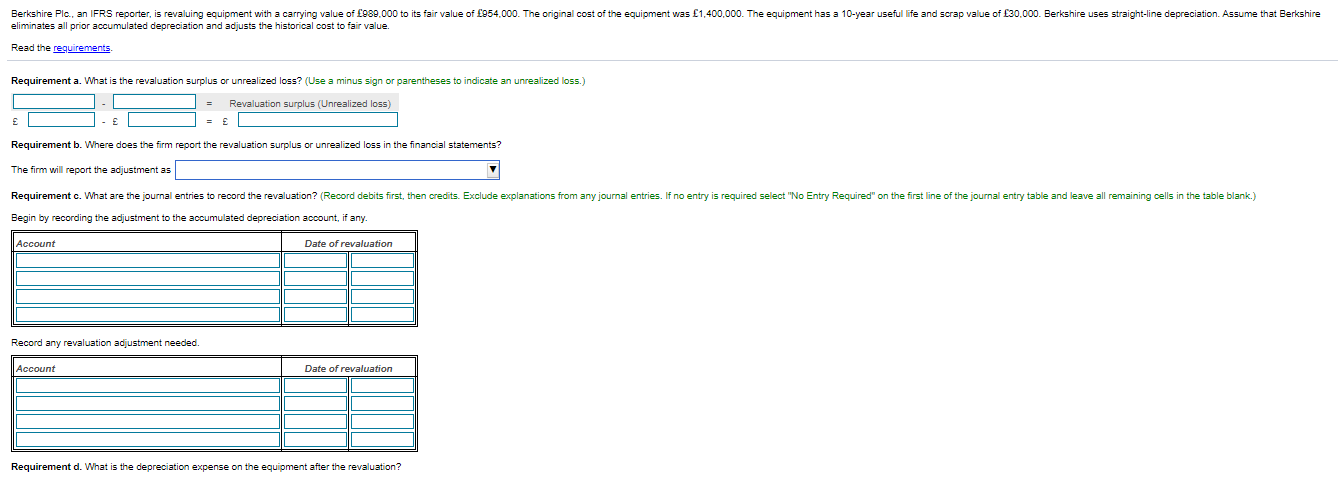

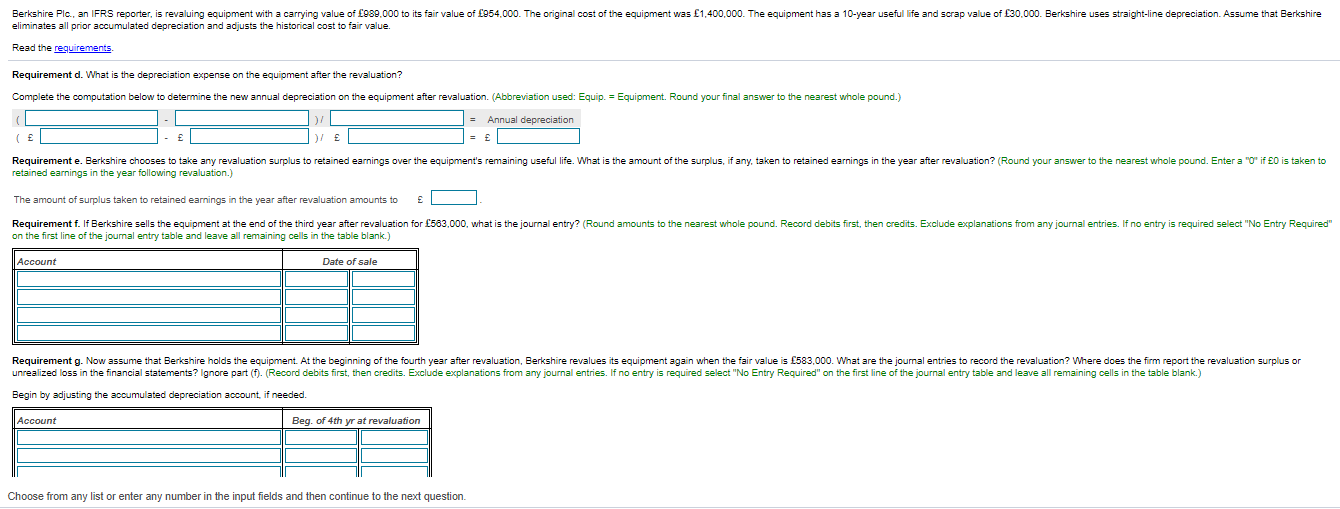

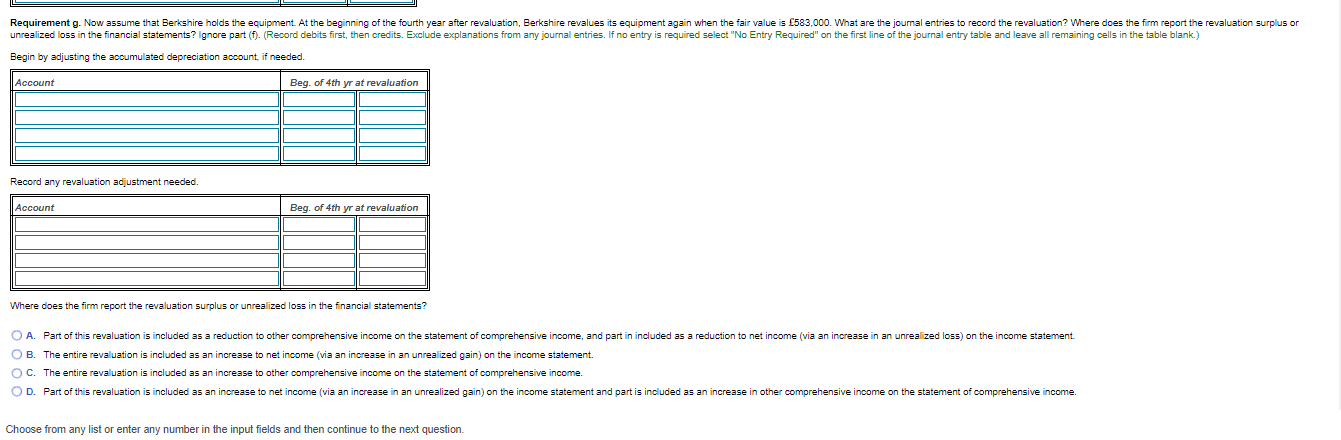

Berkshire Plc., an IFRS reporter, is revaluing equipment with a carrying value of 989.000 to its fair value of 954.000. The original cost of the equipment was 1,400,000. The equipment has a 10-year useful life and scrap value of 30,000. Berkshire uses straight-line depreciation. Assume that Berkshire eliminates all prior accumulated depreciation and adjusts the historical cost to fair value. Read the requirements Requirement a. What is the revaluation surplus or unrealized loss? (Use a minus sign or parentheses to indicate an unrealized loss.) Revaluation surplus (Unrealized loss) Requirement b. Where does the firm report the revaluation surplus or unrealized loss in the financial statements? The firm will report the adjustment as Requirement c. What are the journal entries to record the revaluation? (Record debits first, then credits. Exclude explanations from any journal entries. If no entry is required select "No Entry Required" on the first line of the journal entry table and leave all remaining cells in the table blank.) Begin by recording the adjustment to the accumulated depreciation account, if any. Account Date of revaluation Record any revaluation adjustment needed. Account Date of revaluation Requirement d. What is the depreciation expense on the equipment after the revaluation? Berkshire Plc., an IFRS reporter, is revaluing equipment with a carrying value of 989.000 to its fair value of 954.000. The original cost of the equipment was 1,400,000. The equipment has a 10-year useful life and scrap value of 30,000. Berkshire uses straight-line depreciation. Assume that Berkshire eliminates all prior accumulated depreciation and adjusts the historical cost to fair value. Read the requirements Requirement d. What is the depreciation expense on the equipment after the revaluation? Complete the computation below to determine the new annual depreciation on the equipment after revaluation. (Abbreviation used: Equip. = Equipment. Round your final answer to the nearest whole pound.) = Annual depreciation ( Requirement e. Berkshire chooses to take any revaluation surplus to retained earnings over the equipment's remaining useful life. What is the amount of the surplus, if any, taken to retained earnings in the year after revaluation? (Round your answer to the nearest whole pound. Enter a "O" if 0 is taken to retained earnings in the year following revaluation.) The amount of surplus taken to retained earnings in the year after revaluation amounts to Requirement f. If Berkshire sells the equipment at the end of the third year after revaluation for 583.000, what is the journal entry? (Round amounts to the nearest whole pound. Record debits first, then credits. Exclude explanations from any journal entries. If no entry is required select "No Entry Required" on the first line of the journal entry table and leave all remaining cells in the table blank.) Account Date of sale Requirement g. Now assume that Berkshire holds the equipment. At the beginning of the fourth year after revaluation, Berkshire revalues its equipment again when the fair value is 583,000. What are the journal entries to record the revaluation? Where does the firm report the revaluation surplus or unrealized loss in the financial statements? Ignore part (f). (Record debits first, then credits. Exclude explanations from any journal entries. If no entry is required select "No Entry Required" on the first line of the journal entry table and leave all remaining cells in the table blank.) Begin by adjusting the accumulated depreciation account, if needed. Account Beg. of 4th yr at revaluation Choose from any list or enter any number in the input fields and then continue to the next question. Requirement g. Now assume that Berkshire holds the equipment. At the beginning of the fourth year after revaluation, Berkshire revalues its equipment again when the fair value is 583,000. What are the journal entries to record the revaluation? Where does the firm report the revaluation surplus or unrealized loss in the financial statements? Ignore part (1). (Record debits first, then credits. Exclude explanations from any journal entries. If no entry is required select "No Entry Required" on the first line of the journal entry table and leave all remaining cells in the table blank.) Begin by adjusting the accumulated depreciation account, if needed. Account Beg. of 4th yr at revaluation Record any revaluation adjustment needed. Account Beg. of 4th yr at revaluation Where does the firm report the revaluation surplus or unrealized loss in the financial statements? O A. Part of this revaluation is included as a reduction to other comprehensive income on the statement of comprehensive income, and part in included as a reduction to net income (via an increase in an unrealized loss) on the income statement OB. The entire revaluation is included as an increase to net income (via an increase in an unrealized gain) on the income statement. OC. The entire revaluation is included as an increase to other comprehensive income on the statement of comprehensive income. OD. Part of this revaluation is included as an increase to net income (via an increase in an unrealized gain) on the income statement and part is included as an increase in other comprehensive income on the statement of comprehensive income. Choose from any list or enter any number in the input fields and then continue to the next question. Berkshire Plc., an IFRS reporter, is revaluing equipment with a carrying value of 989.000 to its fair value of 954.000. The original cost of the equipment was 1,400,000. The equipment has a 10-year useful life and scrap value of 30,000. Berkshire uses straight-line depreciation. Assume that Berkshire eliminates all prior accumulated depreciation and adjusts the historical cost to fair value. Read the requirements Requirement a. What is the revaluation surplus or unrealized loss? (Use a minus sign or parentheses to indicate an unrealized loss.) Revaluation surplus (Unrealized loss) Requirement b. Where does the firm report the revaluation surplus or unrealized loss in the financial statements? The firm will report the adjustment as Requirement c. What are the journal entries to record the revaluation? (Record debits first, then credits. Exclude explanations from any journal entries. If no entry is required select "No Entry Required" on the first line of the journal entry table and leave all remaining cells in the table blank.) Begin by recording the adjustment to the accumulated depreciation account, if any. Account Date of revaluation Record any revaluation adjustment needed. Account Date of revaluation Requirement d. What is the depreciation expense on the equipment after the revaluation? Berkshire Plc., an IFRS reporter, is revaluing equipment with a carrying value of 989.000 to its fair value of 954.000. The original cost of the equipment was 1,400,000. The equipment has a 10-year useful life and scrap value of 30,000. Berkshire uses straight-line depreciation. Assume that Berkshire eliminates all prior accumulated depreciation and adjusts the historical cost to fair value. Read the requirements Requirement d. What is the depreciation expense on the equipment after the revaluation? Complete the computation below to determine the new annual depreciation on the equipment after revaluation. (Abbreviation used: Equip. = Equipment. Round your final answer to the nearest whole pound.) = Annual depreciation ( Requirement e. Berkshire chooses to take any revaluation surplus to retained earnings over the equipment's remaining useful life. What is the amount of the surplus, if any, taken to retained earnings in the year after revaluation? (Round your answer to the nearest whole pound. Enter a "O" if 0 is taken to retained earnings in the year following revaluation.) The amount of surplus taken to retained earnings in the year after revaluation amounts to Requirement f. If Berkshire sells the equipment at the end of the third year after revaluation for 583.000, what is the journal entry? (Round amounts to the nearest whole pound. Record debits first, then credits. Exclude explanations from any journal entries. If no entry is required select "No Entry Required" on the first line of the journal entry table and leave all remaining cells in the table blank.) Account Date of sale Requirement g. Now assume that Berkshire holds the equipment. At the beginning of the fourth year after revaluation, Berkshire revalues its equipment again when the fair value is 583,000. What are the journal entries to record the revaluation? Where does the firm report the revaluation surplus or unrealized loss in the financial statements? Ignore part (f). (Record debits first, then credits. Exclude explanations from any journal entries. If no entry is required select "No Entry Required" on the first line of the journal entry table and leave all remaining cells in the table blank.) Begin by adjusting the accumulated depreciation account, if needed. Account Beg. of 4th yr at revaluation Choose from any list or enter any number in the input fields and then continue to the next question. Requirement g. Now assume that Berkshire holds the equipment. At the beginning of the fourth year after revaluation, Berkshire revalues its equipment again when the fair value is 583,000. What are the journal entries to record the revaluation? Where does the firm report the revaluation surplus or unrealized loss in the financial statements? Ignore part (1). (Record debits first, then credits. Exclude explanations from any journal entries. If no entry is required select "No Entry Required" on the first line of the journal entry table and leave all remaining cells in the table blank.) Begin by adjusting the accumulated depreciation account, if needed. Account Beg. of 4th yr at revaluation Record any revaluation adjustment needed. Account Beg. of 4th yr at revaluation Where does the firm report the revaluation surplus or unrealized loss in the financial statements? O A. Part of this revaluation is included as a reduction to other comprehensive income on the statement of comprehensive income, and part in included as a reduction to net income (via an increase in an unrealized loss) on the income statement OB. The entire revaluation is included as an increase to net income (via an increase in an unrealized gain) on the income statement. OC. The entire revaluation is included as an increase to other comprehensive income on the statement of comprehensive income. OD. Part of this revaluation is included as an increase to net income (via an increase in an unrealized gain) on the income statement and part is included as an increase in other comprehensive income on the statement of comprehensive income. Choose from any list or enter any number in the input fields and then continue to the next