Answered step by step

Verified Expert Solution

Question

1 Approved Answer

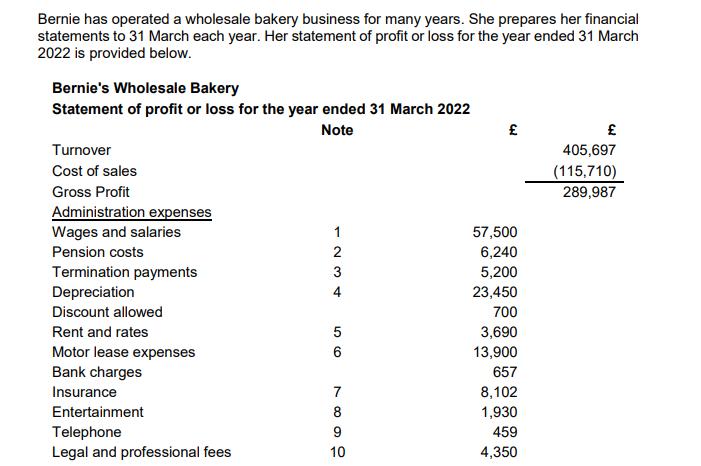

Bernie has operated a wholesale bakery business for many years. She prepares her financial statements to 31 March each year. Her statement of profit

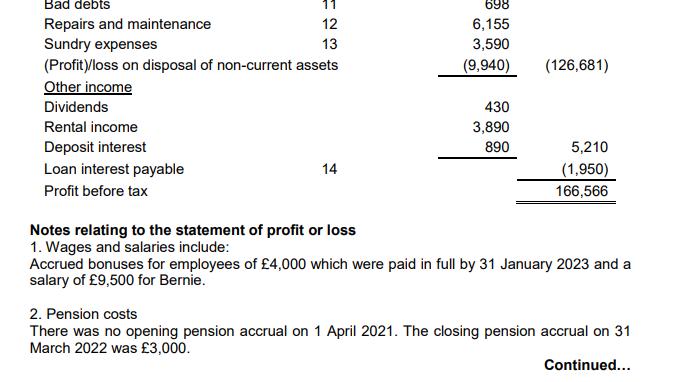

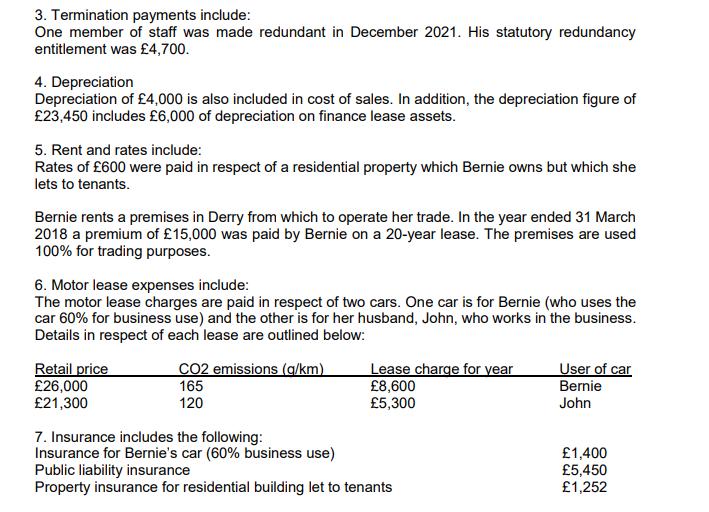

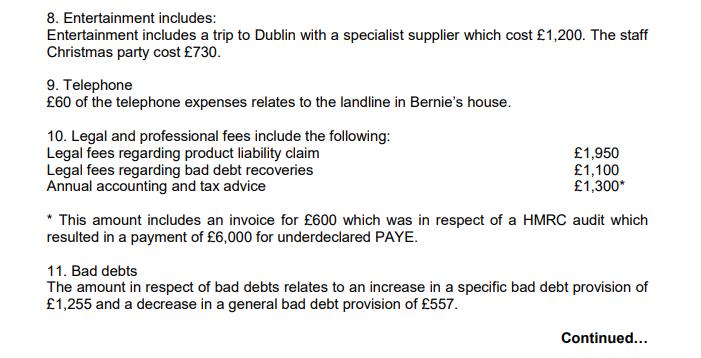

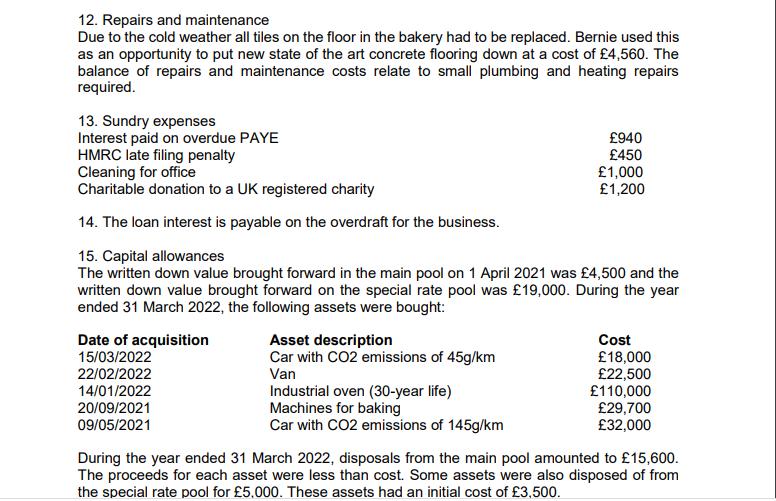

Bernie has operated a wholesale bakery business for many years. She prepares her financial statements to 31 March each year. Her statement of profit or loss for the year ended 31 March 2022 is provided below. Bernie's Wholesale Bakery Statement of profit or loss for the year ended 31 March 2022 Note Turnover Cost of sales Gross Profit Administration expenses Wages and salaries Pension costs Termination payments Depreciation Discount allowed Rent and rates Motor lease expenses Bank charges Insurance Entertainment Telephone Legal and professional fees 123 + 4 56 7 8 9 10 57,500 6,240 5,200 23,450 700 3,690 13,900 657 8,102 1,930 459 4,350 405,697 (115,710) 289,987 Bad debts Repairs and maintenance Sundry expenses (Profit)/loss on disposal of non-current assets 11 12 13 Other income Dividends Rental income Deposit interest Loan interest payable Profit before tax 14 Notes relating to the statement of profit or loss 1. Wages and salaries include: 698 6,155 3,590 (9,940) 430 3,890 890 (126,681) 5,210 (1,950) 166,566 Accrued bonuses for employees of 4,000 which were paid in full by 31 January 2023 and a salary of 9,500 for Bernie. 2. Pension costs There was no opening pension accrual on 1 April 2021. The closing pension accrual on 31 March 2022 was 3,000. Continued... 3. Termination payments include: One member of staff was made redundant in December 2021. His statutory redundancy entitlement was 4,700. 4. Depreciation Depreciation of 4,000 is also included in cost of sales. In addition, the depreciation figure of 23,450 includes 6,000 of depreciation on finance lease assets. 5. Rent and rates include: Rates of 600 were paid in respect of a residential property which Bernie owns but which she lets to tenants. Bernie rents a premises in Derry from which to operate her trade. In the year ended 31 March 2018 a premium of 15,000 was paid by Bernie on a 20-year lease. The premises are used 100% for trading purposes. 6. Motor lease expenses include: The motor lease charges are paid in respect of two cars. One car is for Bernie (who uses the car 60% for business use) and the other is for her husband, John, who works in the business. Details in respect of each lease are outlined below: Retail price 26,000 21,300 CO2 emissions (g/km) 165 120 Lease charge for year 8,600 User of car Bernie 5,300 John 7. Insurance includes the following: Public liability insurance Insurance for Bernie's car (60% business use) 1,400 5,450 Property insurance for residential building let to tenants 1,252 8. Entertainment includes: Entertainment includes a trip to Dublin with a specialist supplier which cost 1,200. The staff Christmas party cost 730. 9. Telephone 60 of the telephone expenses relates to the landline in Bernie's house. 10. Legal and professional fees include the following: Legal fees regarding product liability claim Legal fees regarding bad debt recoveries Annual accounting and tax advice 1,950 1,100 1,300* * This amount includes an invoice for 600 which was in respect of a HMRC audit which resulted in a payment of 6,000 for underdeclared PAYE. 11. Bad debts The amount in respect of bad debts relates to an increase in a specific bad debt provision of 1,255 and a decrease in a general bad debt provision of 557. Continued... 12. Repairs and maintenance Due to the cold weather all tiles on the floor in the bakery had to be replaced. Bernie used this as an opportunity to put new state of the art concrete flooring down at a cost of 4,560. The balance of repairs and maintenance costs relate to small plumbing and heating repairs required. 13. Sundry expenses Interest paid on overdue PAYE HMRC late filing penalty Cleaning for office Charitable donation to a UK registered charity 14. The loan interest is payable on the overdraft for the business. 15. Capital allowances The written down value brought forward in the main pool on 1 April 2021 was 4,500 and the written down value brought forward on the special rate pool was 19,000. During the year ended 31 March 2022, the following assets were bought: Date of acquisition 15/03/2022 22/02/2022 14/01/2022 20/09/2021 09/05/2021 Asset description Car with CO2 emissions of 45g/km Van 940 450 1,000 1,200 Industrial oven (30-year life) Machines for baking Car with CO2 emissions of 145g/km Cost 18,000 22,500 110,000 29,700 32,000 During the year ended 31 March 2022, disposals from the main pool amounted to 15,600. The proceeds for each asset were less than cost. Some assets were also disposed of from the special rate pool for 5,000. These assets had an initial cost of 3,500. Requirement (a) (b) Calculate Bernie's taxable trading profits (after capital allowances) for the 2021/22 tax year. You should include an explanation for any adjustments made or not made. 15 Marks Calculate Bernie's income tax liability for 2021/22. 4 Marks Total 19 Marks

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started