Answered step by step

Verified Expert Solution

Question

1 Approved Answer

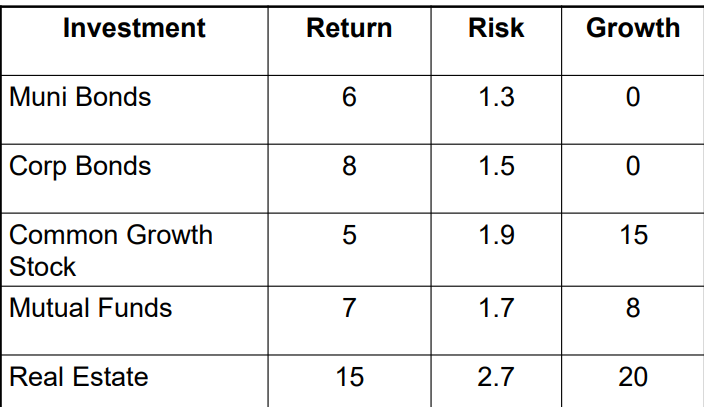

Bernie Maddog could have had a balanced portfolio for his clients (instead of getting caught up in the ponzi scheme). Based on the investment choices

Bernie Maddog could have had a balanced portfolio for his clients (instead of getting caught up in the ponzi scheme). Based on the investment choices shown in the following slide, find the optimal mix of investments, subject to these balancing rules: Average risk is below 1.9. No more than 50% of portfolio in any one investment. At least 20% bonds (corp plus muni). Growth at least a factor of 12. Investment choices:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started