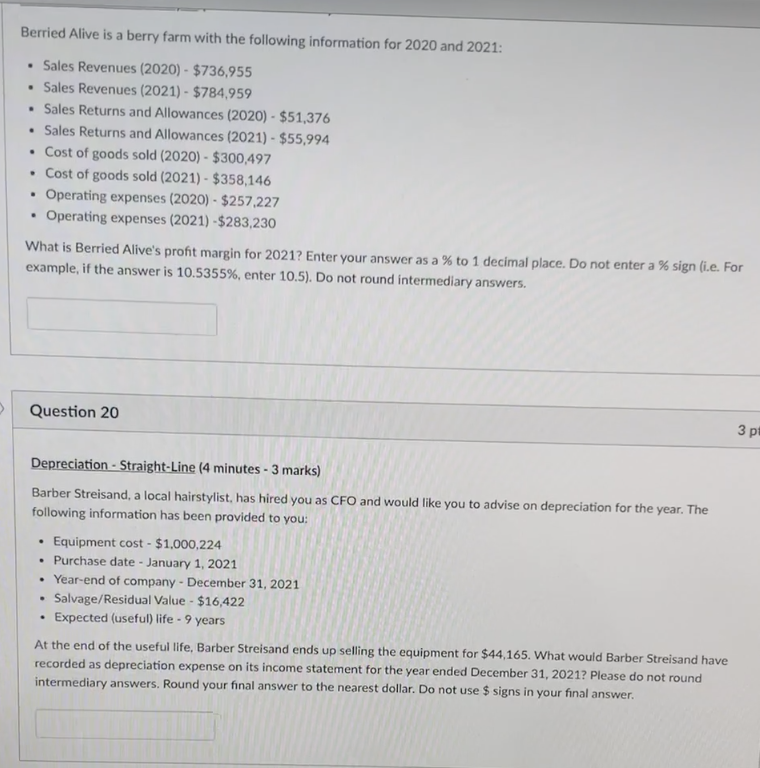

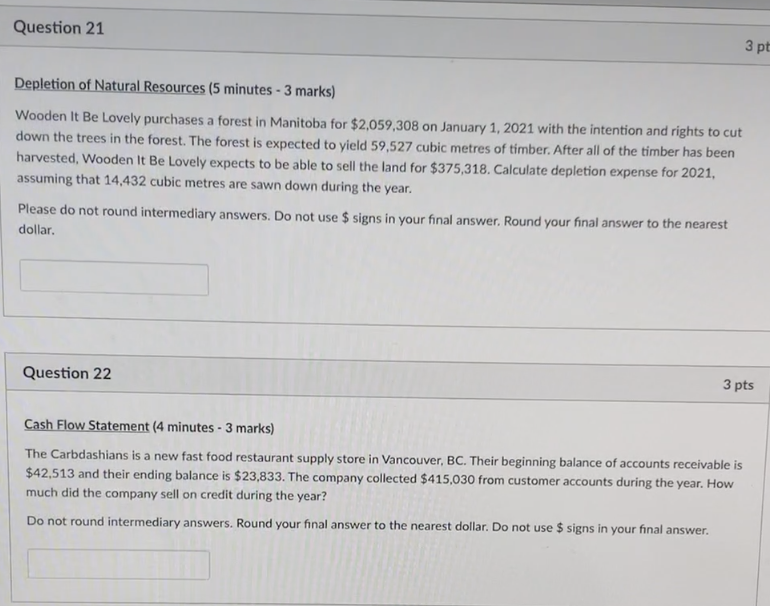

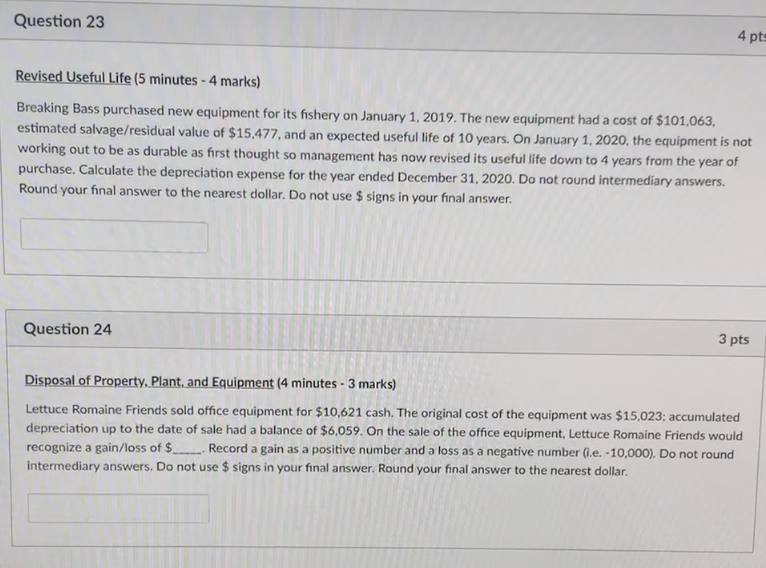

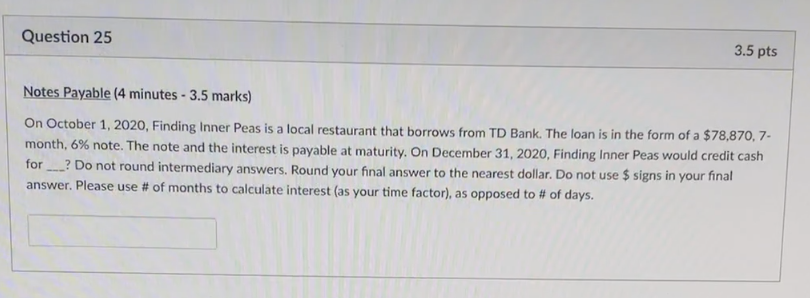

Berried Alive is a berry farm with the following information for 2020 and 2021: Sales Revenues (2020) - $736,955 Sales Revenues (2021) - $784,959 Sales Returns and Allowances (2020) - $51,376 Sales Returns and Allowances (2021) - $55,994 Cost of goods sold (2020) - $300,497 Cost of goods sold (2021) - $358,146 Operating expenses (2020) - $257,227 Operating expenses (2021) -$283,230 What is Berried Alive's profit margin for 2021? Enter your answer as a % to 1 decimal place. Do not enter a % sign (i.e. For example, if the answer is 10.5355%, enter 10.5). Do not round intermediary answers, Question 20 3 pt Depreciation - Straight-Line (4 minutes - 3 marks) Barber Streisand, a local hairstylist, has hired you as CFO and would like you to advise on depreciation for the year. The following information has been provided to you: . Equipment cost - $1,000,224 Purchase date - January 1, 2021 Year-end of company - December 31, 2021 Salvage/Residual Value - $16,422 Expected (useful) life - 9 years At the end of the useful life, Barber Streisand ends up selling the equipment for $44,165. What would Barber Streisand have recorded as depreciation expense on its income statement for the year ended December 31, 2021? Please do not round intermediary answers. Round your final answer to the nearest dollar. Do not use $ signs in your final answer. Question 21 3 pt Depletion of Natural Resources (5 minutes - 3 marks) Wooden It Be Lovely purchases a forest in Manitoba for $2,059,308 on January 1, 2021 with the intention and rights to cut down the trees in the forest. The forest is expected to yield 59,527 cubic metres of timber. After all of the timber has been harvested, Wooden It Be Lovely expects to be able to sell the land for $375,318. Calculate depletion expense for 2021, assuming that 14.432 cubic metres are sawn down during the year. Please do not round intermediary answers. Do not use $ signs in your final answer. Round your final answer to the nearest dollar. Question 22 3 pts Cash Flow Statement (4 minutes - 3 marks) The Carbdashians is a new fast food restaurant supply store in Vancouver, BC. Their beginning balance of accounts receivable is $42,513 and their ending balance is $23,833. The company collected $415,030 from customer accounts during the year. How much did the company sell on credit during the year? Do not round intermediary answers. Round your final answer to the nearest dollar. Do not use $ signs in your final answer. Question 23 4 pts Revised Useful Life (5 minutes - 4 marks) Breaking Bass purchased new equipment for its fishery on January 1, 2019. The new equipment had a cost of $101,063, estimated salvage/residual value of $15,477, and an expected useful life of 10 years. On January 1, 2020, the equipment is not working out to be as durable as first thought so management has now revised its useful life down to 4 years from the year of purchase. Calculate the depreciation expense for the year ended December 31, 2020. Do not round intermediary answers. Round your final answer to the nearest dollar. Do not use $ signs in your final answer. Question 24 3 pts Disposal of Property. Plant, and Equipment (4 minutes - 3 marks) Lettuce Romaine Friends sold office equipment for $10,621 cash. The original cost of the equipment was $15,023; accumulated depreciation up to the date of sale had a balance of $6,059. On the sale of the office equipment, Lettuce Romaine Friends would recognize a gain/loss of $ Record a gain as a positive number and a loss as a negative number (.e. -10,000). Do not round intermediary answers. Do not use $ signs in your final answer. Round your final answer to the nearest dollar. Question 25 3.5 pts Notes Payable (4 minutes - 3.5 marks) On October 1, 2020, Finding Inner Peas is a local restaurant that borrows from TD Bank. The loan is in the form of a $78,870,7- month, 6% note. The note and the interest is payable at maturity. On December 31, 2020, Finding Inner Peas would credit cash for ___? Do not round intermediary answers, Round your final answer to the nearest dollar. Do not use $ signs in your final answer. Please use # of months to calculate interest (as your time factor), as opposed to # of days