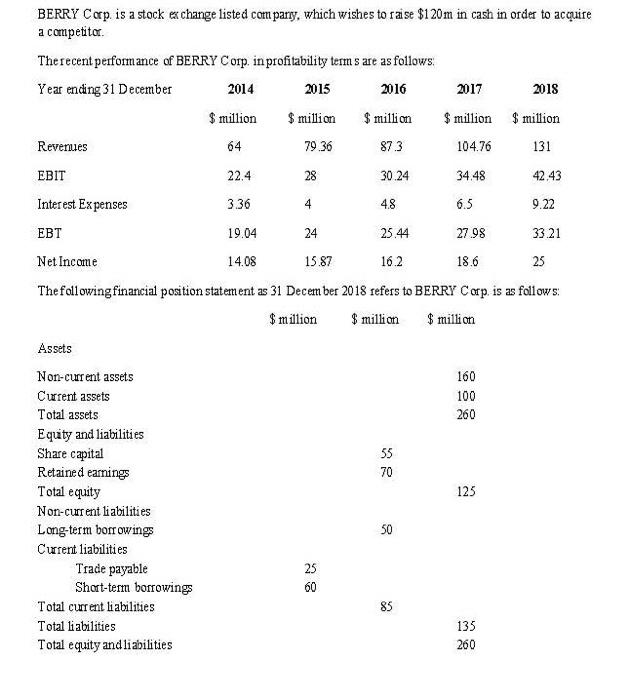

BERRY Cap. is a stock exchange listed comparty, which wishes to raise $120m in cash in order to acquire a competitor The recent performance of BERRY Corp. in profitability terms are as follows: Year ending 31 December 2014 2015 2016 2017 2018 $ million $ million $ million $ million $ million Revenues 64 79.36 873 104.76 131 EBIT 22.4 28 30.24 34.48 42.43 Interest Expenses 3.36 4 48 6.5 9.22 EBT 19.04 24 25.44 27.98 33.21 Net Income 14.08 15.87 16.2 18.6 25 The following financial position statement as 31 December 2018 refers to BERRY Corp. is as follows: $ million $ million $ million Assets 160 100 260 55 70 125 Non-current assets Curent assets Total assets Equity and liabilities Share capital Retained earnings Total equity Non-curent liabilities Long-term borrowing Curent liabilities Trade payable Short-term borrowing Total current liabilities Total liabilities Total equity and liabilities 50 25 60 85 135 260 Notes: 1. The long-term borrowings are 7% bonds that are repayable in 2020 2. The short-term borrowings consist of an overdraft at an annual interest rate of 8% 3. The current assets do not include and cash deposits +BERRY Co. has not paid any dividends in the last five years 5. The number of ordinary shares issued by the company has not changed in recent years 6. The target company has no debt finance and its forecast profit before interest and tax will increase by$12 million Required: 1-Evalute suitable methods of raising the S120 million required by BERRY Co supporting your evaluation with both analysis and critical discussion (30 points) 2- Bricfly explain the factors that will influence the rate of interest charged on a new issue of bonds. (10 points) Lecturer: Ao Veng a BERRY Cap. is a stock exchange listed comparty, which wishes to raise $120m in cash in order to acquire a competitor The recent performance of BERRY Corp. in profitability terms are as follows: Year ending 31 December 2014 2015 2016 2017 2018 $ million $ million $ million $ million $ million Revenues 64 79.36 873 104.76 131 EBIT 22.4 28 30.24 34.48 42.43 Interest Expenses 3.36 4 48 6.5 9.22 EBT 19.04 24 25.44 27.98 33.21 Net Income 14.08 15.87 16.2 18.6 25 The following financial position statement as 31 December 2018 refers to BERRY Corp. is as follows: $ million $ million $ million Assets 160 100 260 55 70 125 Non-current assets Curent assets Total assets Equity and liabilities Share capital Retained earnings Total equity Non-curent liabilities Long-term borrowing Curent liabilities Trade payable Short-term borrowing Total current liabilities Total liabilities Total equity and liabilities 50 25 60 85 135 260 Notes: 1. The long-term borrowings are 7% bonds that are repayable in 2020 2. The short-term borrowings consist of an overdraft at an annual interest rate of 8% 3. The current assets do not include and cash deposits +BERRY Co. has not paid any dividends in the last five years 5. The number of ordinary shares issued by the company has not changed in recent years 6. The target company has no debt finance and its forecast profit before interest and tax will increase by$12 million Required: 1-Evalute suitable methods of raising the S120 million required by BERRY Co supporting your evaluation with both analysis and critical discussion (30 points) 2- Bricfly explain the factors that will influence the rate of interest charged on a new issue of bonds. (10 points) Lecturer: Ao Veng a