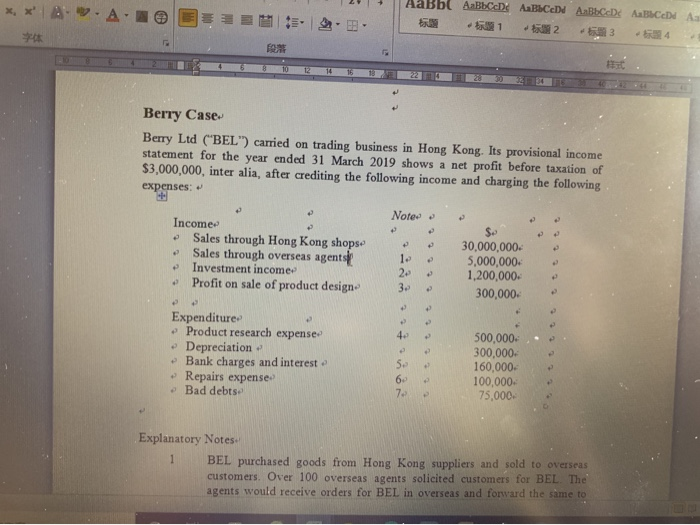

Berry Ltd (BEL) carried on trading business in Hong Kong. Its provisional income statement for the year ended 31 March 2019 shows a net profit before taxation of $3,000,000, inter alia, after crediting the following income and charging the following expenses:

I

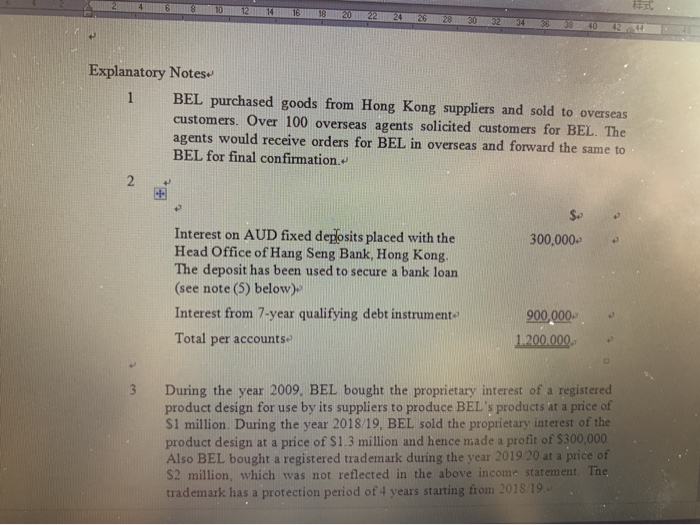

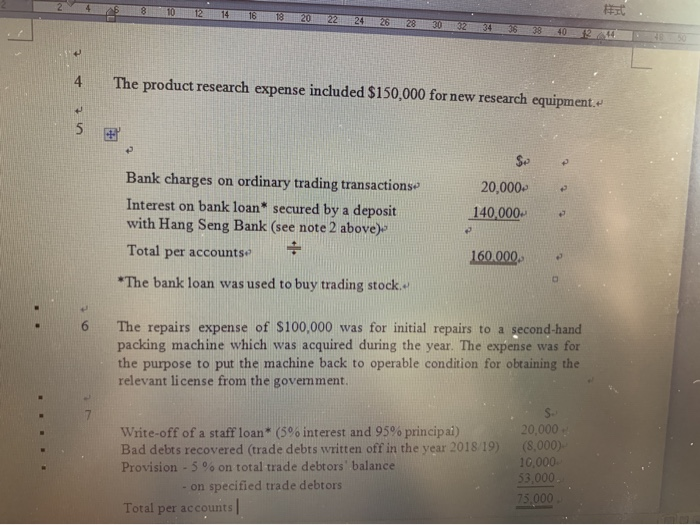

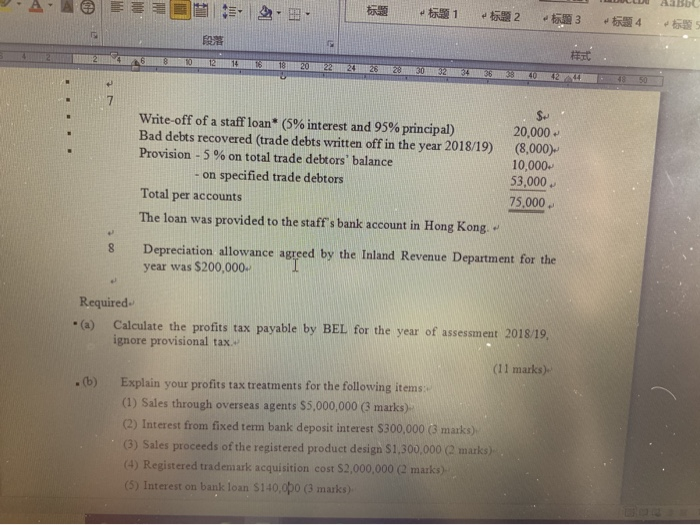

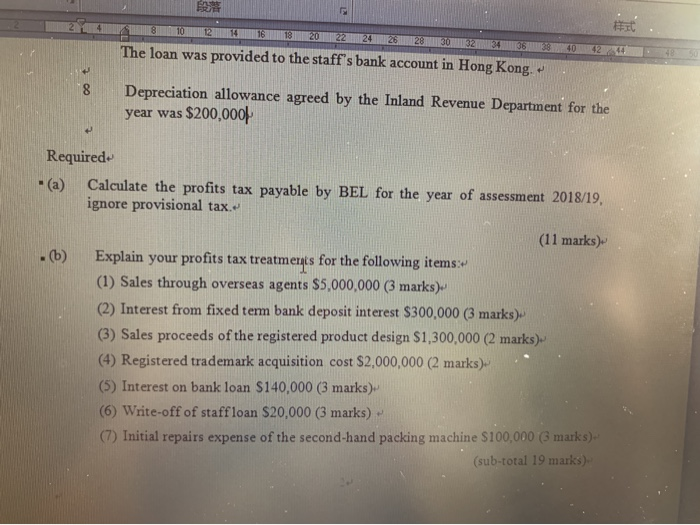

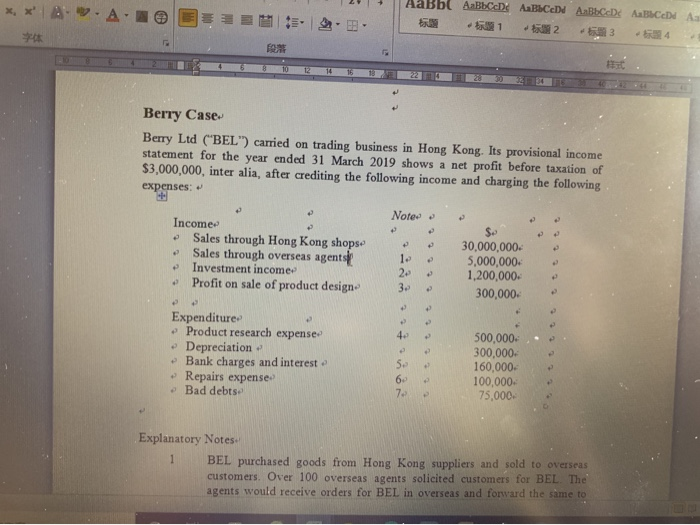

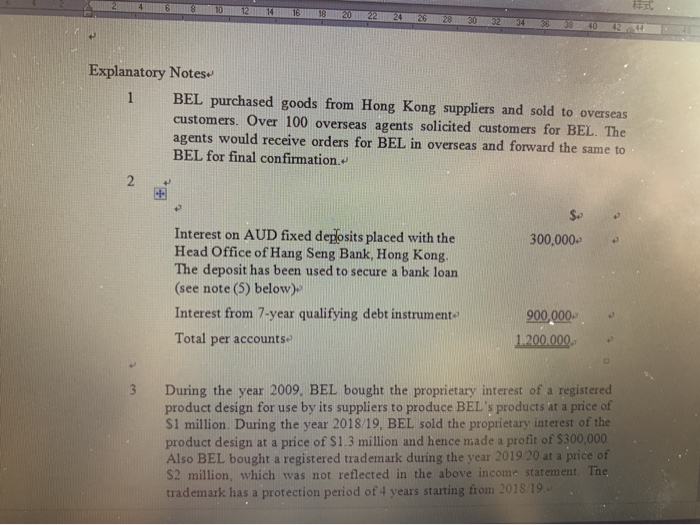

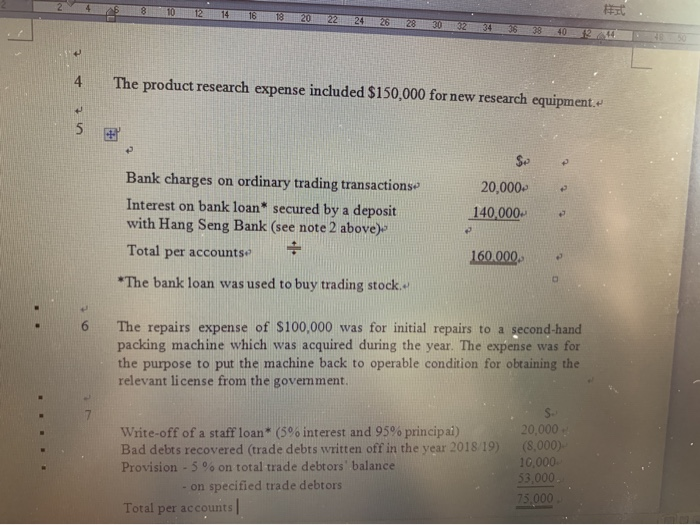

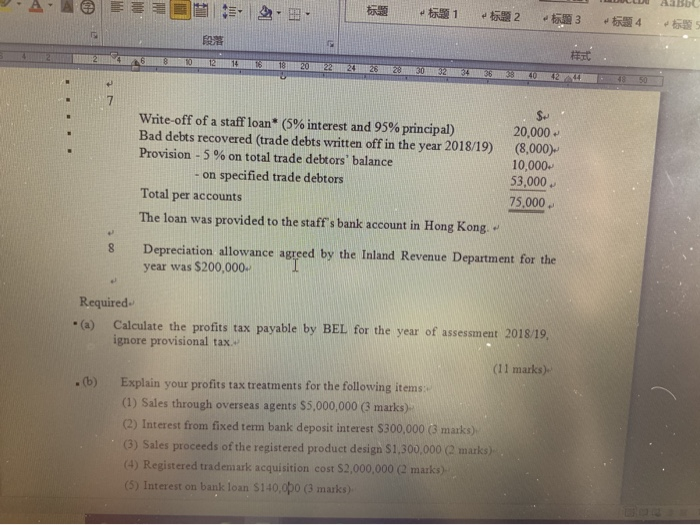

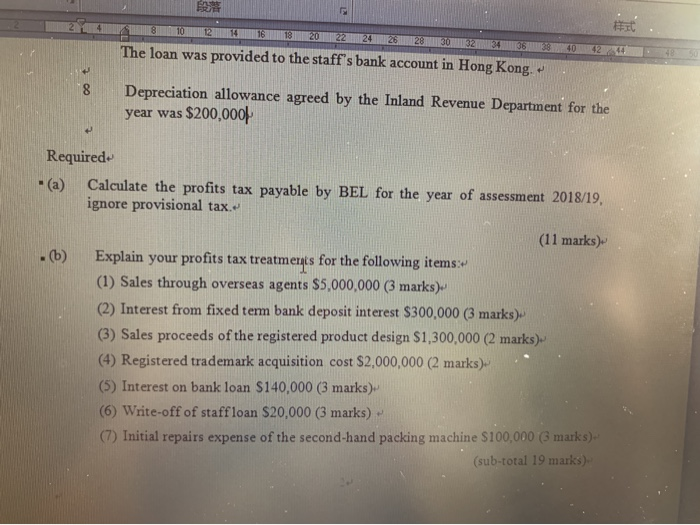

A .A. - . 1 2 6036 Berry Case Berry Ltd ("BEL") carried on trading business in Hong Kong. Its provisional income statement for the year ended 31 March 2019 shows a net profit before taxation of $3,000,000, inter alia, after crediting the following income and charging the following expenses: Note - Income Sales through Hong Kong shops Sales through overseas agents Investment income Profit on sale of product design 1. 30,000,000 5,000,000 1,200,000 300,000 3. Expenditure Product research expense Depreciation Bank charges and interest Repairs expense. Bad debts. 500,000 300,000 160,000- 100,000 75,000 Explanatory Notes BEL purchased goods from Hong Kong suppliers and sold to overseas customers. Over 100 overseas agents solicited customers for BEL The agents would receive orders for BEL in overseas and forward the same to Explanatory Notes 1 BEL purchased goods from Hong Kong suppliers and sold to overseas customers. Over 100 overseas agents solicited customers for BEL. The agents would receive orders for BEL in overseas and forward the same to BEL for final confirmation. 300,000 Interest on AUD fixed deposits placed with the Head Office of Hang Seng Bank, Hong Kong. The deposit has been used to secure a bank loan (see note (5) below) Interest from 7-year qualifying debt instrumento Total per accounts: 900,000 1.200.000 During the year 2009, BEL bought the proprietary interest of a registered product design for use by its suppliers to produce BEL's products at a price of S1 million. During the year 2018/19. BEL sold the proprietary interest of the product design at a price of $1.3 million and hence made a profit of $300,000. Also BEL bought a realstered trademark during the year 2019.20 at a price of $2 million, which was not reflected in the above income statement. The trademark has a protection period of 4 years starting from 2018 19. 2 4 6 8 10 12 14 16 18 20 22 24 26 28 30 32 34 36 38 402 4 The product research expense included $150,000 for new research equipment. 5 Se 20,000 140,000 Bank charges on ordinary trading transactions Interest on bank loan* secured by a deposit with Hang Seng Bank (see note 2 above) Total per accounts *The bank loan was used to buy trading stock. 160.000 6 The repairs expense of $100,000 was for initial repairs to a second-hand packing machine which was acquired during the year. The expense was for the purpose to put the machine back to operable condition for obtaining the relevant license from the government. Write-off of a staff loan* (5% interest and 95% principai) Bad debts recovered (trade debts written off in the year 2018/19) Provision - 5 % on total trade debtors balance - on specified trade debtors Total per accounts S. 20,000 (8,000). 10,000 53,000 75,000 UAA EDER. 21 22 23 24 25 Write-off of a staff loan* (5% interest and 95% principal) Bad debts recovered (trade debts written off in the year 2018/19) Provision - 5 % on total trade debtors' balance - on specified trade debtors Total per accounts The loan was provided to the staff's bank account in Hong Kong 20,000 (8,000) 10,000 53,000 75.000 Depreciation allowance agreed by the Inland Revenue Department for the year was $200,000 Required *(a) Calculate the profits tax payable by BEL for the year of assessment 2018/19. ignore provisional tax. (11 marks) . (b) Explain your profits tax treatments for the following items: (1) Sales through overseas agents $5,000,000 (3 marks) (2) Interest from fixed term bank deposit interest $300,000 (3 marks) (3) Sales proceeds of the registered product design $1,300,000 (2 marks) (4) Registered trademark acquisition cost $2,000,000 marks (5) Interest on bank loan $140,00 (3 marks) 2022 24 28 30 32 34060 The loan was provided to the staff's bank account in Hong Kong. 2 Depreciation allowance agreed by the Inland Revenue Department for the year was $200,000 Required - (a) Calculate the profits tax payable by BEL for the year of assessment 2018/19, ignore provisional tax. (11 marks) - (b) Explain your profits tax treatments for the following items ! (1) Sales through overseas agents $5,000,000 (3 marks) (2) Interest from fixed term bank deposit interest $300,000 (3 marks) (3) Sales proceeds of the registered product design $1,300,000 (2 marks). (4) Registered trademark acquisition cost $2,000,000 (2 marks) (5) Interest on bank loan $140,000 (3 marks) (6) Write-off of staff loan $20,000 (3 marks). Initial repairs expense of the second-hand packing machine S100,000 (3 marks (sub-total 19 marks) A .A. - . 1 2 6036 Berry Case Berry Ltd ("BEL") carried on trading business in Hong Kong. Its provisional income statement for the year ended 31 March 2019 shows a net profit before taxation of $3,000,000, inter alia, after crediting the following income and charging the following expenses: Note - Income Sales through Hong Kong shops Sales through overseas agents Investment income Profit on sale of product design 1. 30,000,000 5,000,000 1,200,000 300,000 3. Expenditure Product research expense Depreciation Bank charges and interest Repairs expense. Bad debts. 500,000 300,000 160,000- 100,000 75,000 Explanatory Notes BEL purchased goods from Hong Kong suppliers and sold to overseas customers. Over 100 overseas agents solicited customers for BEL The agents would receive orders for BEL in overseas and forward the same to Explanatory Notes 1 BEL purchased goods from Hong Kong suppliers and sold to overseas customers. Over 100 overseas agents solicited customers for BEL. The agents would receive orders for BEL in overseas and forward the same to BEL for final confirmation. 300,000 Interest on AUD fixed deposits placed with the Head Office of Hang Seng Bank, Hong Kong. The deposit has been used to secure a bank loan (see note (5) below) Interest from 7-year qualifying debt instrumento Total per accounts: 900,000 1.200.000 During the year 2009, BEL bought the proprietary interest of a registered product design for use by its suppliers to produce BEL's products at a price of S1 million. During the year 2018/19. BEL sold the proprietary interest of the product design at a price of $1.3 million and hence made a profit of $300,000. Also BEL bought a realstered trademark during the year 2019.20 at a price of $2 million, which was not reflected in the above income statement. The trademark has a protection period of 4 years starting from 2018 19. 2 4 6 8 10 12 14 16 18 20 22 24 26 28 30 32 34 36 38 402 4 The product research expense included $150,000 for new research equipment. 5 Se 20,000 140,000 Bank charges on ordinary trading transactions Interest on bank loan* secured by a deposit with Hang Seng Bank (see note 2 above) Total per accounts *The bank loan was used to buy trading stock. 160.000 6 The repairs expense of $100,000 was for initial repairs to a second-hand packing machine which was acquired during the year. The expense was for the purpose to put the machine back to operable condition for obtaining the relevant license from the government. Write-off of a staff loan* (5% interest and 95% principai) Bad debts recovered (trade debts written off in the year 2018/19) Provision - 5 % on total trade debtors balance - on specified trade debtors Total per accounts S. 20,000 (8,000). 10,000 53,000 75,000 UAA EDER. 21 22 23 24 25 Write-off of a staff loan* (5% interest and 95% principal) Bad debts recovered (trade debts written off in the year 2018/19) Provision - 5 % on total trade debtors' balance - on specified trade debtors Total per accounts The loan was provided to the staff's bank account in Hong Kong 20,000 (8,000) 10,000 53,000 75.000 Depreciation allowance agreed by the Inland Revenue Department for the year was $200,000 Required *(a) Calculate the profits tax payable by BEL for the year of assessment 2018/19. ignore provisional tax. (11 marks) . (b) Explain your profits tax treatments for the following items: (1) Sales through overseas agents $5,000,000 (3 marks) (2) Interest from fixed term bank deposit interest $300,000 (3 marks) (3) Sales proceeds of the registered product design $1,300,000 (2 marks) (4) Registered trademark acquisition cost $2,000,000 marks (5) Interest on bank loan $140,00 (3 marks) 2022 24 28 30 32 34060 The loan was provided to the staff's bank account in Hong Kong. 2 Depreciation allowance agreed by the Inland Revenue Department for the year was $200,000 Required - (a) Calculate the profits tax payable by BEL for the year of assessment 2018/19, ignore provisional tax. (11 marks) - (b) Explain your profits tax treatments for the following items ! (1) Sales through overseas agents $5,000,000 (3 marks) (2) Interest from fixed term bank deposit interest $300,000 (3 marks) (3) Sales proceeds of the registered product design $1,300,000 (2 marks). (4) Registered trademark acquisition cost $2,000,000 (2 marks) (5) Interest on bank loan $140,000 (3 marks) (6) Write-off of staff loan $20,000 (3 marks). Initial repairs expense of the second-hand packing machine S100,000 (3 marks (sub-total 19 marks)