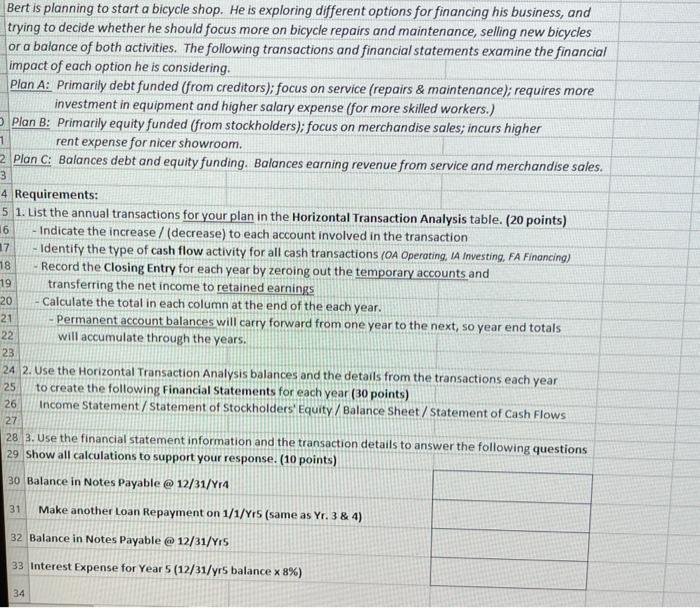

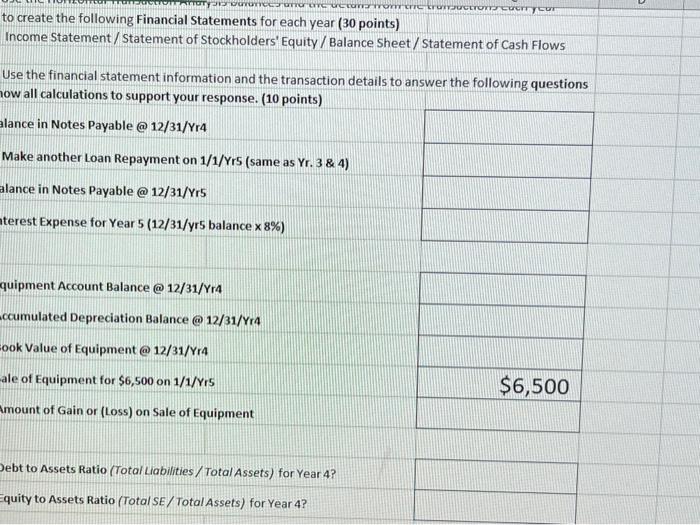

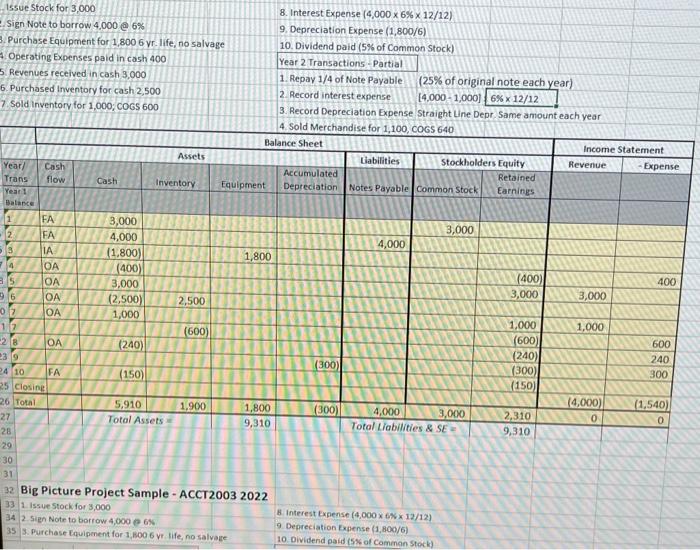

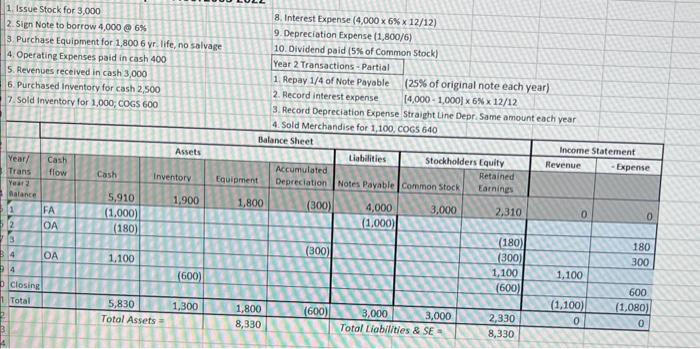

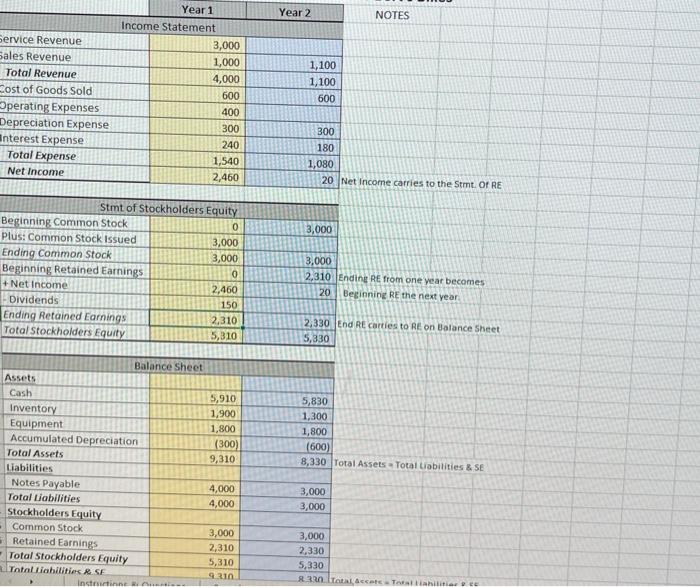

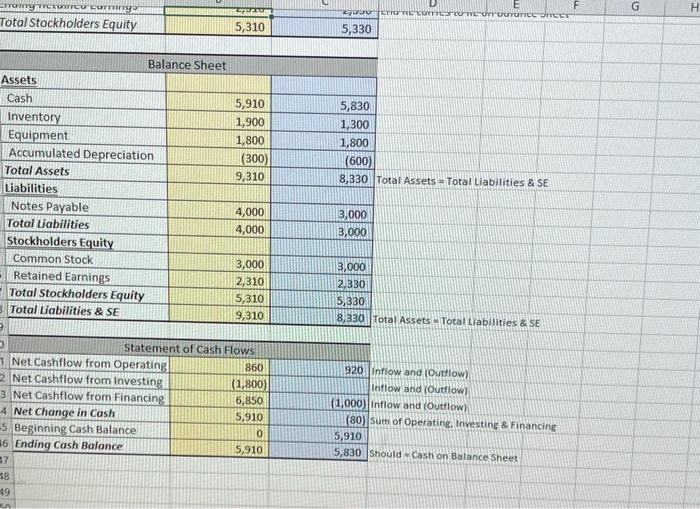

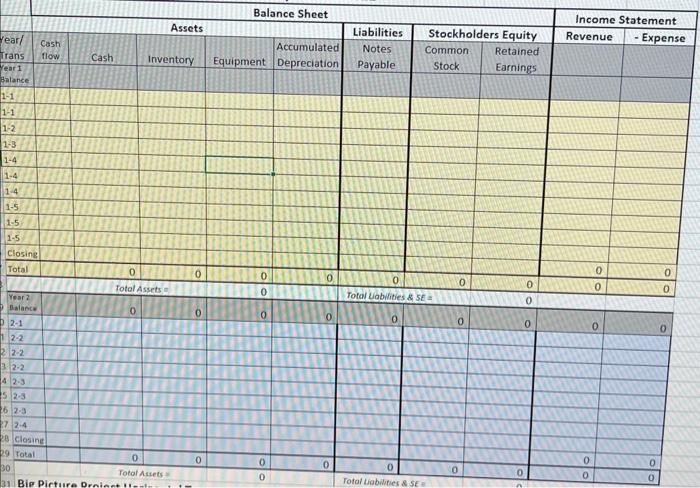

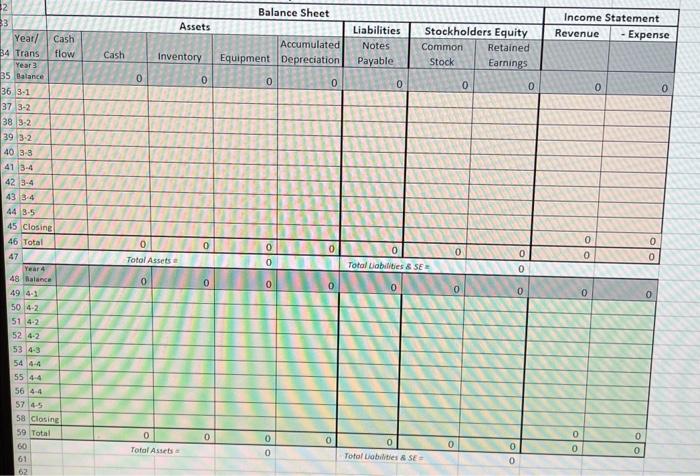

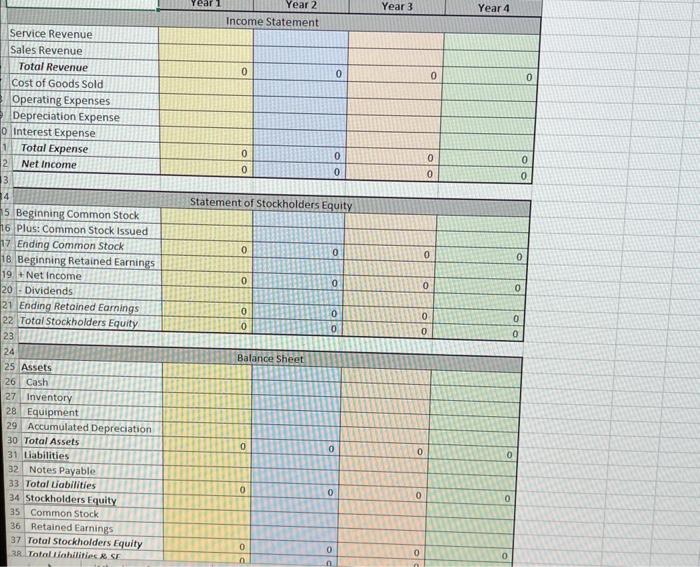

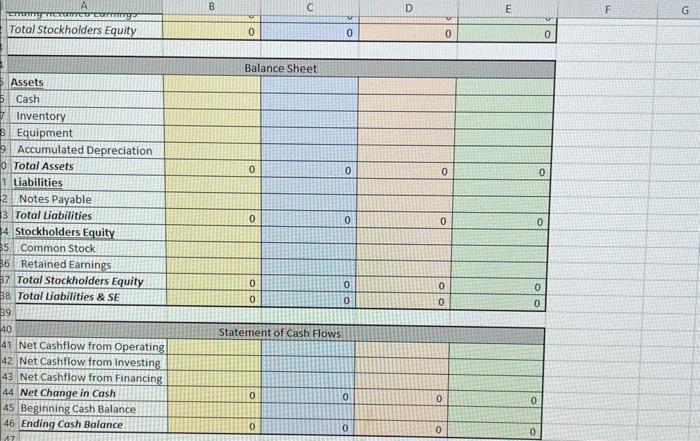

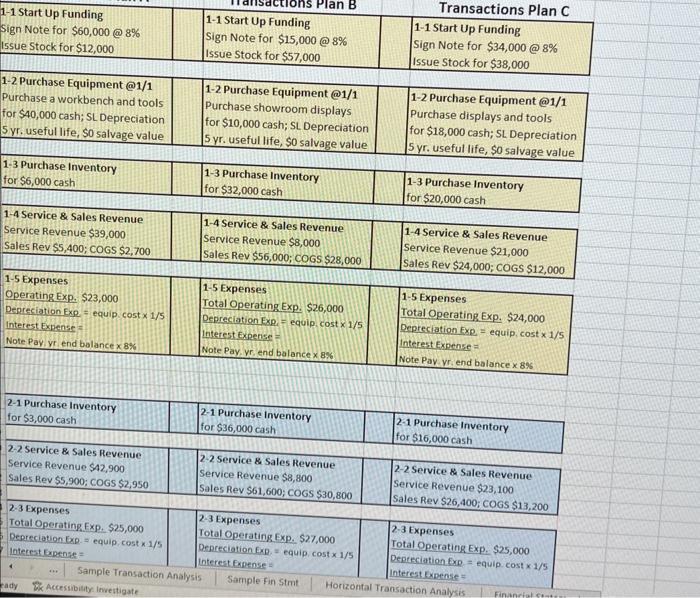

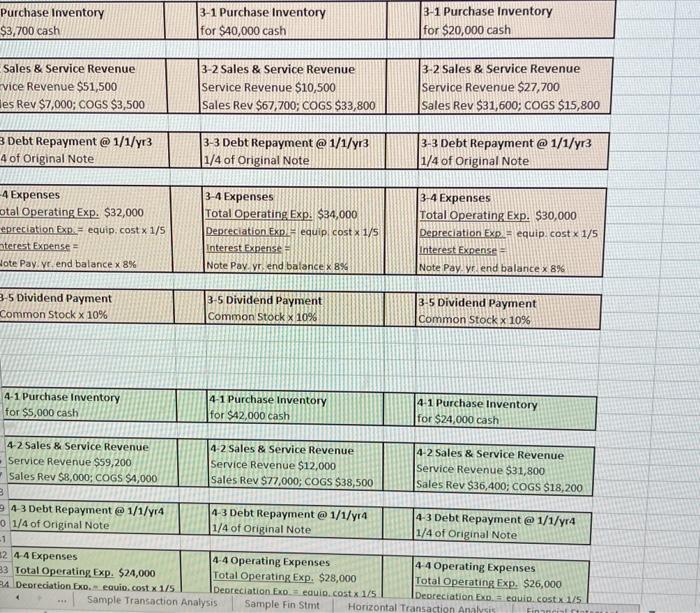

Bert is planning to start a bicycle shop. He is exploring different options for financing his business, and trying to decide whether he should focus more on bicycle repairs and maintenance, selling new bicycles or a balance of both activities. The following transactions and financial statements examine the financial impact of each option he is considering. Plan A: Primarily debt funded (from creditors); focus on service (repairs \& maintenance); requires more investment in equipment and higher salary expense (for more skilled workers.) Plan B: Primarily equity funded (from stockholders); focus on merchandise sales; incurs higher rent expense for nicer showroom. Plan C: Balances debt and equity funding. Balances earning revenue from service and merchandise sales. 4 Requirements: 1. List the annual transactions for your plan in the Horizontal Transaction Analysis table. (20 points) - Indicate the increase / (decrease) to each account involved in the transaction - Identify the type of cash flow activity for all cash transactions (OA Operating, IA Investing. FA Financing) - Record the Closing Entry for each year by zeroing out the temporary accounts and transferring the net income to retained earnings - Calculate the total in each column at the end of the each year. - Permanent account balances will carry forward from one year to the next, so year end totals will accumulate through the years. 2. Use the Horizontal Transaction Analysis balances and the details from the transactions each year to create the following Financial Statements for each year ( 30 points) Income Statement/statement of Stockholders' Equity/Balance Sheet/statement of Cash Flows 3. Use the financial statement information and the transaction details to answer the following questions 29 Show all calculations to support your response. (10 points) 30 Balance in Notes Payable@12/31/Yra 31 Make another Loan Repayment on 1/1/ Yrs (same as Yr. 3&4 ) 32 Balance in Notes Payable@12/31/Y,5 33 Interest Expense for Year 5(12/31/ yr 5 balance 8%) to create the following Financial Statements for each year ( 30 points) Income Statement/Statement of Stockholders' Equity / Balance Sheet/Statement of Cash Flows Use the financial statement information and the transaction details to answer the following questions how all calculations to support your response. (10 points) Makce in Notes Payable @12/31/Yr4 Make another Loan Repayment on 1/1/Yr5 (same as Yr. 3 \& 4) Big Picture Project Sample - ACCT2003 2022 1 issue stock for 3,000 8. Interest Expense (4,000612/12) 2.sin Note to borrow 4,000065 9. Depreciation Expense (1,800/6) 5. 3. Purchase Equipenent for 1,10006 yr life, no salvage 10. Dividend paid ( 5% of comman Stock) 1. Issue Stock for 3,000 2. Sign Note to borrow 4,000 @ 6% 3. Purchase Equipment for 1,800,6 yr. lif 4. Operating Expenses paid in cash 400 5. Revenues received in cash 3,000 6. Purchased Inventory for cash 2,500 7. Sold Inventory for 1,000; coGs 600 8. Interest Expense (4,0006%12/12) \begin{tabular}{|l|c|c|c|c|c|c|} \hline \multicolumn{1}{c|}{ A } & B & C & D & E & \\ \hline Total Stockholders Equity & 0 & 0 & 0 & 0 & 0 \\ \hline \end{tabular} \begin{tabular}{|l|l|l|l|} \hline \begin{tabular}{l|l|l|} Purchase Inventory \\ $3,700cash \end{tabular} & 3-1 Purchase Inventory for $40,000cash & 3-1 Purchase Inventory for $20,000cash \\ \hline \end{tabular} \begin{tabular}{|l|l|l|l|} \hline 43 Debt Repayment @ 1/1/yr4 & & 43 Debt Repayment @ 1/1/yr4 1/4 of Original Note & 43 Debt Repayment @ 1/1/yr4 1/4 of Original Note \\ \hline \end{tabular} \begin{tabular}{|l|l|l|||||||l|} \hline 4-5 Dividend Payment & & \begin{tabular}{l|l|l|l|} 45 Dividend Payment \\ Common stock 10% \end{tabular} & 45 Dividend Payment Common Stock 10% \\ \hline \end{tabular} Bert is planning to start a bicycle shop. He is exploring different options for financing his business, and trying to decide whether he should focus more on bicycle repairs and maintenance, selling new bicycles or a balance of both activities. The following transactions and financial statements examine the financial impact of each option he is considering. Plan A: Primarily debt funded (from creditors); focus on service (repairs \& maintenance); requires more investment in equipment and higher salary expense (for more skilled workers.) Plan B: Primarily equity funded (from stockholders); focus on merchandise sales; incurs higher rent expense for nicer showroom. Plan C: Balances debt and equity funding. Balances earning revenue from service and merchandise sales. 4 Requirements: 1. List the annual transactions for your plan in the Horizontal Transaction Analysis table. (20 points) - Indicate the increase / (decrease) to each account involved in the transaction - Identify the type of cash flow activity for all cash transactions (OA Operating, IA Investing. FA Financing) - Record the Closing Entry for each year by zeroing out the temporary accounts and transferring the net income to retained earnings - Calculate the total in each column at the end of the each year. - Permanent account balances will carry forward from one year to the next, so year end totals will accumulate through the years. 2. Use the Horizontal Transaction Analysis balances and the details from the transactions each year to create the following Financial Statements for each year ( 30 points) Income Statement/statement of Stockholders' Equity/Balance Sheet/statement of Cash Flows 3. Use the financial statement information and the transaction details to answer the following questions 29 Show all calculations to support your response. (10 points) 30 Balance in Notes Payable@12/31/Yra 31 Make another Loan Repayment on 1/1/ Yrs (same as Yr. 3&4 ) 32 Balance in Notes Payable@12/31/Y,5 33 Interest Expense for Year 5(12/31/ yr 5 balance 8%) to create the following Financial Statements for each year ( 30 points) Income Statement/Statement of Stockholders' Equity / Balance Sheet/Statement of Cash Flows Use the financial statement information and the transaction details to answer the following questions how all calculations to support your response. (10 points) Makce in Notes Payable @12/31/Yr4 Make another Loan Repayment on 1/1/Yr5 (same as Yr. 3 \& 4) Big Picture Project Sample - ACCT2003 2022 1 issue stock for 3,000 8. Interest Expense (4,000612/12) 2.sin Note to borrow 4,000065 9. Depreciation Expense (1,800/6) 5. 3. Purchase Equipenent for 1,10006 yr life, no salvage 10. Dividend paid ( 5% of comman Stock) 1. Issue Stock for 3,000 2. Sign Note to borrow 4,000 @ 6% 3. Purchase Equipment for 1,800,6 yr. lif 4. Operating Expenses paid in cash 400 5. Revenues received in cash 3,000 6. Purchased Inventory for cash 2,500 7. Sold Inventory for 1,000; coGs 600 8. Interest Expense (4,0006%12/12) \begin{tabular}{|l|c|c|c|c|c|c|} \hline \multicolumn{1}{c|}{ A } & B & C & D & E & \\ \hline Total Stockholders Equity & 0 & 0 & 0 & 0 & 0 \\ \hline \end{tabular} \begin{tabular}{|l|l|l|l|} \hline \begin{tabular}{l|l|l|} Purchase Inventory \\ $3,700cash \end{tabular} & 3-1 Purchase Inventory for $40,000cash & 3-1 Purchase Inventory for $20,000cash \\ \hline \end{tabular} \begin{tabular}{|l|l|l|l|} \hline 43 Debt Repayment @ 1/1/yr4 & & 43 Debt Repayment @ 1/1/yr4 1/4 of Original Note & 43 Debt Repayment @ 1/1/yr4 1/4 of Original Note \\ \hline \end{tabular} \begin{tabular}{|l|l|l|||||||l|} \hline 4-5 Dividend Payment & & \begin{tabular}{l|l|l|l|} 45 Dividend Payment \\ Common stock 10% \end{tabular} & 45 Dividend Payment Common Stock 10% \\ \hline \end{tabular}