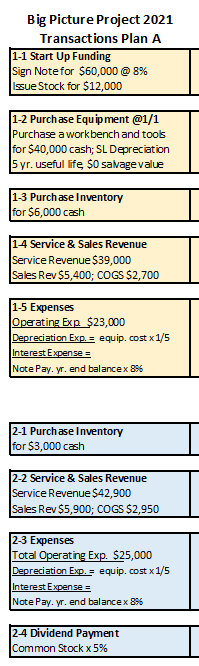

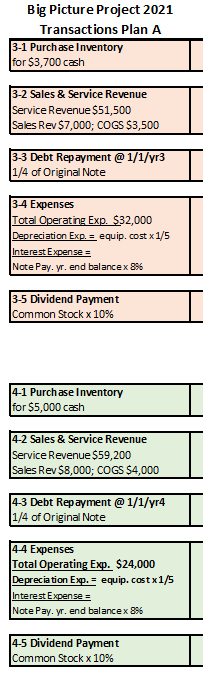

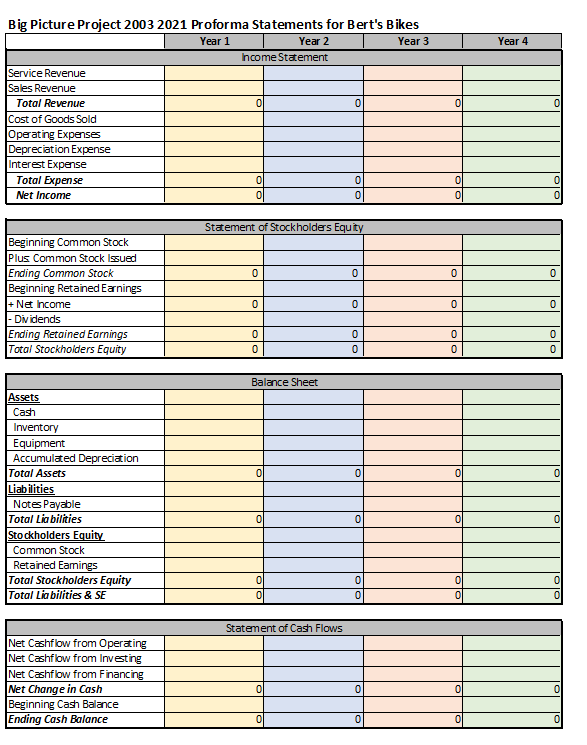

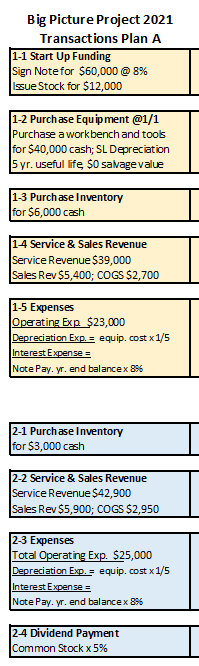

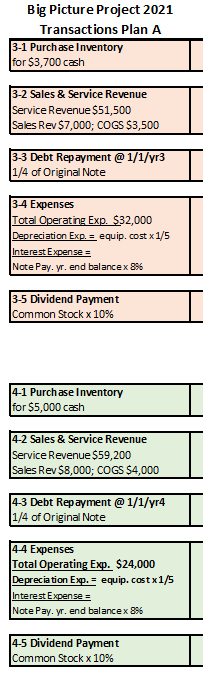

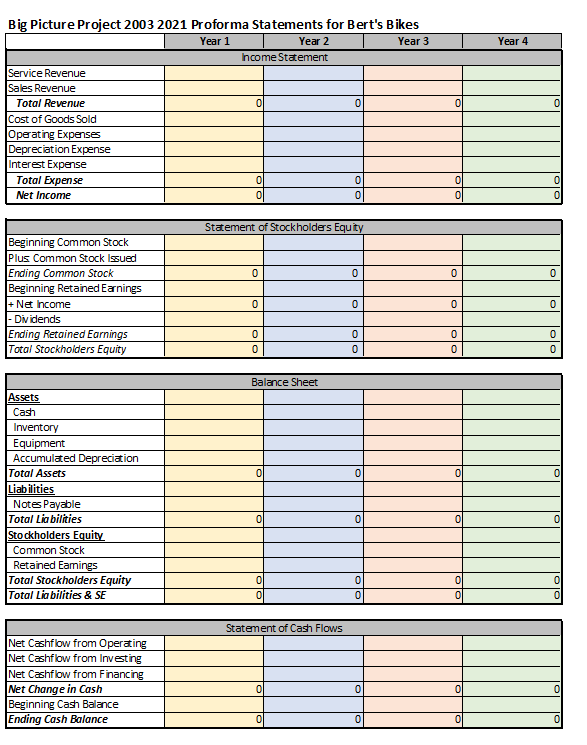

Bert is planning to start a bicycle shop. He is exploring different options for financing his business, and trying to decide whether he should focus more on bicycle repairs and maintenance, selling new bicycles or a balance of both activities. The following transactions and financial statements examine the financial impact of each option he is considering. Plan A: Primarily debt funded (from creditors); focus on service (repairs & maintenance); requires more investment in equipment and higher salary expense (for more skilled workers.) Big Picture Project 2021 Transactions Plan A 1-1 Start Up Funding Sign Note for $60,000 @ 8% Issue Stock for $12,000 1-2 Purchase Equipment @1/1 Purchase a workbench and tools for $40,000 cash; SL Depreciation 5 yr useful life $0 salvage value 1-3 Purchase Inventory for $6,000 cash 1-4 Service & Sales Revenue Service Revenue $39,000 Sales Rev $5,400; COGS $2,700 1-5 Expenses Operating Exp $23,000 Depreciation Exp. = equip.cost x1/5 Interest Expense Note Pay. yr. end balancex 3% 2-1 Purchase Inventory for $3,000 cash 2-2 Service & Sales Revenue Service Revenue $42,900 Sales Rev $5,900; COGS $2,950 23 Expenses Total Operating Exp. $25,000 Depreciation Exp. = equip.cost x1/5 Interest Expense = Note Pay yr. end balance x 856 24 Dividend Payment Common Stock x 5% Big Picture Project 2021 Transactions Plan A 3-1 Purchase Inventory for $3,700 cash 3-2 Sales & Service Revenue Service Revenue $51,500 Sales Rev $7,000; COGS $3,500 3-3 Debt Repayment @ 1/1/yr3 1/4 of Original Note 3-4 Expenses Total Operating Exp. $32,000 Depreciation Exp. = equip.cost x1/5 Interest Expense = Note Pay. yr. end balance x 8% 3-5 Dividend Payment Common Stock x 10% 4-1 Purchase Inventory for $5,000 cash 4-2 Sales & Service Revenue Service Revenue $59,200 Sales Rev $8,000; COGS $4,000 4-3 Debt Repayment @ 1/1/yr4 1/4 of Original Note 44 Expenses Total Operating Exp. $24,000 Depreciation Exp. = equip.cost x1/5 Interest Expense = Note Pay.yr. end balance x 896 4-5 Dividend Payment Common Stock x 10% Year 4 Big Picture Project 2003 2021 Proforma Statements for Bert's Bikes Year 1 Year 2 Year 3 Income Statement Service Revenue Sales Revenue Total Revenue Cost of Goods Sold Operating Expenses Depreciation Expense Interest Expense Total Expense 0 Net Income 0 0 0 0 0 0 0 Statement of Stockholders Equity 0 0 0 Beginning Common Stock Plus Common Stock Issued Ending Common Stock Beginning Retained Earnings + Net Income - Dividends Ending Retained Earnings Total Stockholders Equity 0 0 0 0 0 0 lolo Olo 0 0 Balance Sheet 0 0 0 Assets Cash Inventory Equipment Accumulated Depreciation Total Assets Liabilities Notes Payable Total Liabilities Stockholders Equity Common Stock Retained Earings Total Stockholders Equity Total Liabilities & SE 0 0 0 0 0 0 0 0 0 0 0 Statement of Cash Flows Net Cashflow from Operating Net Cashflow from Investing Net Cashflow from Financing Net Change in Cash Beginning Cash Balance Ending Cash Balance 0 0 0 0 0 Bert is planning to start a bicycle shop. He is exploring different options for financing his business, and trying to decide whether he should focus more on bicycle repairs and maintenance, selling new bicycles or a balance of both activities. The following transactions and financial statements examine the financial impact of each option he is considering. Plan A: Primarily debt funded (from creditors); focus on service (repairs & maintenance); requires more investment in equipment and higher salary expense (for more skilled workers.) Big Picture Project 2021 Transactions Plan A 1-1 Start Up Funding Sign Note for $60,000 @ 8% Issue Stock for $12,000 1-2 Purchase Equipment @1/1 Purchase a workbench and tools for $40,000 cash; SL Depreciation 5 yr useful life $0 salvage value 1-3 Purchase Inventory for $6,000 cash 1-4 Service & Sales Revenue Service Revenue $39,000 Sales Rev $5,400; COGS $2,700 1-5 Expenses Operating Exp $23,000 Depreciation Exp. = equip.cost x1/5 Interest Expense Note Pay. yr. end balancex 3% 2-1 Purchase Inventory for $3,000 cash 2-2 Service & Sales Revenue Service Revenue $42,900 Sales Rev $5,900; COGS $2,950 23 Expenses Total Operating Exp. $25,000 Depreciation Exp. = equip.cost x1/5 Interest Expense = Note Pay yr. end balance x 856 24 Dividend Payment Common Stock x 5% Big Picture Project 2021 Transactions Plan A 3-1 Purchase Inventory for $3,700 cash 3-2 Sales & Service Revenue Service Revenue $51,500 Sales Rev $7,000; COGS $3,500 3-3 Debt Repayment @ 1/1/yr3 1/4 of Original Note 3-4 Expenses Total Operating Exp. $32,000 Depreciation Exp. = equip.cost x1/5 Interest Expense = Note Pay. yr. end balance x 8% 3-5 Dividend Payment Common Stock x 10% 4-1 Purchase Inventory for $5,000 cash 4-2 Sales & Service Revenue Service Revenue $59,200 Sales Rev $8,000; COGS $4,000 4-3 Debt Repayment @ 1/1/yr4 1/4 of Original Note 44 Expenses Total Operating Exp. $24,000 Depreciation Exp. = equip.cost x1/5 Interest Expense = Note Pay.yr. end balance x 896 4-5 Dividend Payment Common Stock x 10% Year 4 Big Picture Project 2003 2021 Proforma Statements for Bert's Bikes Year 1 Year 2 Year 3 Income Statement Service Revenue Sales Revenue Total Revenue Cost of Goods Sold Operating Expenses Depreciation Expense Interest Expense Total Expense 0 Net Income 0 0 0 0 0 0 0 Statement of Stockholders Equity 0 0 0 Beginning Common Stock Plus Common Stock Issued Ending Common Stock Beginning Retained Earnings + Net Income - Dividends Ending Retained Earnings Total Stockholders Equity 0 0 0 0 0 0 lolo Olo 0 0 Balance Sheet 0 0 0 Assets Cash Inventory Equipment Accumulated Depreciation Total Assets Liabilities Notes Payable Total Liabilities Stockholders Equity Common Stock Retained Earings Total Stockholders Equity Total Liabilities & SE 0 0 0 0 0 0 0 0 0 0 0 Statement of Cash Flows Net Cashflow from Operating Net Cashflow from Investing Net Cashflow from Financing Net Change in Cash Beginning Cash Balance Ending Cash Balance 0 0 0 0 0