Question

Bertie Company provided the following information at the end of the previous year: Preference share capital, 200 per value, 2500 shares 500,000 Share premium -

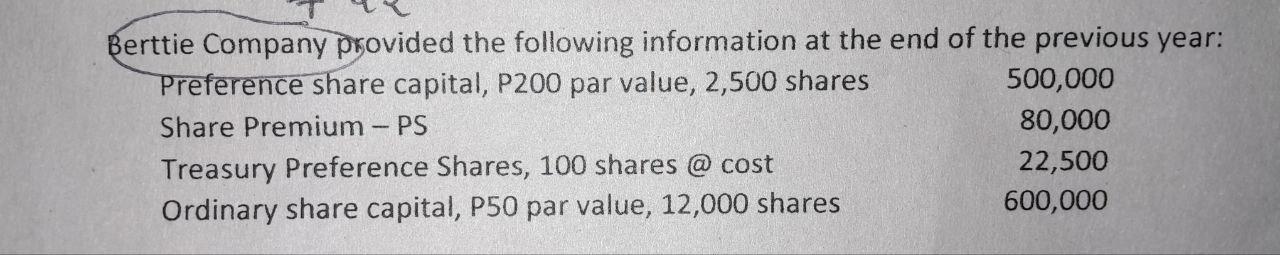

Bertie Company provided the following information at the end of the previous year:

Preference share capital, 200 per value, 2500 shares 500,000

Share premium - PS, 80,000 Treasury preference shares, 100 shares at cost 22,500

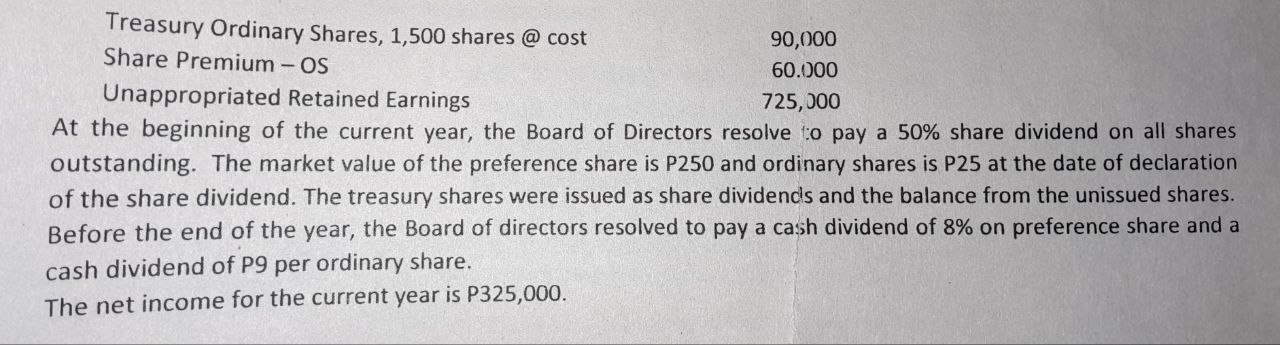

Ordinary share capital, 50 peso per value, 12,000 shares 600,000 Treasury ordinary shares, 1,500 shares at cost 90,000

Share premium ordinary shares, 60,000

Unappropriate return earnings, 725,000

At the beginning of the current year, the Board of Directors resolved to pay a 50% share dividend on all shares outstanding. The market value of the preference share is 250 and ordinary shares is 25 at the date of declaration of the share dividend. The treasury shares were issued at share dividends in the balance from the unissued shares. Before the end of the year, the Board of Directors resolved to pay a cash dividend of 8% on preference share and a cash dividend of 9 per ordinary share. The net income for the current year is 335,000.

1. What is the shareholders' equity as of the end of the previous year?

2. What is the entry on the declaration of 50% share dividend?

3. What is the entry on the issuance of 50% share dividend?

4. What is the entry on the declaration of the cash dividend?

5.What is the balance of the unappropriated earnings at the end of the current year?

6. What is the shareholder's equity as of the end of the current year?

Berttie Company provided the following information at the end of the previous year: Preference share capital, P200 par value, 2,500 shares Share Premium - PS Treasury Preference Shares, 100 shares @ cost Ordinary share capital, P50 par value, 12,000 shares 500,000 80,000 22,500 600,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started