Answered step by step

Verified Expert Solution

Question

1 Approved Answer

RJ's Chrome Rim Corporation is debating whether to acquire an asset through an operating lease arrangement or to borrow funds and purchase the asset.

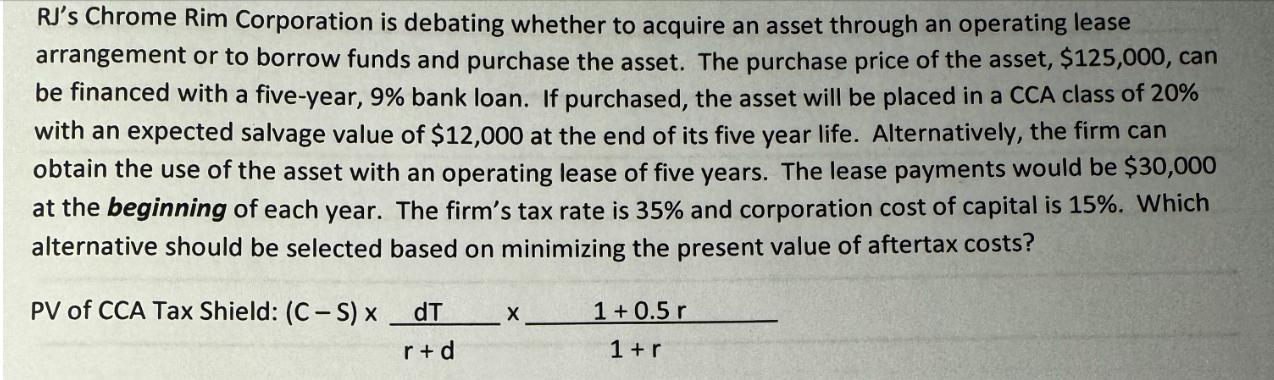

RJ's Chrome Rim Corporation is debating whether to acquire an asset through an operating lease arrangement or to borrow funds and purchase the asset. The purchase price of the asset, $125,000, can be financed with a five-year, 9% bank loan. If purchased, the asset will be placed in a CCA class of 20% with an expected salvage value of $12,000 at the end of its five year life. Alternatively, the firm can obtain the use of the asset with an operating lease of five years. The lease payments would be $30,000 at the beginning of each year. The firm's tax rate is 35% and corporation cost of capital is 15%. Which alternative should be selected based on minimizing the present value of aftertax costs? PV of CCA Tax Shield: (C-S) x dT X r+d 1+0.5 r 1+r

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started