Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Besides historical financial performance as reported in the financial statements of RHB Bank Berhad and UMW Holdings Berhad, what else would you take into consideration

Besides historical financial performance as reported in the financial statements of RHB Bank Berhad and UMW Holdings Berhad, what else would you take into consideration in making the investment decision?

The financial performance data is attached below as reference, if needed.

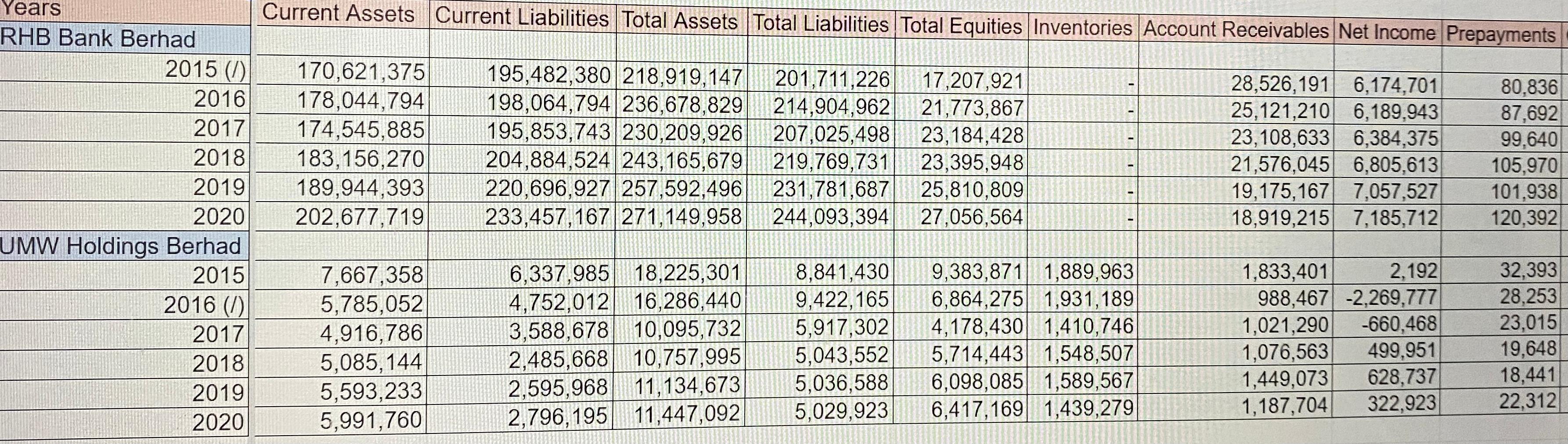

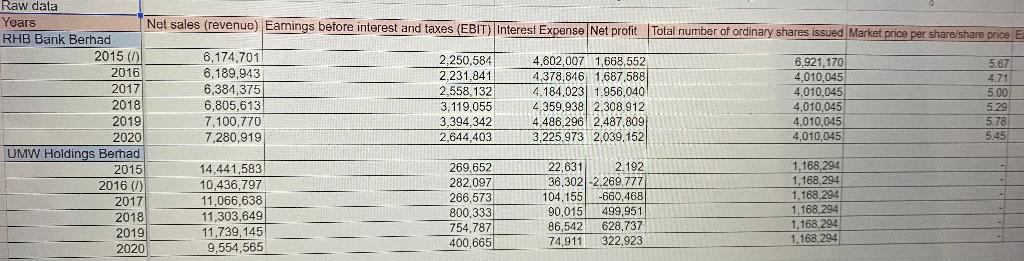

This is the raw data of both companies :-

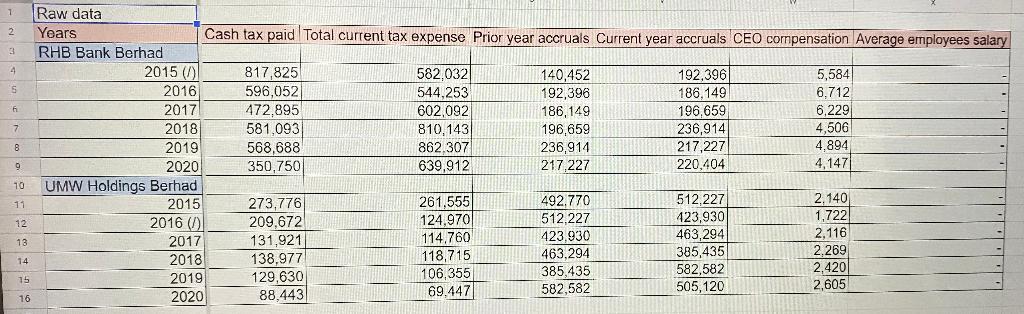

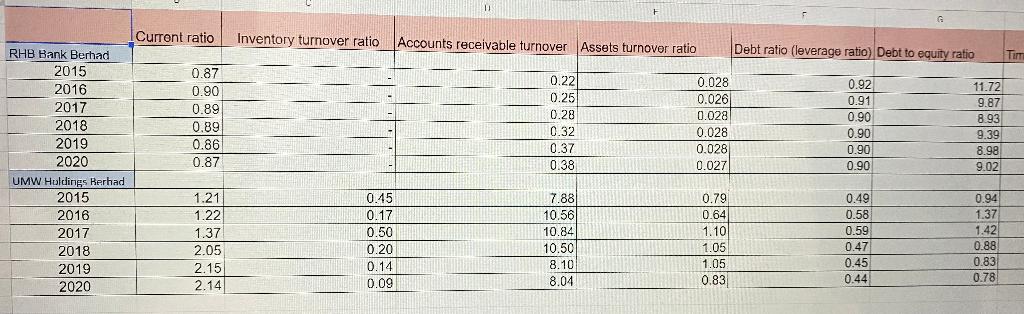

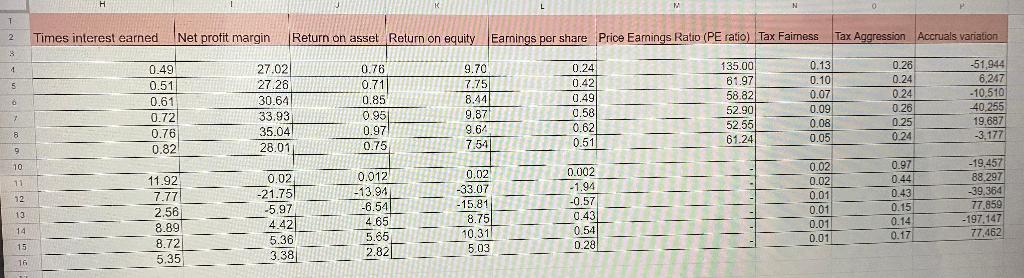

This is the ratio anaylsis of both companies :-

Current Assets Current Liabilities Total Assets Total Liabilities Total Equities Inventories Account Receivables Net Income Prepayments - - 170,621,375 178,044,794 174,545,885 183,156,270 189,944,393 202,677,719 195,482,380218,919,147 COM 198,064,794236,678,829 FORD 195,853,743 230,209,926 204,884,524 243,165,679 240 220,000, 257,592,496 233,457,167\271,149,958 on Years RHB Bank Berhad 2015 (1) 2016 2017 2018 2019 2020 UMW Holdings Berhad 2015 2016 (6) 2017 2018 2019 2020 201,711,226 214,904,962 17 207,025,498 219,769,731 2016 231,781,687 244,093,394 17,207,921 21,773,867 23,184,428 23,395,948 25,810,809 27,056,564 28,526,191 6,174,701 25,121,210 6,189,943 23,108,633 6,384,375 21,576,045 6,805,613 19,175,167) 7,057,527 18,919,215 7,185,712 80,836 87,692 99,640 105,970 101,938 120,392 - - HI 7,667,358 5,785,052 4,916,786 5,085,144 5,593,233 5,991,760 6,337,985 18,225,301 4,752,012 16,286,440 -- 3,588,678 10,095,732 Mor 21 2,485,668 10,757,995 OC 2,595,968 11,134,673 2,796,195 11,447,092 8,841,430 9,422,165 5,917,302 wie 5,043,552 5,036,588 5,029,923 9,383,871 1,889,963 6,864,275 1,931,189 4,178,430 1,410,746 5,714,443 1,548,507 6,098,085 1,589,567 6,417,169 1,439,279 1,833,401 2,192 988,467 -2,269,777 1,021,290 -660,468 1,076,563 499,951 1,449,073 628.737 1,187,704 322.923 32,393 28,253 23,015 19,648 18,441 22,312 Raw data Years RHB Bank Berhad 2015 (6 Net sales (revenue) Eamings before interest and taxes (EBIT) Interest Expense Net profit Total number of ordinary shares issued Market price per share/share price 2016 2017 2018 2019 300 2020 UMW Holdings Berhad Berhed 2015 6,174,701 6.189.943 6,384,375 6,805,613 7,100,770 7.280,919 2.250,584 2.231.841 2,558,132 3.119,055 3,394 342 2,644,403 4,602,007 1,668,552 4,378,846 1.687,588 4,184,023 1.956,040 4359,938 2,308,912 4.486,296 2,487, 809 3,225.973 2,039,152 6,921,170 4,010,045 4,010,045 4,010,045 4,010,045 4,010,045 5.67 4.71 5.00 5.29 5.78 5.45 2016 2017 2018 2019 2020 14,441,583 10,436,797 11,066,638 11,303,649 11,739,145 9,554,565 269.652 282,097 266,573 800,333 754,787 400,665 22,631 2.192 36,302 -2.269.7771 104,155 -660,468 90,015 499,951 86,542 628.737 74,911 322,923 1,168,294 1.168.294 1.168.294 1,168,294 1.168.294 1.168.294 3 4 6 fi 7 8 1 1 Raw data 2 2 Years Cash tax paid Total current tax expense Prior year accruals Current year accruals CEO compensation Average employees salary RHB Bank Berhad 2015 (6) 817,825 582,032 140,452 192,396 5,584 2016 596,052 544,253 192,396 186,149 6.712 2017 472.895 602,092 186,149 196.659 6,229 2018 581,093 810,143 196,659 236,914 4,506 2019 568,688 862,307 236,914 217,227 4,894 9 2020 350,750 639,912 217,227 220,404 4,147 10 UMW Holdings Berhad 2015 273,776 261,555) 492,770 512,227 2,140 2016 (/) 209.672 124.970 512,227 423,930 1.722 2017 13 131,921 2,116 114.760 423.930 463,294 2018 2.269 138,977 463.294 118,715 385,435 385,435 2,420 582,582 106,355 2019 129,630 505,120 2,605 2020 582,582 69.447 88,443 9 11 12 14 15 16 F Current ratio Inventory turnover ratio Accounts receivable turnover Assets turnover ratio Debt ratio (leverage ratio) Debt to equity ratio TENT RHB Bank Berhad 2015 2016 2017 2018 2019 2020 UMW Huldings Berhad 2015 2016 0.87 0.90 0.89 0.89 0.86 0.87 0.22 0.25 0.28 0.32 0.37 0.38 0.028 0.026 0.028 0.028 0.028 0.027 0.92 0.91 0.90 0.90 0.90 0.90 11.72 9.87 8.93 9.39 8.98 9.02 7.88 10.56 10.84 2017 1.21 1.22 1.37 2.05 2.15 2.14 0.15 0.17 0.50 0.20 0.14 0.09 0.79 0.64 1.10 1.05 1.05 0.83 0.49 0.58 0.59 0.47 0.45 0.44 0.94 1.37 1.42 0.88 0.83 0.78 10.50 2018 2019 2020 8.10 8.04 H L N 0 T 2 Times interest earned Net profit margin Return on asset Return on equity Earnings per share Price Earnings Ratio (PE ratio) Tax Faimess Tax Aggression Accruals variation 3 135.00 4 61.97 5 6 0.49 0.51 0.61 0.72 0.76 0.82 27.02 27.26 30.64 33.93 35.04 28.01 0.76 0.71 0.85 0.95 0.97 0.75 9.70 7.75 8.441 9.87 9.64 7.54 0.24 0.42 0.49 0.58 0.62 0.51 0.13 0.10 0.07 0.09 0.08 0.05 58.82 52.90 52.55 61.24 0.26 0.24 0.24 0.26 0.25 0.24 -51,944 6,247 -10,510 -40.255 19,687 -3.177 7 8 9 10 11 0.02 -21.757 12 11.92 7.77 2.56 8.89 8.72 5.35 0.012 -13.94 -6.54 4.65 5.65 2.82 0.02 -33.07 -15.81 8.75 10.31 0.002 -1.94 -0.57 0.43 0.54 0.28 0.02 0.02 0.01 0.01 0.01 0.01 0.97 0.44 0.43 0.15 0.14 0.17 -5.97 4.42 5.36 3.38 13 -19,457 88,297 -39,364 77,859 -197,147 77,462 14 15 5.03 16 Current Assets Current Liabilities Total Assets Total Liabilities Total Equities Inventories Account Receivables Net Income Prepayments - - 170,621,375 178,044,794 174,545,885 183,156,270 189,944,393 202,677,719 195,482,380218,919,147 COM 198,064,794236,678,829 FORD 195,853,743 230,209,926 204,884,524 243,165,679 240 220,000, 257,592,496 233,457,167\271,149,958 on Years RHB Bank Berhad 2015 (1) 2016 2017 2018 2019 2020 UMW Holdings Berhad 2015 2016 (6) 2017 2018 2019 2020 201,711,226 214,904,962 17 207,025,498 219,769,731 2016 231,781,687 244,093,394 17,207,921 21,773,867 23,184,428 23,395,948 25,810,809 27,056,564 28,526,191 6,174,701 25,121,210 6,189,943 23,108,633 6,384,375 21,576,045 6,805,613 19,175,167) 7,057,527 18,919,215 7,185,712 80,836 87,692 99,640 105,970 101,938 120,392 - - HI 7,667,358 5,785,052 4,916,786 5,085,144 5,593,233 5,991,760 6,337,985 18,225,301 4,752,012 16,286,440 -- 3,588,678 10,095,732 Mor 21 2,485,668 10,757,995 OC 2,595,968 11,134,673 2,796,195 11,447,092 8,841,430 9,422,165 5,917,302 wie 5,043,552 5,036,588 5,029,923 9,383,871 1,889,963 6,864,275 1,931,189 4,178,430 1,410,746 5,714,443 1,548,507 6,098,085 1,589,567 6,417,169 1,439,279 1,833,401 2,192 988,467 -2,269,777 1,021,290 -660,468 1,076,563 499,951 1,449,073 628.737 1,187,704 322.923 32,393 28,253 23,015 19,648 18,441 22,312 Raw data Years RHB Bank Berhad 2015 (6 Net sales (revenue) Eamings before interest and taxes (EBIT) Interest Expense Net profit Total number of ordinary shares issued Market price per share/share price 2016 2017 2018 2019 300 2020 UMW Holdings Berhad Berhed 2015 6,174,701 6.189.943 6,384,375 6,805,613 7,100,770 7.280,919 2.250,584 2.231.841 2,558,132 3.119,055 3,394 342 2,644,403 4,602,007 1,668,552 4,378,846 1.687,588 4,184,023 1.956,040 4359,938 2,308,912 4.486,296 2,487, 809 3,225.973 2,039,152 6,921,170 4,010,045 4,010,045 4,010,045 4,010,045 4,010,045 5.67 4.71 5.00 5.29 5.78 5.45 2016 2017 2018 2019 2020 14,441,583 10,436,797 11,066,638 11,303,649 11,739,145 9,554,565 269.652 282,097 266,573 800,333 754,787 400,665 22,631 2.192 36,302 -2.269.7771 104,155 -660,468 90,015 499,951 86,542 628.737 74,911 322,923 1,168,294 1.168.294 1.168.294 1,168,294 1.168.294 1.168.294 3 4 6 fi 7 8 1 1 Raw data 2 2 Years Cash tax paid Total current tax expense Prior year accruals Current year accruals CEO compensation Average employees salary RHB Bank Berhad 2015 (6) 817,825 582,032 140,452 192,396 5,584 2016 596,052 544,253 192,396 186,149 6.712 2017 472.895 602,092 186,149 196.659 6,229 2018 581,093 810,143 196,659 236,914 4,506 2019 568,688 862,307 236,914 217,227 4,894 9 2020 350,750 639,912 217,227 220,404 4,147 10 UMW Holdings Berhad 2015 273,776 261,555) 492,770 512,227 2,140 2016 (/) 209.672 124.970 512,227 423,930 1.722 2017 13 131,921 2,116 114.760 423.930 463,294 2018 2.269 138,977 463.294 118,715 385,435 385,435 2,420 582,582 106,355 2019 129,630 505,120 2,605 2020 582,582 69.447 88,443 9 11 12 14 15 16 F Current ratio Inventory turnover ratio Accounts receivable turnover Assets turnover ratio Debt ratio (leverage ratio) Debt to equity ratio TENT RHB Bank Berhad 2015 2016 2017 2018 2019 2020 UMW Huldings Berhad 2015 2016 0.87 0.90 0.89 0.89 0.86 0.87 0.22 0.25 0.28 0.32 0.37 0.38 0.028 0.026 0.028 0.028 0.028 0.027 0.92 0.91 0.90 0.90 0.90 0.90 11.72 9.87 8.93 9.39 8.98 9.02 7.88 10.56 10.84 2017 1.21 1.22 1.37 2.05 2.15 2.14 0.15 0.17 0.50 0.20 0.14 0.09 0.79 0.64 1.10 1.05 1.05 0.83 0.49 0.58 0.59 0.47 0.45 0.44 0.94 1.37 1.42 0.88 0.83 0.78 10.50 2018 2019 2020 8.10 8.04 H L N 0 T 2 Times interest earned Net profit margin Return on asset Return on equity Earnings per share Price Earnings Ratio (PE ratio) Tax Faimess Tax Aggression Accruals variation 3 135.00 4 61.97 5 6 0.49 0.51 0.61 0.72 0.76 0.82 27.02 27.26 30.64 33.93 35.04 28.01 0.76 0.71 0.85 0.95 0.97 0.75 9.70 7.75 8.441 9.87 9.64 7.54 0.24 0.42 0.49 0.58 0.62 0.51 0.13 0.10 0.07 0.09 0.08 0.05 58.82 52.90 52.55 61.24 0.26 0.24 0.24 0.26 0.25 0.24 -51,944 6,247 -10,510 -40.255 19,687 -3.177 7 8 9 10 11 0.02 -21.757 12 11.92 7.77 2.56 8.89 8.72 5.35 0.012 -13.94 -6.54 4.65 5.65 2.82 0.02 -33.07 -15.81 8.75 10.31 0.002 -1.94 -0.57 0.43 0.54 0.28 0.02 0.02 0.01 0.01 0.01 0.01 0.97 0.44 0.43 0.15 0.14 0.17 -5.97 4.42 5.36 3.38 13 -19,457 88,297 -39,364 77,859 -197,147 77,462 14 15 5.03 16

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started