Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Best Baseball, Inc. is a retailer of sporting goods. The company uses a perpetual inventory system, records purchases at net cost, and records sales revenue

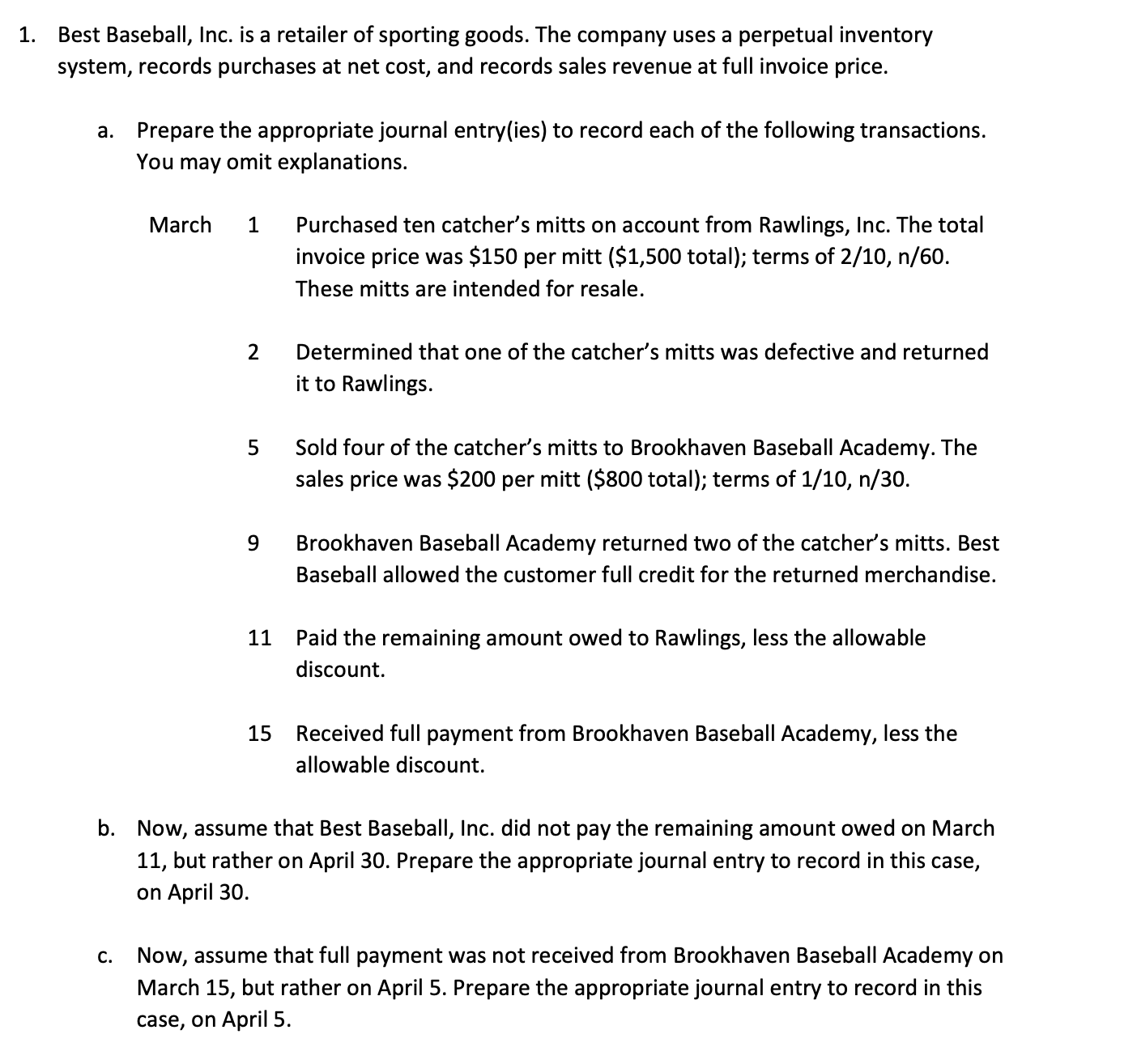

Best Baseball, Inc. is a retailer of sporting goods. The company uses a perpetual inventory

system, records purchases at net cost, and records sales revenue at full invoice price.

a Prepare the appropriate journal entryies to record each of the following transactions.

You may omit explanations.

March Purchased ten catcher's mitts on account from Rawlings, Inc. The total

invoice price was $ per mitt total; terms of

These mitts are intended for resale.

Determined that one of the catcher's mitts was defective and returned

it to Rawlings.

Sold four of the catcher's mitts to Brookhaven Baseball Academy. The

sales price was $ per mitt $ total; terms of

Brookhaven Baseball Academy returned two of the catcher's mitts. Best

Baseball allowed the customer full credit for the returned merchandise.

Paid the remaining amount owed to Rawlings, less the allowable

discount.

Received full payment from Brookhaven Baseball Academy, less the

allowable discount.

b Now, assume that Best Baseball, Inc. did not pay the remaining amount owed on March

but rather on April Prepare the appropriate journal entry to record in this case,

on April

c Now, assume that full payment was not received from Brookhaven Baseball Academy on

March but rather on April Prepare the appropriate journal entry to record in this

case, on April

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started