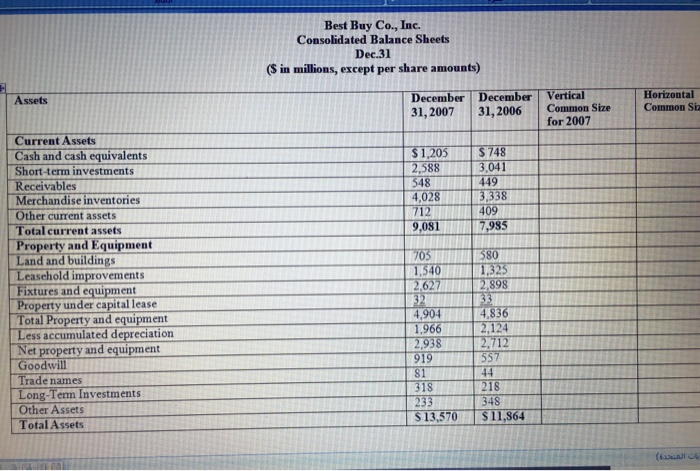

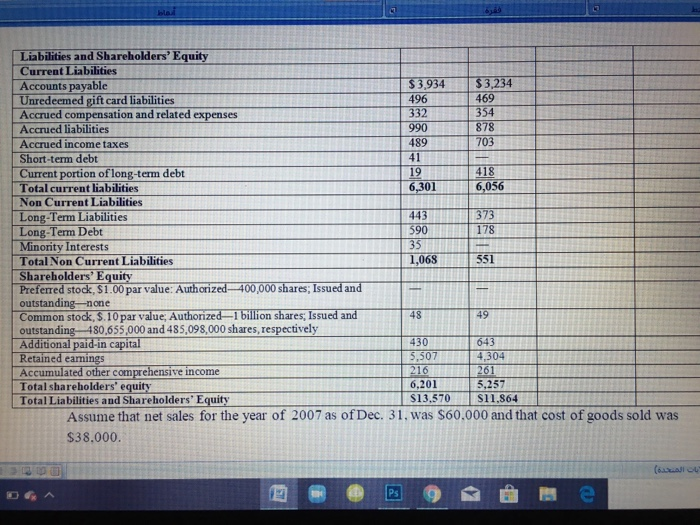

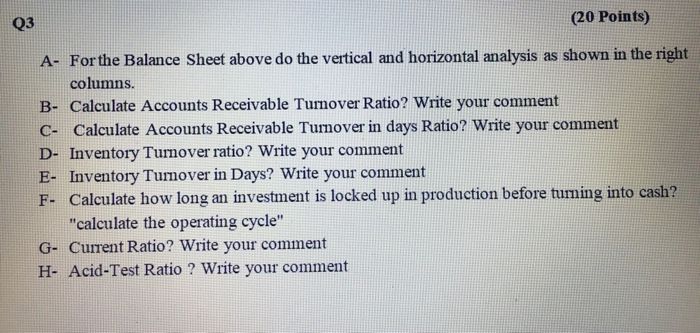

Best Buy Co., Inc. Consolidated Balance Sheets Dec.31 ($ in millions, except per share amounts) Assets December December 31, 2007 31, 2006 Vertical Common Size for 2007 Horizontal Common St $ 1,205 2,588 548 4,028 $ 748 3,041 449 3,338 409 7,985 712 9,081 Current Assets Cash and cash equivalents Short-term investments Receivables Merchandise inventories Other current assets Total current assets Property and Equipment Land and buildings Leasehold improvements Fixtures and equipment Property under capital lease Total Property and equipment Less accumulated depreciation Net property and equipment Goodwill Trade names Long-Tenn Investments Other Assets Total Assets 580 1,325 2,898 33 705 1,540 2,627 32 4,904 1.966 2.938 919 81 318 233 $ 13,570 4,836 2,124 2,712 557 44 218 348 S11,864 Liabilities and Shareholders' Equity Current Liabilities Accounts payable $ 3,934 $3,234 Unredeemed gift card liabilities 496 469 Accried compensation and related expenses 332 354 Accrued liabilities 990 878 Accrued income taxes 489 703 Short-term debt 41 Current portion of long-term debt 19 418 Total current liabilities 6,301 6,056 Non Current Liabilities Long-Term Liabilities 443 373 Long-Term Debt 590 178 Minority Interests 35 Total Non Current Liabilities 1,068 551 Shareholders' Equity Preferred stock, $1.00 par value: Authorized 400,000 shares, Issued and outstanding-none Common stock, $.10 par value; Authorized-1 billion shares: Issued and 48 49 outstanding 480,655,000 and 485,098,000 shares, respectively Additional paid-in capital 430 643 Retained earings 5.507 4,304 Accumulated other comprehensive income 216 261 Total shareholders' equity 6,201 5,257 Total Liabilities and Shareholders' Equity $13.570 $11,864 Assume that net sales for the year of 2007 as of Dec. 31. was $60.000 and that cost of goods sold was $38.000 ) ET Ps Q3 (20 Points) A- For the Balance Sheet above do the vertical and horizontal analysis as shown in the right columns. B- Calculate Accounts Receivable Turnover Ratio? Write your comment C- Calculate Accounts Receivable Turnover in days Ratio? Write your comment D- Inventory Tumover ratio? Write your comment E- Inventory Turnover in Days? Write your comment F- Calculate how long an investment is locked up in production before turning into cash? "calculate the operating cycle" G- Current Ratio? Write your comment H- Acid-Test Ratio ? Write your comment