Answered step by step

Verified Expert Solution

Question

1 Approved Answer

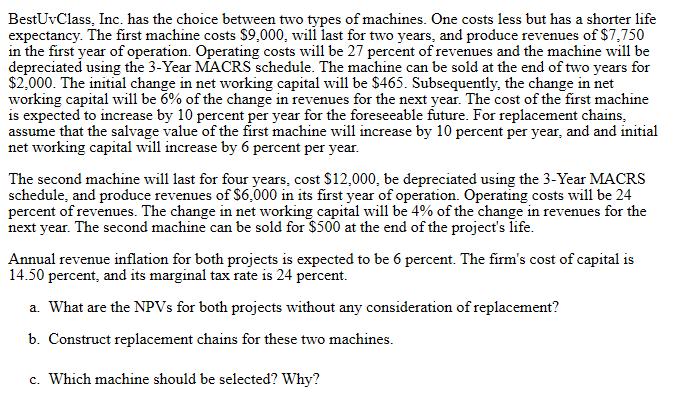

BestUvClass, Inc. has the choice between two types of machines. One costs less but has a shorter life expectancy. The first machine costs $9,000,

BestUvClass, Inc. has the choice between two types of machines. One costs less but has a shorter life expectancy. The first machine costs $9,000, will last for two years, and produce revenues of $7,750 in the first year of operation. Operating costs will be 27 percent of revenues and the machine will be depreciated using the 3-Year MACRS schedule. The machine can be sold at the end of two years for $2,000. The initial change in net working capital will be $465. Subsequently, the change in net working capital will be 6% of the change in revenues for the next year. The cost of the first machine is expected to increase by 10 percent per year for the foreseeable future. For replacement chains, assume that the salvage value of the first machine will increase by 10 percent per year, and and initial net working capital will increase by 6 percent per year. The second machine will last for four years, cost S12,000, be depreciated using the 3-Year MACRS schedule, and produce revenues of S6,000 in its first year of operation. Operating costs will be 24 percent of revenues. The change in net working capital will be 4% of the change in revenues for the next year. The second machine can be sold for $500 at the end of the project's life. Annual revenue inflation for both projects is expected to be 6 percent. The firm's cost of capital is 14.50 percent, and its marginal tax rate is 24 percent. a. What are the NPVS for both projects without any consideration of replacement? b. Construct replacement chains for these two machines. c. Which machine should be selected? Why?

Step by Step Solution

★★★★★

3.36 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Based on the given data find below workings Have co...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started