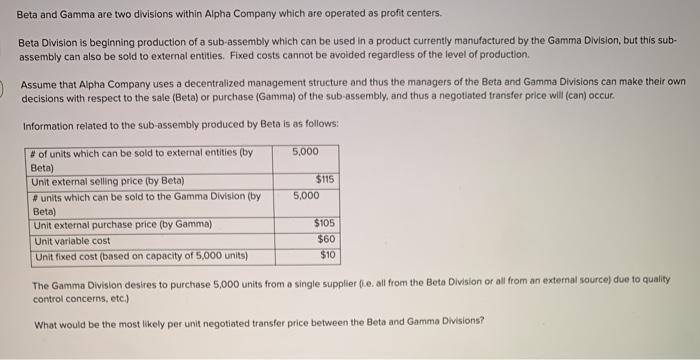

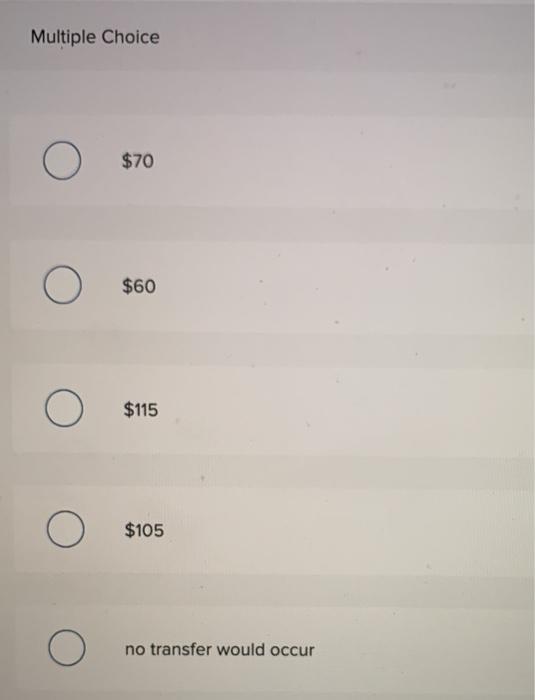

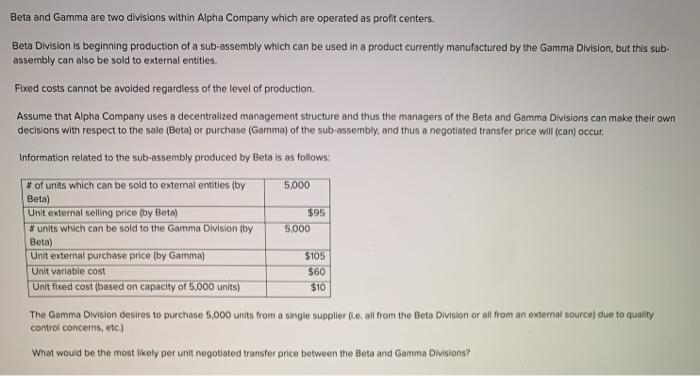

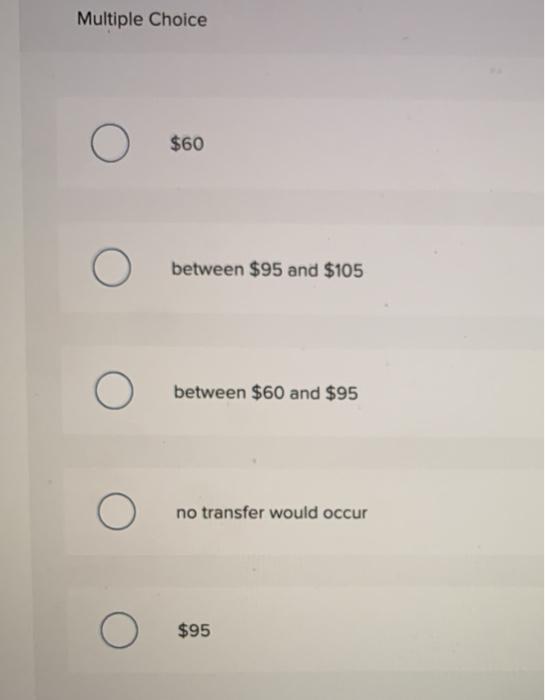

Beta and Gamma are two divisions within Alpha Company which are operated as profit centers. Beta Division is beginning production of a sub-assembly which can be used in a product currently manufactured by the Gamma Division, but this sub- assembly can also be sold to external entities. Fixed costs cannot be avoided regardless of the level of production Assume that Alpha Company uses a decentralized management structure and thus the managers of the Beta and Gamma Divisions can make their own decisions with respect to the sale (Beta) or purchase (Gamma) of the subassembly, and thus a negotiated transfer price will (can) occur. Information related to the sub-assembly produced by Beta is as follows: # of units which can be sold to external entities (by 5,000 Beta) Unit external selling price (by Beta) # units which can be sold to the Gamma Division (by 5.000 Beta) Unit external purchase price (by Gamma) $105 Unit variable cost $60 Unit fixed cost (based on capacity of 5,000 units) $10 $115 The Gamma Division desires to purchase 5,000 units from a single supplier le all from the Beta Division or all from an external source) due to quality control concerns, etc.) What would be the most likely per unit negotiated transfer price between the Beta and Gamma Divisions? Multiple Choice O $70 O $60 O $115 $105 O no transfer would occur Beta and Gamma are two divisions within Alpha Company which are operated as profit centers. Beta Division is beginning production of a sub-assembly which can be used in a product currently manufactured by the Gamma Division, but this sub- assembly can also be sold to external entities. Fixed costs cannot be avoided regardless of the level of production Assume that Alpha Company uses a decentralized management structure and thus the managers of the Beta and Gamma Divisions can make their own decisions with respect to the sale (Beta) or purchase (Gamma) of the sub-assembly, and thus a negotiated transfer price will (can) occur. Information related to the sub-assembly produced by Beto is as follows: # of units which can be sold to external entities (by 5.000 Beta) Unit external selling price (by Beta) $95 #units which can be sold to the Gamma Division (by 5,000 Beta) Unit external purchase price (by Gamma) Unit variable cost Unit fixed cost (based on capacity of 5,000 units) The Gamma Division desires to purchase 5,000 units from a single supplier (.call from the Beto Division or all from an external sources due to quality control concerns, etc) What would be the most likely per unit negotiated transfer price between the Beta and Gamma Divisions? $105 $60 $10 Multiple Choice O $60 O between $95 and $105 between $60 and $95 O no transfer would occur O $95