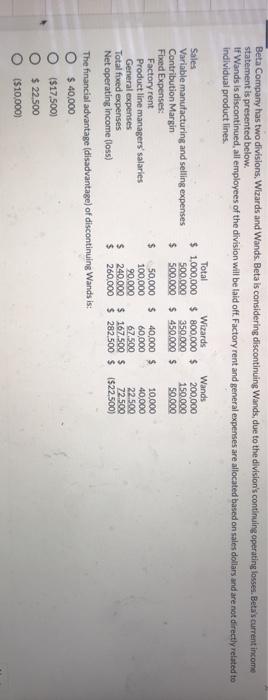

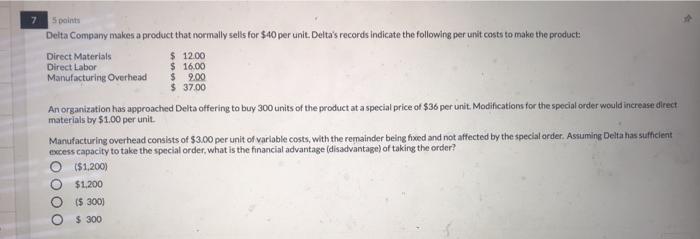

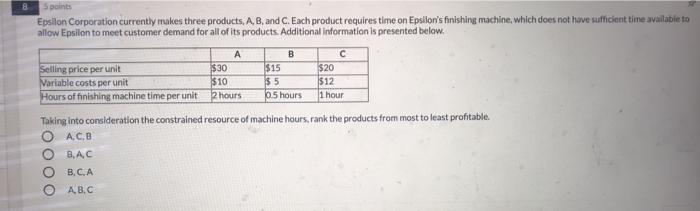

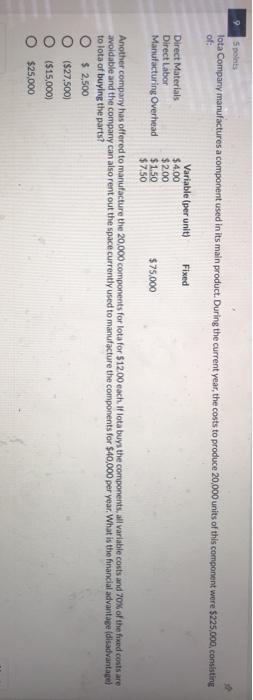

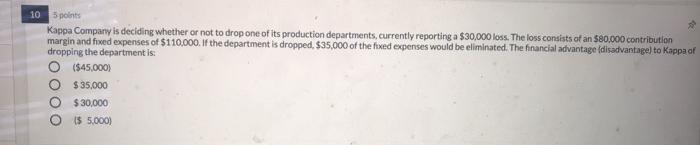

Beta Company has two divisions, Wizards and Wands. Beta is considering discontinuing Wands, due to the division's continuing operating fosses. Beta's current income statement is presented below. If Wands is discontinued, all employees of the division will be laid off. Factory rent and general expenses are allocated based on sales dollars and are not directly related to individual product lines. Total Wizards Wands Sales $ 1,000,000 $ 800,000 $ 200.000 Variable manufacturing and selling expenses 500.000 350.000 150.000 Contribution Margin $ 500.000 $450,000 $ 50.000 Fixed Expenses: Factory rent $ 50,000 $ 40,000 $ 10,000 Product line managers salaries 100,000 60,000 40,000 General expenses 67.500 22.500 Total fixed expenses $ 240.000 $167.500 $ 72.500 Net operating income (loss) $ 260,000 $282,500 $ 522,500) The financial advantage (disadvantage) of discontinuing Wands is: O $ 40,000 ($17.500) $ 22.500 ($10,000) 20.000 5 points Delta Company makes a product that normally sells for $40 per unit. Delta's records indicate the following per unit costs to make the product: Direct Materials $ 12.00 Direct Labor $ 16.00 Manufacturing Overhead $ 0.00 $ 37.00 An organization has approached Delta offering to buy 300 units of the product at a special price of $36 per unit, Modifications for the special order would increase direct materials by $1.00 per unit. Manufacturing overhead consists of $3.00 per unit of variable costs, with the remainder being fixed and not affected by the special order. Assuming Delta has sufficient excess capacity to take the special order, what is the financial advantage (disadvantage of taking the order? O ($1.2001 $1,200 (5 300) $ 300 8 Spoints Epsilon Corporation currently makes three products, A. B. and C. Each product requires time on Epsilon's finishing machine, which does not have sufficient time available to nilow Epsilon to meet customer demand for all of its products. Additional information is presented below. A B Selling price per unit $30 $15 $20 Variable costs per unit $10 55 $12 Hours of finishing machine time per unit 2 hours 0.5 hours 1 hour Taking into consideration the constrained resource of machine hours, rank the products from most to least profitable. A.C.B BAC B.C.A , Spolets lota Company manufactures a component used in its main product. During the current year, the costs to produce 20,000 units of this component were $225,000, consisting of: Variable (per unit) Fixed Direct Materials $4.00 Direct Labor $2.00 Manufacturing Overhead $1.50 $75,000 $7.50 Another company has offered to manufacture the 20,000 components for lota for $12.00 each. If lota buys the components, all variable costs and 70% of the fixed costs are avoidable and the company can also rent out the space currently used to manufacture the components for $40,000 per year. What is the financial advantage disadvantage to lota of buying the parts? O $2,500 ($27,500) ($15,000) $25,000 OOOO 10 points Kappa Company is deciding whether or not to drop one of its production departments, currently reporting a $30,000 loss. The loss consists of an $80.000 contribution margin and fed expenses of $110,000. If the department is dropped. $35,000 of the fixed expenses would be eliminated. The financial advantage disadvantage) to Kappa of dropping the department is O ($45,000) O $35,000 $ 30,000 15 5.000)