Answered step by step

Verified Expert Solution

Question

1 Approved Answer

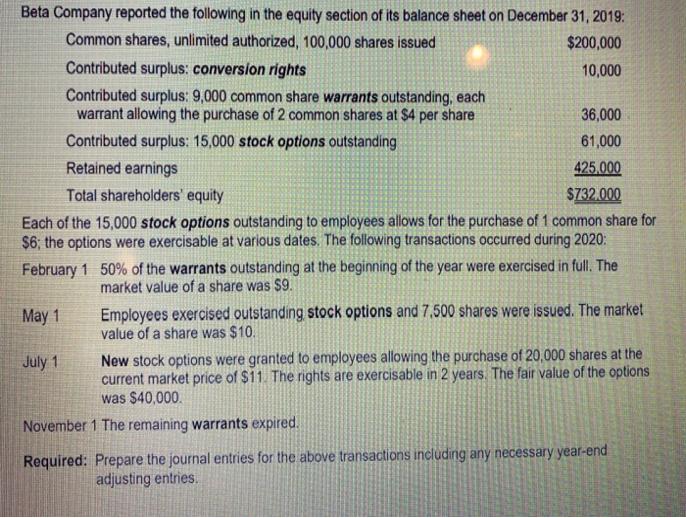

Beta Company reported the following in the equity section of its balance sheet on December 31, 2019: Common shares, unlimited authorized, 100,000 shares issued

Beta Company reported the following in the equity section of its balance sheet on December 31, 2019: Common shares, unlimited authorized, 100,000 shares issued $200,000 Contributed surplus: conversion rights 10,000 Contributed surplus: 9,000 common share warrants outstanding, each warrant allowing the purchase of 2 common shares at $4 per share 36,000 Contributed surplus: 15,000 stock options outstanding 61,000 Retained earnings 425,000 Total shareholders' equity $732.000 Each of the 15,000 stock options outstanding to employees allows for the purchase of 1 common share for $6; the options were exercisable at various dates. The following transactions occurred during 2020: February 1 50% of the warrants outstanding at the beginning of the year were exercised in full. The market value of a share was $9. May 1 July 1 Employees exercised outstanding stock options and 7,500 shares were issued. The market value of a share was $10. New stock options were granted to employees allowing the purchase of 20,000 shares at the current market price of $11. The rights are exercisable in 2 years. The fair value of the options was $40,000. November 1 The remaining warrants expired. Required: Prepare the journal entries for the above transactions including any necessary year-end adjusting entries.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Beta Company General Journal For the Year Ended December 31 2020 Date Account Titles Debit ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

66428120ab1ec_979689.pdf

180 KBs PDF File

66428120ab1ec_979689.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started