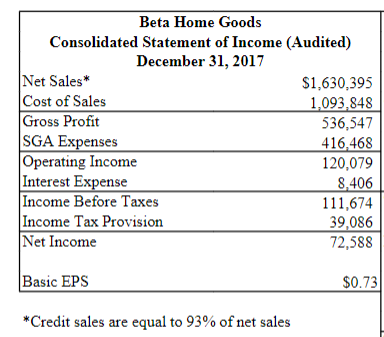

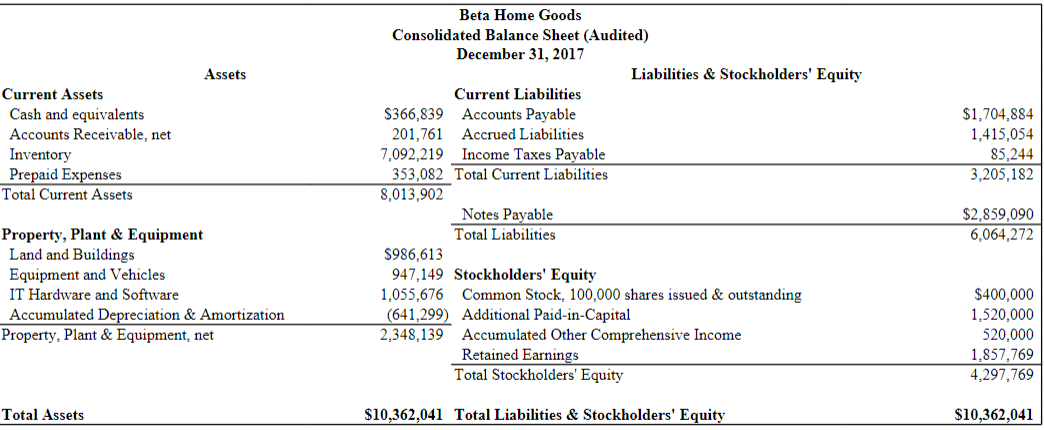

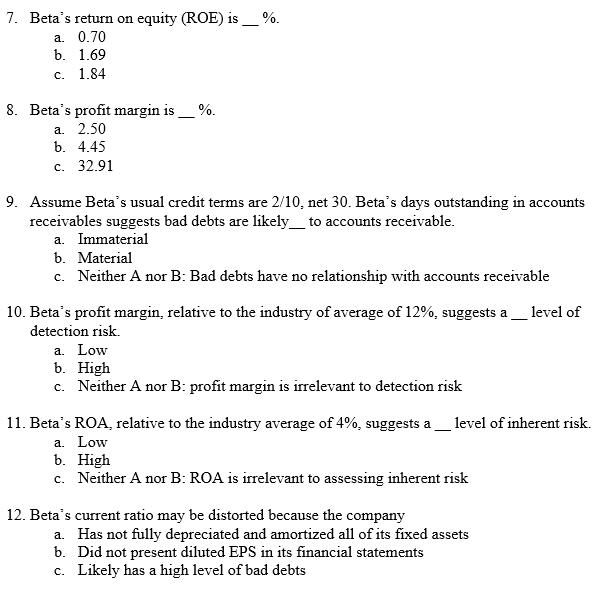

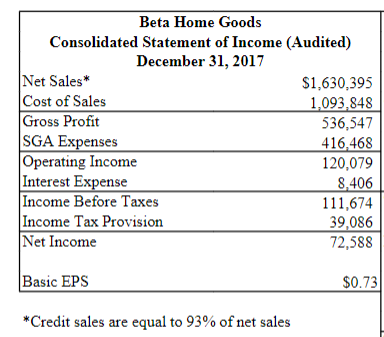

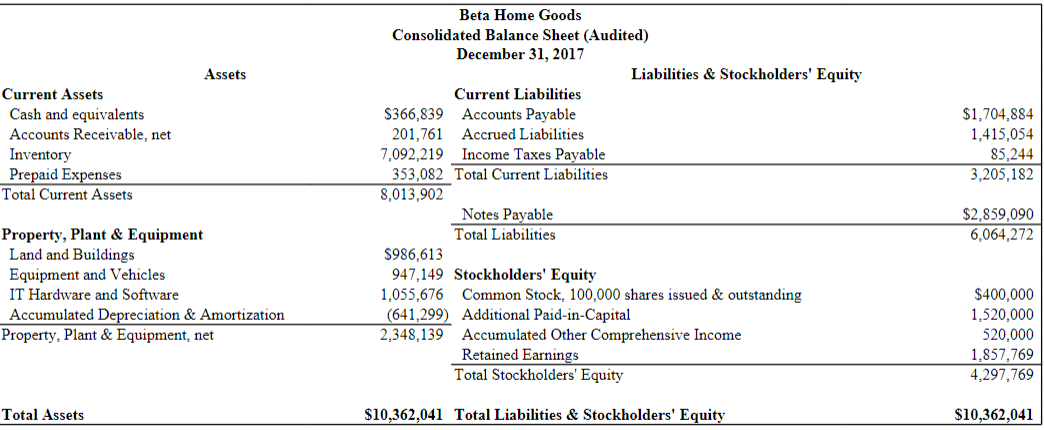

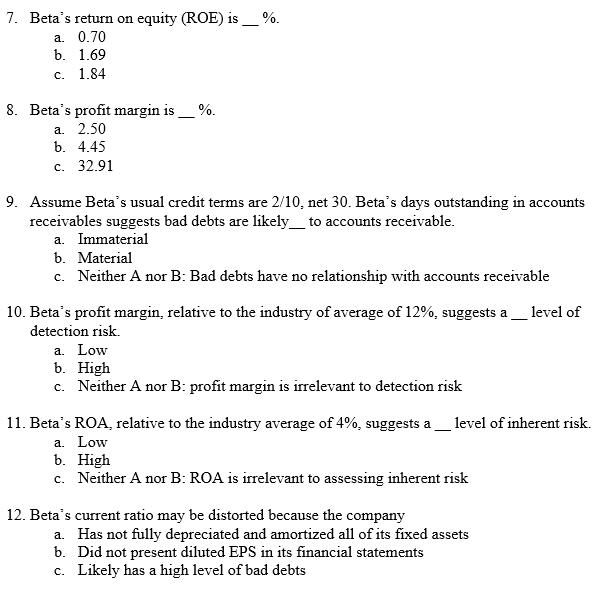

Beta Home Goods Consolidated Statement of Income (Audited) December 31, 2017 Net Sales* $1,630,395 Cost of Sales 1,093,848 Gross Profit 536,547 SGA Expenses 416,468 Operating Income 120,079 Interest Expense 8.406 Income Before Taxes 111,674 Income Tax Provision 39,086 Net Income 72,588 Basic EPS $0.73 *Credit sales are equal to 93% of net sales Assets Current Assets Cash and equivalents Accounts Receivable, net Inventory Prepaid Expenses Total Current Assets $1,704,884 1,415,054 85,244 3,205,182 Beta Home Goods Consolidated Balance Sheet (Audited) December 31, 2017 Liabilities & Stockholders' Equity Current Liabilities $366,839 Accounts Payable 201,761 Accrued Liabilities 7,092,219 Income Taxes Payable 353,082 Total Current Liabilities 8,013,902 Notes Payable Total Liabilities $986,613 947,149 Stockholders' Equity 1,055,676 Common Stock, 100,000 shares issued & outstanding (641,299) Additional Paid-in-Capital 2,348,139 Accumulated Other Comprehensive Income Retained Earnings Total Stockholders' Equity $2,859,090 6,064,272 Property, Plant & Equipment Land and Buildings Equipment and Vehicles IT Hardware and Software Accumulated Depreciation & Amortization Property, Plant & Equipment, net $400.000 1,520,000 520,000 1,857,769 4,297,769 Total Assets $10.362,041 Total Liabilities & Stockholders' Equity $10,362,041 7. Beta's return on equity (ROE) is __%. a. 0.70 b. 1.69 c. 1.84 8. Beta's profit margin is __%. a. 2.50 b. 4.45 c. 32.91 9. Assume Beta's usual credit terms are 2/10, net 30. Beta's days outstanding in accounts receivables suggests bad debts are likely_ to accounts receivable. a. Immaterial b. Material c. Neither A nor B: Bad debts have no relationship with accounts receivable 10. Beta's profit margin, relative to the industry of average of 12%, suggests a _ level of detection risk. a. Low b. High c. Neither A nor B: profit margin is irrelevant to detection risk 11. Beta's ROA, relative to the industry average of 4%, suggests a _ level of inherent risk. a. Low b. High c. Neither A nor B: ROA is irrelevant to assessing inherent risk 12. Beta's current ratio may be distorted because the company a. Has not fully depreciated and amortized all of its fixed assets b. Did not present diluted EPS in its financial statements c. Likely has a high level of bad debts